(Originally published on March 6, 2024) | Access the full report here

Overview – The many reasons people invest in gold

When Thematica (now called Thematic Insights) last looked at the gold sector, in August 2022 with the price of gold at approximately US$1,900 per ounce, this was our conclusion:

Keep in mind that the supply of gold is effectively flat.

The total supply of gold increases over time by roughly the same rate as the human population. Put in different terms, on a per capita basis, the supply of gold has remained flat over the very long term.

With increasing demand for gold on several fronts and flat supply, this must impact the gold price – and likely sooner rather than later.

For these reasons, Thematica is assigning the gold sector a letter grade of “A” as a current investment opportunity. As always, investors are advised to do their own due diligence.

Since that time, the price of gold surged more than 10 per cent in 2023, touching a new all-time high above US$2,100.

Today, the price of gold is trading at US$2,028 per ounce, Thematic Insights is once again taking a favourable outlook towards the gold market and encouraging investors to do their due diligence here.

Why?

Different investors (and different analysts) could supply a variety of reasons. Which is the “best” reason to invest in gold depends, in large part, on one’s own perspective as an investor.

In this edition of Thematic Insights, we supply three of the best reasons why investors should consider adding gold to their portfolios.

- Gold as a commodity

- Gold as a monetary asset

- Gold as an investment

In some respects, these reasons overlap.

Why is gold the supreme monetary asset in the global monetary system (ranked above even the U.S. dollar)? Because gold is “the best money.”

To understand why this is true, we need to understand the definition of money (as opposed to mere currency, such as U.S. dollars). With some slight semantic variations, these are the four principal traits of sound money.

- Rare and/or precious

- Uniform

- Evenly divisible

- A store of value

To have value as money, the commodity being used must be rare, or precious, or preferably both.

That commodity must be uniform in quality, so each unit of currency has the same value. For example, gemstones are rare and precious. But each stone is essentially unique. Thus, gemstones fail as a basis for good money because of their lack of uniformity.

Good money must also be evenly divisible: each unit of currency must be an identical measure of that commodity.

Lastly, and most importantly, good money must be a store of value. Money (as opposed to currency) preserves the wealth of the holder.

Why has gold been regarded as the best form of money on the planet for thousands of years (with silver as a close second)? Because no other commodity satisfies the requirements for good money as well as gold does.

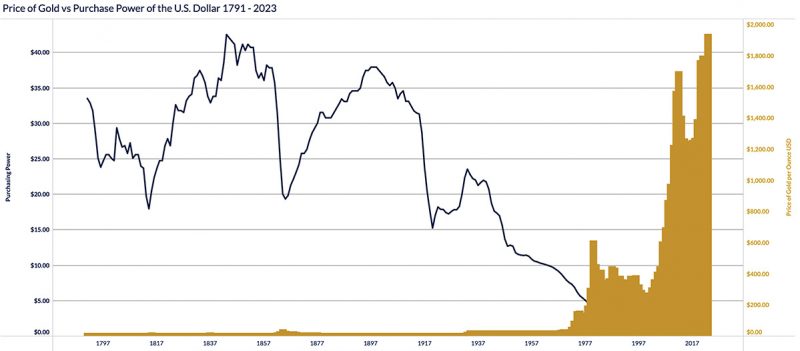

The obvious illustration between good money (gold) and mere currency is to compare the value of gold and the U.S. dollar over time.

Since the Nixon administration “closed the gold window” in 1971 and the U.S. dollar was no longer backed by gold, it has lost 98 per cent of its value versus gold.

Conversely, gold as money preserves the wealth of the holder.

In ancient Rome, with a 1 oz gold coin a gentleman could be attired in the finest garments of that era: a hand-made toga of the highest quality, along with a leather belt and sandals.

In the Renaissance, with a 1 oz gold coin a gentleman could purchase a tailor-made suit and accessories.

Today, with (the value of) a 1 oz gold coin a gentleman can purchase a fine suit and accessories. However, because the price of gold is temporarily undervalued, he’d have to buy “off the rack.”

For the women in our audience, comparisons with female clothing don’t work here – because women’s fashion has become increasingly extravagant in terms of exotic materials as well as much more time and effort devoted to design.

The example above illustrates 2,000 years of perfect wealth preservation with gold, while the U.S. dollar has lost 98 per cent of its value in a little more than 50 years. The best money versus the best currency? It’s no competition.

For investors looking to add leverage to their gold investing, they can choose gold mining stocks.

We won’t be devoting a feature article to gold mining stocks in this edition (as we did last time). But suffice it to say gold mining stocks offer at least as much value at the beginning of 2024 as they did in the middle of 2023.

The price of gold was US$35 per ounce in 1971. It was approximately US$275 per ounce in 2000. It’s US$2,000+ per ounce today.

