- With the White House’s recent tariffs on Chinese graphite imports, Green Battery Minerals (TSXV:GEM) is touting its domestic project

- The U.S. administration has signed an Executive Order establishing a 25 per cent tariff on Chinese imports, including natural graphite, which will increase from 0 per cent to 25 per cent in 2026

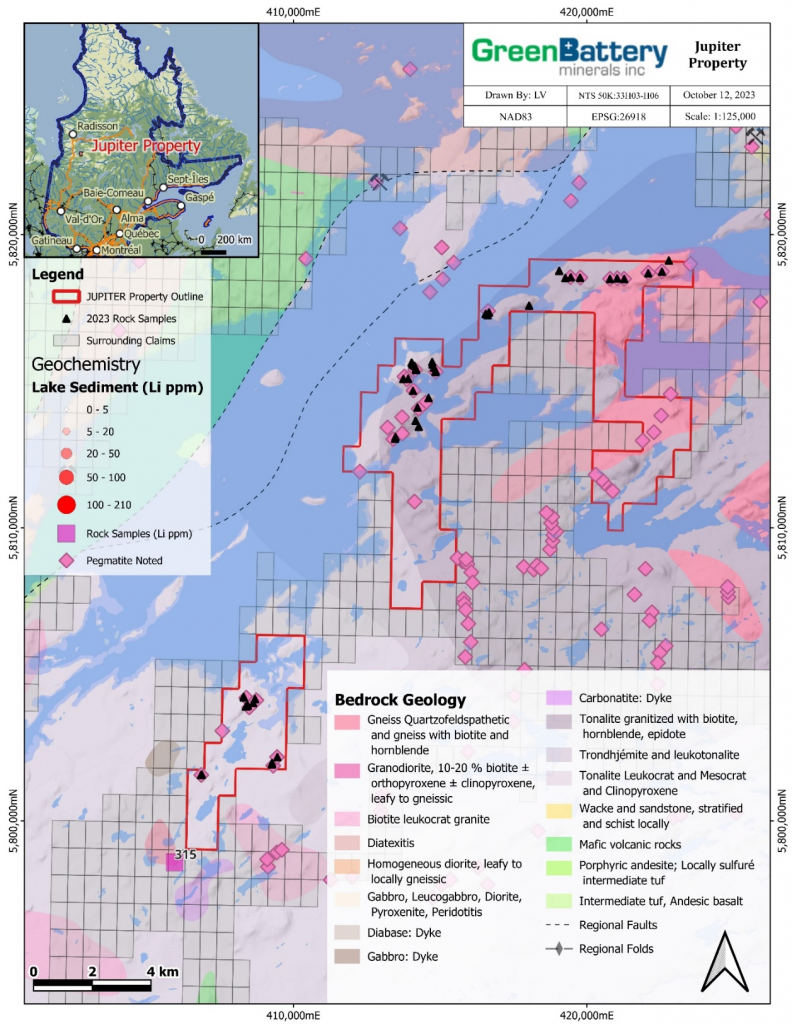

- Green Battery Metals is touting its Jupiter Lithium Property in Québec as the means to meet its goal of discovering deposits that host the elements critical to lithium-ion batteries

- Green Battery Minerals Inc. (TSXV:GEM) last traded at $0.025 per share

With the White House’s recent tariffs on Chinese graphite imports, Green Battery Minerals (TSXV:GEM) is touting its domestic project.

In a bid to bolster domestic manufacturing in critical industries, the U.S. administration has signed an Executive Order establishing a 25 per cent tariff on Chinese imports, including natural graphite. The tariffs on natural graphite will increase from 0 per cent to 25 per cent in 2026.

In a statement the White House called China’s trade practices concerning technology transfer, intellectual property and innovation unfair and a threat to American businesses and workers.

“China’s forced technology transfers and intellectual property theft have contributed to its control of 70, 80, and even 90 per cent of global production for the critical inputs necessary for our technologies, infrastructure, energy, and healthcare – creating unacceptable risks to America’s supply chains and economic security,” U.S. President Joe Biden said.

Combined with previous U.S. tariffs on some steel and aluminum products, the changes are projected to impact around US$18 billion in current annual imports.

The tariff rate on lithium-ion EV batteries will increase from 7.5 per cent to 25 per cent this year, while the tariff rate on lithium-ion non-EV batteries will increase from 7.5 per cent to 25 per cent in 2026. The tariff rate on battery parts will increase from 7.5 per cent to 25 per cent in 2024.

The tariff rate on natural graphite and permanent magnets will increase from zero to 25 per cent in 2026. The tariff rate for certain other critical minerals will increase from zero to 25 per cent in 2024.

According to the U.S. Census Bureau, the U.S. imported US$427 billion in goods from China in 2023 and exported US$148 billion back to the country.

China controls most of the world’s graphite production and countries in the West relied on its source, particularly for EV and battery manufacturing. Now companies and governments are working to replace the existing graphite supply chain.

Benchmark Mineral Intelligence data suggests that at least 97 more natural graphite mines will be needed by 2035 to meet demand for the EV market and the natural graphite market is set to enter a deficit in 2025.

This is where Green Battery Metals comes in. The team is touting its Jupiter Lithium Property in Québec as the means to meet its goal of discovering deposits that are host to the elements critical to lithium-ion batteries.

The property is an early-stage exploration opportunity that comprises 122 Québec mineral exploration claims, which amount to 64 square kilometres, where up to 33 pegmatite occurrences have been identified.

Elsewhere in the province, the company also operates the Berkwood Graphite Project, which has a current in-pit constrained mineral resource totalling 1,755,300 tonnes of indicated resources.

Green Battery Minerals is an exploration stage company focused on exploring and developing natural resource properties.

Green Battery Minerals Inc. (TSXV:GEM) last traded at $0.025 per share. Its stock is up 25 per cent in the past month but down 64.28 per cent since this time last year.

Join the discussion: Find out what everybody’s saying about this stock on the Green Battery Minerals Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image: Green Battery Minerals Inc.)