With gold hitting all-time highs above US$2,300 per ounce, and gold stocks lagging their target commodity by the largest margin in more than two decades, junior mining investors are being gifted dozens of opportunities with multi-bagger upside backed by quality projects, safe jurisdictions, been-there, done-that management teams, and stocks trading undeservedly at or near all-time lows.

An undercovered name that fits this thesis on every count is Pinnacle Silver and Gold (TSXV:PINN), market capitalization C$0.87 million, whose stock has given back 60 per cent year-over year, and 96.83 per cent since 2019, despite owning and advancing two Ontario-based gold exploration projects with demonstrated district-scale potential. Let’s explore the projects in more detail to better understand how investors are positioned for an exponential stock price re-rating.

The Argosy Gold Mine Project

Pinnacle’s 100-per-cent-owned Argosy Gold Mine Project is host to the most significant past-producing gold mine in the Birch-Uchi Belt, which yielded 101,875 ounces of gold and a minor amount of silver between 1931 and 1952 from 276,573 tonnes of ore averaging 12.7 g/t Au. Birch-Uchi is three times larger than the nearby Red Lake Belt and is thought to house similar geology, but it is comparatively underexplored because of being accessible only by air or winter road.

The 604-hectare property, subject to a 2.5 per cent net smelter royalty, is only 2.5 km south of the iron formation-hosted Richardson Lake Occurrence, and just 10 km northwest of First Mining Gold’s (TSX:FF) Springpole Deposit, the largest in Birch-Uchi, with 4.6 million ounces of gold and 24.3 million ounces of silver indicated, and 0.3 million ounces of gold and 1.4 million ounces of silver inferred, all of which support the robustness of Argosy’s quartz-vein-hosted gold mineralization.

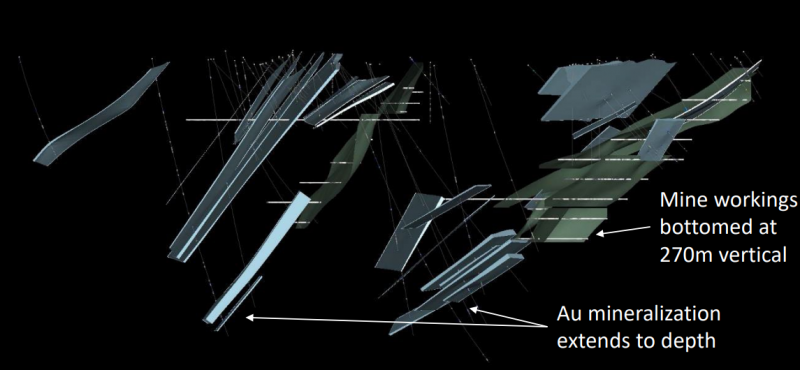

Management has identified significant depth potential on the property, with historical development reaching a depth of only 270 m, and a previous operator uncovering high-grade gold mineralization below the old mine workings up to 400 m deep, yielding historical results of 11.75 g/t Au over 1.55 m (No. 2 Vein), 14.67 g/t Au over 1.7 m (No. 3 Vein), 10.95 g/t Au over 2.63 m (No. 11 Vein), and 14.15 g/t Au over 1.65 m (P Vein), supporting the search for resources on parallel, unexplored veins.

Next steps include a LiDAR survey, mapping and sampling programs, and a summer 2024 drill program to further demonstrate the continuity of Argosy’s gold mineralization at depth.

The North Birch Gold Project

Only 300 metres away from Argosy, Pinnacle’s 100-per-cent-owned North Birch Gold Project spans 3,850 hectares in the Birch-Uchi Belt, with both projects only 110 km northeast of Red Lake, Ontario, which boasts a rich mining history going back more than a century.

The property covers a geological setting, supported by airborne magnetic, induced polarization and LiDAR surveys, which management interprets as highly prospective for iron formation-hosted and high-grade quartz vein-hosted gold mineralization, offering several strong drill targets for follow-up.

North Birch houses a folded and sheared iron formation (IF) similar to the one hosting Newmont’s 7-million-ounce Musselwhite Mine, only 190 km to the northeast. Historic exploration south of the IF yielded a drill hole with up to 35 g/t Au over 1.6 m, as well as a grab sample at 5.64 g/t Au from pyritic iron formation at nearby H Lake, substantiating iron formations’ well-documented role as strong physical and chemical traps for gold all over the world.

Management also believes the stratigraphy underlying most of North Birch may be similar to the Balmer Assemblage, host to the 20-million-ounce Campbell/Red Lake gold orebody (past production and reserves) in the adjacent Red Lake Belt.