It’s always a safe bet to predict the price of gold will rise (over time). In this edition of Thematic Insights, we seek to explain to investors why this is true.

Chapter One | Gold: The eternal commodity

Gold is money. In fact, as we established in the overview, gold is the best form of money ever devised by humanity. We’ll have much more to say about this in a subsequent article in this edition.

Gold is also a prized investment asset. The supply of gold has (remarkably) remained roughly flat versus the total global population, over a span of thousands of years. In other words, the supply of gold increases at a near-identical rate to the growth of the human population.

However, for many people, gold’s principal attraction is as a commodity. Like other commodities, a significant percentage of the supply of gold is “consumed” via the production of many goods for which gold is an input.

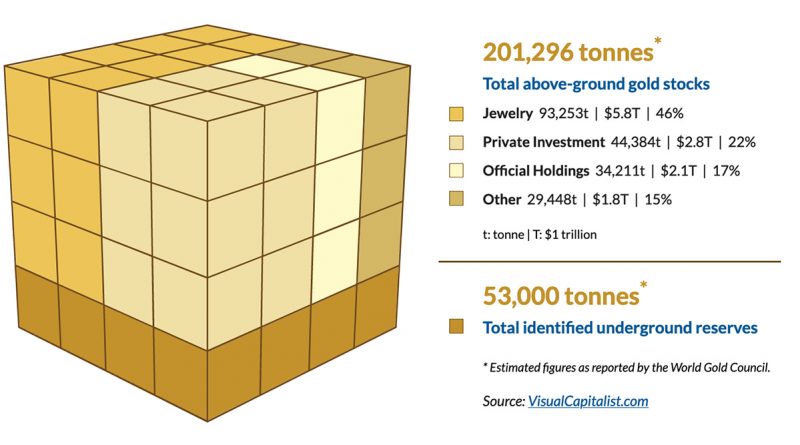

The global distribution of all unearthed gold

If the entirety of the world’s extracted gold were arranged together, it would form a cube with each side measuring just 22 metres.

Gold as jewelry

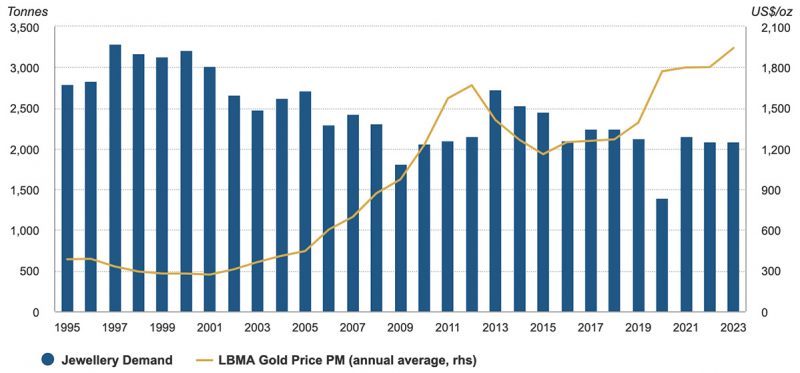

Obviously, the single largest consumer application for gold is as jewelry. A long-term chart of gold jewelry demand paints an interesting picture.

At first glance, it’s not a very impressive-looking chart. After all, total gold jewelry demand has actually slipped a little over time. But let’s add some context to this picture.

First, since the late 1990s when gold was pushed below US$300 per ounce, the price of gold has increased by roughly a factor of seven. For a consumer good that has increased 7X in price, gold jewelry demand actually looks pretty good.

Then there are economic demographics. Western economies, which used to account for the majority of global jewelry demand, are no longer prosperous.

In the United States, nearly 40 per cent of the population are not part of the labour force. In 2015, only 59.2 per cent of Americans were officially employed and that number has changed very little since that time. Of those Americans who do have jobs, more than 40 per cent are living paycheque-to-paycheque.

That’s a vast majority of the U.S. population who can no longer afford to buy gold jewelry, except on the most special of occasions. With U.S. media recently boasting that “the U.S. economy is doing so much better than the rest of the world,” these dismal economic numbers can’t be expected to be any better in Canada or other Western nations.

In short, the desire for gold as jewelry is at least as strong as ever, but affordability has had some impact on demand. However, these aren’t the only variables that have a significant impact on the overall demand for gold jewelry.

The prices of other commodities can also affect the demand for gold as a commodity.

With respect to jewelry, gold’s primary “competition” is from silver. Here we need to educate investors on another important aspect of the demand for gold jewelry: the huge jewelry market of India.

Gold jewelry: the peoples’ bank

As we noted at the beginning of this edition of Thematic Insights, considerable “overlap” exists when considering gold as a commodity, monetary asset and/or investment. Here is an excellent illustration of this point.

Out of India’s enormous population of 1.4 billion people, more than 900 million of that is a rural population. Despite India’s economic strides, this is still largely a peasant population that (among other things) lacks access to banking services.

How does India’s 900-plus million rural population manage their finances? Through gold and silver jewelry.

Since most Indians can’t deposit their savings into a bank account, they wear their savings. Any surpluses they generate in their agrarian economy are converted into jewelry and worn (primarily) by the female members of the household.

Why not simply retain these savings in (paper) rupees? Because India’s rural population is too smart to make that error.

As we pointed out in the overview, since the U.S. dollar lost its gold backing in 1971, the dollar has lost more than 98 per cent of its purchasing power versus gold. And India’s rupee has lost ground versus the dollar over these 50-plus years.

If India’s rural population retained their savings in rupees, those savings would literally (and rapidly) evaporate over time because of so-called “inflation.” By converting their paper rupees into gold and silver jewelry, Indians preserve their savings – something many Westerners are not clever enough to emulate.

In India, gold jewelry is a consumer good and a monetary asset. This brings us back to our discussion of gold as a commodity.

As rational and astute consumers, Indians want the best value for their hard-earned savings. Contrary to Western mythology that silver is now merely “an industrial metal,” most of the world’s population still recognizes silver as a precious metal.

Consequently, when the price of silver falls (relative to gold), Indians divert a larger percentage of their savings into silver jewelry.

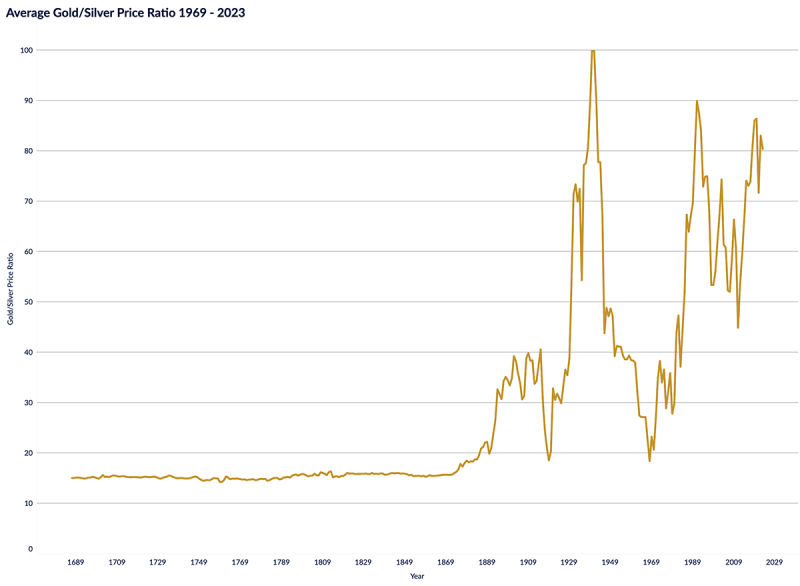

For more than 4,000 years, the gold/silver price ratio gravitated tightly around a level of 15:1. This reflects the natural ratio of gold to silver in the Earth’s crust: approximately 17:1.

Only over the past 100 years has this price ratio become wildly distorted. In recent years, the gold/silver price ratio has been bouncing around a level of 90:1.

For Indian consumers, silver jewelry is “on sale” relative to gold jewelry. This is strongly reflected in the consumer data from India.

Why demand for silver is soaring in India

India’s massive silver demand cutting world’s warehouse stocks

Global inventories of silver are going to zero because of this gross under-pricing of silver. The price of silver is due for a massive upward revaluation that will shrink the bloated gold/silver price ratio.

What will happen in India’s jewelry markets when the gold/silver price ratio falls towards a more rational level? Indians will ramp up their purchases of gold jewelry as gold becomes relatively more attractive.

Gold’s value as a commodity

This discussion of the gold jewelry market also leads us to one of the most-absurd myths circulated in Western media about gold as a commodity.

This is obviously and demonstrably false in several important respects.

First, gold has enormous aesthetic appeal. It’s beauty and durability have made gold coveted above all other metals – even though silver actually has a higher brilliance quotient than gold.

Not only is gold enormously popular around the world as jewelry because of this aesthetic appeal. A significant portion of all the gold ever mined has been crafted into the world’s most-treasured religious artifacts and architecture.

Beyond that, we have India’s example above. For most of the world’s agrarian populations (not just Indians), gold is an enormously important tool as a safe and secure vessel for their savings.

Then there is the third way to demonstrate gold’s intrinsic value: as an industrial metal. Here, a tech website has conveniently made a list for Thematic Insights readers.