Just 12 km to the southeast, First Mining’s Springpole enhances North Birch’s prospectivity even further, as the former boasts a 2021 pre-feasibility study estimating a post-tax net present value (5%) of US$995 million, a post-tax internal rate of return of 29%, and average production of over 300,000 ounces of gold per year.

Pinnacle’s initial diamond drilling program in February-March 2022 explored the southeastern part of an 8-km-long target horizon. Drill hole NB22001 intersected a

deformation zone more than 100 m wide within the IF, as interpreted from geophysics and LiDAR, yielding gold and copper assays up to 0.25 g/t Au and 363 ppm copper (Cu). Intercepting highly sheared IF up to a vertical depth of 320 m, the drill hole demonstrates the presence of quartz-carbonate alteration and pyrite-pyrrhotite mineralization, common indicators of gold mineralization that warrant follow-up drilling.

Drill hole NB22002, for its part, tested coincident magnetic and induced polarization anomalies 800 m along stratigraphic strike to the northwest, discovering a zone of strong biotite alteration with geochemistry indicative of strong hydrothermal activity separate from the IF and deformation zone.

Pinnacle is planning to map, sample and drill additional IF targets at North Birch this summer with a high probability of uncovering additional mineralization, given its gold-rich neighbours and known mineralization at Argosy.

Management to hang your conviction on

The path to delineating the full extent of North Birch and Argosy’s exploration upside is paved by a team of mining veterans, each of them well-versed in the ins-and-outs of pinpointing economically extractable metals and minerals.

Pinnacle’s President, Director and CEO, Robert Archer, is a professional geologist with more than 40 years of mining industry experience throughout the Americas, including 15 years cutting his teeth at major mining companies. As Co-Founder of Great Panther Mining, a mid-tier precious metals producer, he served as President and CEO from 2004-2017 and as Director until 2020. Archer joined Pinnacle as a Director in March 2018, and was appointed CEO in January 2019 and President in October 2021.

Archer’s established leadership is complemented by:

- David Cross, Pinnacle’s Chief Financial Officer, who brings more than 21 years of experience in junior mining finance and corporate governance.

- Colin Jones, Independent Director, and his almost 40 years of experience as a mining, exploration and consulting geologist on all continents.

- David Salari, Independent Director, whose more than 35 years in mining and mineral processing include global experience in the design, construction and operation of extractive metallurgical plants.

- Ron Schmitz, Independent Director, who has served as a director and/or chief financial officer for various public and private companies since 1997 and is currently Principal and President of ASI Accounting Services, which has provided administrative, accounting and office services to public and private companies since 1995.

It’s Pinnacle’s complete package, composed of prospective properties, a hot target commodity, a stock price at a near total loss, and a management team that knows how to transform value in the ground to value in shareholders’ pockets, that makes its ongoing private placement an opportune one.

A capital raise geared towards shareholder value creation

The junior gold stock is offering exposure to its free-lunch of a value proposition through a non-brokered private placement of up to C$600,000. It will issue up to 20 million units composed of one common share and one half of one share purchase warrant, with each warrant convertible into an additional share priced at C$0.05 for 24 months from issuance.

Net proceeds will go towards summer 2024 drilling preparations at Argosy and North Birch, as well as new project evaluations and general working capital, granting the company added flexibility to adapt to changing market conditions and harvest leverage from gold continuing to test all-time highs, with top economist David Rosenberg seeing a reasonable path to US$3,000 per ounce for the precious metal.

Exponential upside at a peak-fear valuation

As should be evident by now, an investment in Pinnacle Silver and Gold today is squarely aligned with the multi-bagger returns for which junior mining stocks are revered.

The junior gold stock, left for dead by prevailing macroeconomic forces – including generationally high interest rates disincentivizing risk – is a clear example of market inefficiency, positioning long-term investors to benefit alongside a 23 per cent contingent of smart-money shareholders (5 per cent institutional and 18 per cent insiders), as the field team breaks ground on summer exploration and actively pursues other district-scale opportunities in the Americas.

It’s not often that investors come across an opportunity with maximal reversion potential, but when they do, as with Pinnacle, it should immediately travel to the top of their due diligence lists.

Join the discussion: Find out what everybody’s saying about this junior gold stock on the Pinnacle Silver and Gold Corp. Bullboard, and check out Stockhouse’s stock forums and message boards.

This is sponsored content issued on behalf of Pinnacle Silver and Gold (formerly named Newrange Gold), please see full disclaimer here.