31 gold uses in different industries (need to know facts)

These “31 different uses” fall into 11 categories.

- Wealth production and financial exchange

- Decoration, jewelry and medals

- Electronics

- Space exploration

- Dentistry

- Glassmaking

- Gilding

- Manufacturing

- Food/drink

- Cosmetics/beauty

- Printing

The first observation to make regarding this list is these are all high-end applications, such as advanced electronics, high-end cosmetic applications, and the most-expensive decorative uses.

In the food and beverage industry, gold is used only in the most-exclusive establishments which incorporate “gold leaf” into their cuisine designs. If gold was not so precious and valuable, it would have countless additional industrial uses.

Gold’s ability to conduct heat and electricity is exceeded only by silver and copper. But gold does not tarnish over time, which makes it superior to those other metals in some electronics applications.

Gold is highly malleable. It has good ductility (flexibility) and superior biocompatibility (low toxicity in human biology). Gold’s chemical/metallurgical properties also make it highly attractive in certain nanotechnology applications.

Gold’s value as humanity’s “eternal commodity” is beyond question. We need merely peruse our own language base for proof of this.

Good as gold. The Golden Rule. All that glitters is not gold. A golden touch.

Yet, as valuable and important as gold is as a commodity, it arguably possesses even greater significance as a monetary asset and an investment.

Chapter Two | Gold: The ultimate monetary asset

We have already stated that gold is the best monetary asset in the global financial system. However, for readers without a financial background, this might be putting the cart before the horse.

What is a “monetary asset”?

In its simplest form, this refers to money – real money, not mere currency. We previously defined money for the benefit of readers.

Money possesses important qualities that currencies (such as the U.S. dollar) are lacking. Money is rare and/or precious. Currency is neither.

Gold is the ultimate vehicle for wealth preservation

Money preserves the wealth of the holder. Conversely, currencies lose their value over time – often rapidly – because of inflation.

When the U.S. dollar was still backed by gold (prior to 1971), we had relative price stability. Because the U.S. dollar was the foundation for the global monetary system, all nations saw little change in the prices for goods and services over time.

As soon as the U.S. dollar lost its gold backing, it immediately began losing value and has been losing its purchasing power ever since at an ever-increasing rate.

The dollar has lost 98 per cent of its purchasing power versus gold since 1971. But it’s not just gold. The U.S. dollar and other paper currencies have lost nearly all their value with respect to all goods and services.

Fifty years ago, people could purchase a house for $25,000 in the suburbs of most major cities in North America. Today, $25,000 is barely adequate for a downpayment on a cheap condominium. Most new automobiles today cost more than houses did 50 years ago.

Why? Why are our currencies now not merely worth less but are literally almost “worthless” in comparison with 1971?

That’s a question that can be answered in one word: inflation. But it’s a somewhat deceptive answer because the bankers who create all monetary inflation never properly explain all the price inflation that is a result.

If the bankers wanted to be more honest, the massive loss of purchasing power in our paper currencies wouldn’t be called “inflation” at all. It would be called dilution, because this is what is constantly taking place in our monetary system.

(Source: Lawrence H. Officer and Samuel H. Williamson, “The Annual Consumer Price Index for the United States, 1774-Present,” MeasuringWorth, 2024 and Lawrence H. Officer and Samuel H. Williamson, “The Price of Gold, 1257 – Present.,” MeasuringWorth, 2024.)

How fiat currencies are destroyed by ‘inflation’

The word “inflation” comes from economics, but that definition of inflation has nothing to do with changes in prices.

The word “inflation” comes from economics, but that definition of inflation has nothing to do with changes in prices.

The formal definition of “inflation” in economics is to inflate the supply of money (currency).

Central banks continually print more of their paper currency out of thin air, inflating the supply of that currency and diluting its value. The more that they “inflate” the supply of currency, the more that these currencies are diluted, and the faster that prices rise.

As the world’s premier monetary asset (and real money), gold is immune to inflation. The supply of gold remains essentially flat over time relative to the size of the global population, so the supply of gold is never diluted.

However, we can only fully appreciate gold as a monetary asset by comparing it to other (supposed) monetary assets.

In general terms, a monetary asset is some financial instrument, usually “paper,” that is fully liquid and more or less universally accepted as a form of payment.

Currencies are considered to be monetary assets. So are the sovereign bonds of major economies. However, this requires much closer scrutiny.

The global sovereign “bond market” is, in fact, a gigantic euphemism. Sophisticated readers will appreciate that any financial transaction cloaked entirely in euphemistic terms should be regarded with skepticism – if not outright suspicion.

The whole concept of “buying a bond” is a euphemism. A bond is a loan. The bond-holder is lending their money to the issuer of that bond (debt).

This is where this gigantic euphemism gets very interesting. Today, with governments (particularly Western governments) issuing far more debt than at any time in history, most of the tens of trillions of dollars in new government debt issued each year is now soaked up by other governments.

Are these governments “lending” each other money?

No. That’s not possible. They are all debtors.

The central bank of one nation conjures up vast quantities of their fiat currency (diluting that currency even further) and then uses this new funny-money to “buy the bonds” of other governments.

The U.K. issues new pounds and that new funny-money is used to “buy” U.S. Treasuries. The Federal Reserve issues new dollars and those dollars are used to “buy” Japanese bonds. Japan conjures up more yen and uses that to “buy” U.K. bonds.

The global financial system has become a Ponzi scheme

Today, most of the global financial system is propped up via this daisy-chain of debt accompanied by the ever-increasing dilution of our currencies. For our governments to remain financially afloat today, they must issue ever-increasing quantities of their own currencies just to soak up the ever-increasing supply of their debts.

Today, the U.S. government has to issue more than $1 trillion in new Treasuries each year just to pay the interest on its previous bond debt.

What do we call a “scheme” that requires ever-increasing amounts of capital to avoid financial implosion? A Ponzi scheme.

In fact, the Western financial system is a dual Ponzi scheme. The central banks have created their Ponzi scheme of currency dilution as the only way to (temporarily) prop up the debt Ponzi scheme of Western governments.

Why don’t these governments simplify this scheme?

Why don’t they use the new funny-money conjured by their central bank to “buy” their own bonds? Because then we would have the totally ludicrous and obviously fraudulent spectacle of governments openly “loaning” themselves money to pay their bills.

The old-fashioned term for that is “cheque-kiting.”

This is why (price) inflation continues to get worse, and it’s why no matter what the central banks pretend, inflation will continue to worsen.

The only alternative to exponentially increasing the supply of these currencies to soak up the exponentially increasing supply of debt is bankruptcy.

These are the “monetary assets” against which gold is stacked up.

In financial lexicon, gold is the only monetary asset that carries no “counterparty risk.” In contrast, these other monetary assets represent the maximum counterparty risk that accompanies all Ponzi schemes.

For students of monetary history, none of what is occurring today in our financial and monetary system is a surprise.

In fact, this all became inevitable the day the United States “closed the gold window” and renounced gold-backing for the U.S. dollar in 1971.

A gold standard offers enormous financial and monetary virtues beyond merely the blessing of price stability. We can best understand this through the eyes of one of the most vehement critics of the gold standard, noted economist John Maynard Keynes (1883-1946).

Keynes smeared the gold standard with two infamous insults.

First, he dismissed the gold standard itself as “a barbarous relic.” Keynes derisively referred to the gold standard as “the Golden Handcuffs.”

Why? A gold standard, by its very nature, greatly restricts the capacity of central banks to issue new currency and greatly restricts the capacity of governments to incur new debt.

How gold offers financial and monetary salvation

The Golden Handcuffs force governments and central banks to act in a financially responsible manner.

Because currencies are backed by gold with a gold standard, new currency can be issued only to the degree that a nation increases its gold reserves. Similarly, because all bonds (denominated in these currencies) must ultimately also be backed by gold, governments are greatly restricted in the issuance of new debt.

The moment that the gold standard ceased to exist, all these currencies became “fiat currencies”: currencies that are accepted only as payment because of government decree (or “fiat”). And all fiscal and monetary discipline with our governments evaporated.

In the 1,000 years since humanity began experimenting with fiat currencies, they have a perfect record. Fiat currencies always collapse to zero in value – or are simply removed from circulation prior to the final death spiral.

Fiat currencies have a perfect record because the governments that create these currencies also have a perfect record.

Without the constraints of the Golden Handcuffs, all governments lose fiscal discipline over time and end up insolvent with debt. To cover up that insolvency, governments conjure ever-increasing amounts of their fiat currency to soak up the debt – and we end up with exactly the same dual Ponzi scheme we see today.

The ultimate end-point is always the same: bankruptcy and hyperinflation. Worthless bonds and worthless currencies.

The central bankers can see what is happening, even if most of our political leaders are too dimwitted and poorly educated to understand. We see this with the behaviour of central banks today.

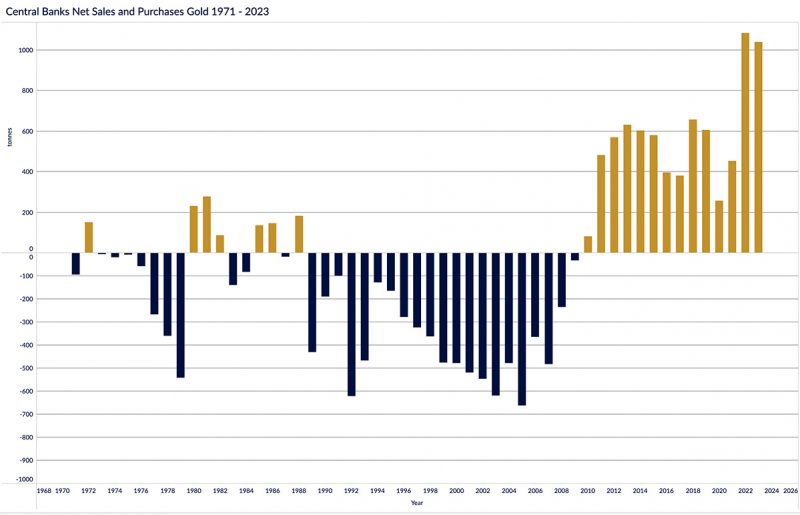

Until 2008, the central banks that create all this new currency had been net-sellers of gold for many years. In other words, prior to 2008 central banks preferred their own fiat currencies to gold.

Since 2008, central banks have become net-buyers of gold. In recent years, central banks have been buying more gold than at any time in history. They’re dumping their own paper currencies to load up on gold.

What do central bankers have in common with the rural population of India? They both have the wisdom to choose real money over rapidly depreciating currencies as their preferred monetary asset.

Central bankers know their fiat currencies are going to zero in value (as they always do). Indian farmers know that gold and silver protect their savings while paper currencies do not.

Which monetary asset should Stockhouse investors prefer? Gold, Ponzi-currencies, or Ponzi-bonds?

Chapter Three | Gold: The perennial top investment

In previous installments of this edition of Thematic Insights, we’ve seen how and why gold is considered humanity’s “eternal commodity.” We’ve also seen how and why gold is deemed to be the world’s “ultimate monetary asset.”

As we noted during those discussions, gold’s status as a commodity overlaps considerably with its status as a monetary asset.

In this installment, we will demonstrate how and why gold has been coveted as a perennial top investment asset. It should come as no great surprise to readers that much of the reason why gold is always a “top investment” is because it is an eternal commodity and ultimate monetary asset.

Because gold is a commodity that is rare in terms of scarcity and “precious” because of its aesthetic qualities, gold has always been humanity’s best money. Because gold is humanity’s best money, it is the ultimate monetary asset in the global monetary system.

Gold as a premier investment asset

Gold’s investment track record over the past 50-plus years (since the end of the gold standard) is second to none.

In 1971, the price of gold was US$35 per ounce.

In 2000, the price of gold as <US$300 per ounce.

In early 2024, the price of gold is US$2,000+ per ounce, fresh off a new all-time high in 2023.

This is roughly a 6,000 per cent (nominal) return in less than 53 years. Compounded annually, that’s a rate of return of about 8 per cent per year.

Manage that rate of return over a year, and this is a good investment. Manage that rate of return over a decade, and this is a spectacular investment. Manage that compounded rate of return across more than half a century and you have the top investment asset.

Gold is not just a prime asset of the wealthy.

It is a prime asset of governments – as evidenced by the competition among central banks to add more gold reserves. Here we see “the Golden Rule” reasserting itself in the 21st century.

Those who have the gold make the rules.

Total global sovereign debt was estimated to rise by 10 per cent in 2022 alone (2023 numbers aren’t yet available).

With these governments already at insolvent levels of debt, this current debt spiral is not remotely sustainable. As already mentioned, the United States must now “borrow” (print) more than $1 trillion per year just to pay the interest on its exponentially increasing $34 trillion national debt.

Most of the major economies in the world are now engaging in fiat currency Ponzi schemes to prop up their insolvency Ponzi schemes.

When these debt bubbles pop and our worthless fiat currencies acquire their intrinsic value (zero), all that our governments will have in terms of monetary assets is their gold.

Here, Canada’s government has been grossly negligent.

Canada is the only G7 nation that doesn’t at least pretend to hold at least 100 tonnes of gold. Canada has virtually zero gold reserves, holding only enough to satisfy demand from the Royal Canadian Mint for its (legal tender) gold coins.

The race for more gold reserves

Outside of the West, central bankers have been much more diligent in acquiring gold to backstop their financial systems. Central banks have been net-buyers of gold since 2008, with gold purchases exploding in recent years, and Russia and China leading the way.

Net official gold purchases soared above 1,000 tonnes for the first time in 2022, reaching 1081.9 tonnes according to the World Gold Council. That was more than 50 per cent higher than any previous year.

Official central bank gold purchases slipped slightly to 1,037.4 tonnes in 2023, but we should attach an asterisk to that number.

Turkey, which is generally one of the biggest gold buyers, was forced to sell 72 tonnes of its gold early in 2023 because of an economic crisis.

Without those emergency sales, net gold purchases would have surpassed the record gold purchases of 2022. And no end is in sight to this trend of increasing central bank gold purchases.

Another major driver of central bank gold buying is “de-dollarization.” We covered this topic in much more detail in our previous Thematica edition on gold.

De-dollarization is happening at a ‘stunning’ pace, Jen says

“The dollar suffered a stunning collapse in 2022 in its market share as a reserve currency, presumably due to its muscular use of sanctions,” (economist Stephen) Jen and his colleague Joana Freire wrote.

“Exceptional actions taken by the U.S. and its allies against Russia have startled large reserve-holding countries,” most of which are emerging economies from the so-called Global South, they wrote.

According to Jen, after adjusting for exchange rates, the dollar fell below 50 per cent of foreign currency reserves for the first time in many decades.

Dollar-holders are being frightened away from the U.S. dollar and replacing those U.S. dollar reserves with gold reserves. That’s very good for gold. That’s very, very bad for the value of the U.S. dollar.

Is gold radically undervalued today?

For readers who are considering adding gold as an investment, this begs the question: what is a fair price for gold today?

By one time-tested standard, the price of gold should be much higher than $2,000 per ounce.

For more than 2,000 years, a 1-oz gold coin has always been sufficient to purchase a suit of the finest attire (including accessories) for contemporary gentlemen. Let’s price this out today.

Acquiring that ensemble would cost $3,450. That’s roughly 70 per cent above the current price for gold ($2,028 per ounce as of this writing).

Why is the price of gold so substantially undervalued? Ask Western central bankers.

“Central banks stand ready to lease gold in increasing quantities should the price rise.”

— Federal Reserve Chairman Alan Greenspan, official testimony to the Committee on Banking and Financial Services, July 24, 1998

This infamous quote requires explanation, particularly the reference to gold leasing.

Gold-leasing is a quasi-legitimate operation of Western central banks to suppress the price of gold. Central banks “lease” their gold reserves to third parties that then dump (or short-sell) that gold onto the market to depress the price.

The obvious question is: what happens to these central bank gold reserves after they have been leased out and sold onto the open market? Traders try to buy back the gold at the (new) depressed price.

However, often that cannot be accomplished without pushing the gold price right back up to its previous level. Thus, significant quantities of this leased gold are never recovered.

This is why most serious analysts of the gold market don’t accept the claimed “gold reserves” of Western central banks as credible numbers, as none of those totals account for central bank gold-leasing operations. And there is good reason for such suspicion.

In the United States, the famous “gold reserves” stored at Fort Knox have not been officially audited since the 1950s.

The U.S. government occasionally “inspects” the gold at Fort Knox. This involves walking up to the vault, recording that the “seal” on the vault is still in place and walking away. No one has (officially) seen the 4,583 tonnes of gold that is claimed to be held at Fort Knox in roughly 70 years.

Why are Western central banks intent on suppressing the price of gold?

Gold is the “canary in the coal mine” that warns us (via a rapidly rising price) when fiat currencies start to be devoured by “inflation.”

Gold is the ultimate measure of value. When the people see the purchasing power of their currency is crumbling versus gold, they know that the end is near for history’s latest fiat currency Ponzi scheme.

Instead of the price of gold rising by “only” approximately 6,000 per cent since 1971 (price in U.S. dollars), it could have risen by more than 9,000 per cent (based on the metrics above) without central bank intervention.

With the limited supply of gold and the enormous (and growing) demand, supply/demand fundamentals are always supportive of still higher gold prices. This means the price of gold could be revalued dramatically higher at any time.

The high-leverage opportunity in gold mining stocks

Acquiring physical gold is not the only way to invest in gold. For investors who are confident about the opportunity in gold and would like to leverage that opportunity, gold mining stocks are an option.

The leverage here is simple. A gold mining company that is (for example) producing gold at a cost of $1,000 per ounce is currently selling its gold for $2,000 per ounce and making a $1,000 profit.

If the price of gold rises to $2,500 per ounce, that would be a 25 per cent increase in the price of gold. But the mining company would see its profit margin increase from $1,000/oz to $1,500/oz – a 50 per cent increase in profitability.

This natural leverage applies to the entire chain of gold mining companies, from the senior producers down to the junior exploration companies. Companies developing new deposits of gold are priced in relation to the existing gold producers.

Gold’s allure as a commodity is undeniable. Gold’s pedigree as a monetary asset is second-to-none. However, for Stockhouse investors, gold’s potency as an investment asset might be its source of greatest attraction.

Hold gold as a long-term investment that always rewards investors. Hold gold as a hot, near-term investment prospect with spectacular potential for appreciation.

For investors seeking to capitalize on the potential of gold mining stocks, most of these gold mining stocks are currently heavily discounted versus the price of gold.

Senior gold producers such as Barrick Gold (TSX:ABX, NYSE:GOLD), Newmont Corporation (TSX:NGT, NYSE:NEM) and Agnico Eagle Mines (TSX:AEM, NYSE:AEM) are priced at very similar levels today as they were in 2016.

At that time, the price of gold was below US$1,400 per ounce. Since then, the price of gold has risen by nearly 50 per cent.

Given that these gold producers should be leveraging the rising price of gold, this means most senior gold producers would have to roughly double in share price just to be fairly valued versus gold.

The smaller gold mining companies are generally even more heavily discounted. This makes gold mining stocks, as a class, one of the most undervalued investments on the planet today.

Conclusion: Why all investors need gold in their portfolios

Do you need gold in your portfolio?

In the midst of a “commodity supercycle,” gold has the best long-term investment profile of any commodity, with spectacular current supply/demand fundamentals.

With nations drowning in debt and fiat currencies rapidly devaluing to zero, gold will be the only monetary asset left standing when the global debt and fiat currency Ponzi schemes implode.

Gold has been the top-performing investment asset over the past 50 years. Yet, arguably, it should have risen more than 50 per cent higher than its present price and is dramatically undervalued today.

Few investors would not at least consider purchasing gold today for one of the three reasons above. Indeed, all it takes is to dangle some gold in front of people – and watch it disappear.

Gold rush: Costco is selling gold bars and they’re flying off the shelves

What’s the hottest new product available at Costco? Gold bars, as Global News reported:

Costco Canada has the 24-karat PAMP Suisse Lady Fortuna Veriscan bars listed for $2,679.99, but they’re only available to Costco members and there’s a limit on how many can be bought – each member can only purchase two at once, every seven days.

Even with those strict sales limits …

“I’ve gotten a couple of calls that people have seen online that we’ve been selling one-ounce gold bars,” Costco chief financial officer Richard Galanti said. “Yes, but when we load them on the site, they’re typically gone within a few hours, and we limit two per member.”

How much gold could Costco sell if it allowed members to buy as much as they wanted – and stocked sufficient quantities? A lot more.

As is generally the case when it comes to commodities, Stockhouse investors are ahead of the curve here.

In the most-recent Stockhouse investor survey, roughly three-quarters of respondents said they already invest in gold. Another approximately 10 per cent plan to enter the market.

We asked Stockhouse investors if they invest in gold …

Stockhouse investors like gold as a commodity (about 20 per cent) and as a monetary asset (approximately 30 per cent), but they love gold as an investment (nearly 50 per cent).

Stockhouse investors like gold as …

More than 70 per cent of respondents viewed “de-dollarization” as being either extremely or somewhat important to the gold market in 2024.

As hounds for mining stocks, Stockhouse investors fully understand the potential of gold mining stocks to leverage the price of gold. More than three-quarters of respondents named gold mining stocks as their preferred investment vehicle for gold.

Stockhouse investors prefer investing in gold …

In 2023, Thematica assigned gold a letter grade of “A” as an investment opportunity. What has changed since then?

- Governments are more insolvent

- Currencies are more diluted

- De-dollarization is more advanced

- Institutional gold demand is still increasing

- Gold hit a new record high in price

- Gold-mining stocks are more undervalued

We’ve already stated the U.S. dollar has lost 98 per cent of its value since going off the gold standard in 1971. Understand the full implications of this.

U.S. Treasuries, which are denominated in U.S. dollars, have also lost 98 per cent of their value versus gold. Indeed, all paper instruments are denominated in some currency, either the USD or an even less-valuable alternative.

This means that all paper instruments have lost approximately 98 per cent of their value versus gold over the past 50 years. And as the U.S. dollar loses the remainder of its value (which has happened to every fiat currency in history), all these paper instruments will also go to zero.

Gold has retained 100 per cent of its value across thousands of years. Paper currencies and paper instruments (such as bonds, derivatives and insurance policies) are certain to lose 100 per cent of their value.

When presented in such stark terms, suddenly “wealth preservation” starts to look very attractive to investors.

With the speed of the trends above increasing – and the risk of paper instruments increasing commensurately – we are assigning gold a letter grade of “A+” as an investment opportunity in this edition of Thematic Insights.

Gold is not merely a perennial top investment, it is the best form of insurance versus financial/monetary catastrophe. As always, we encourage investors to do their own due diligence here.

Sign up to receive future Thematic Insights reports and explore previous investor reports from Stockhouse.

Join the discussion: Find out what everybody’s saying about public companies and hot topics about stocks at Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.