- Umicore (OTC Pink:UMICF), the Belgian-based metals recycler and battery materials producer, has announced a pause in the construction of its battery materials plant in Loyalist, Canada

- This decision follows a comprehensive review of its business operations initiated in July, during which the company also postponed “large scale” investments in an unspecified battery recycling facility in Europe

- Umicore also detailed cost-cutting measures aimed at achieving savings of US$42.94 million by 2025, which will impact around 260 positions, with 100 of those in Belgium, as the company seeks to streamline its operations

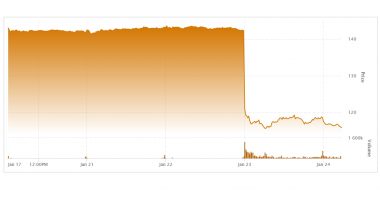

- Umicore stock (OTC Pink:UMICF) last traded at US$12.30 per share

Umicore (OTC Pink:UMICF), the Belgian-based metals recycler and battery materials producer, has announced a pause in the construction of its battery materials plant in Loyalist, Canada.

This decision follows a comprehensive review of its business operations initiated in July, during which the company also postponed “large scale” investments in an unspecified battery recycling facility in Europe.

The company, known for producing catalytic converters and supplying battery materials to automakers, stated that it has not yet utilized any incentives offered by the Canadian government. Should construction resume, Umicore indicated it would still be eligible for these incentives under the same conditions, including commitments to employment.

“Umicore is navigating a challenging environment where we feel the impact of the complex transitioning of the automotive industry towards electric mobility. Serving our North American customers out of Korea is now clearly the most effective use of our assets. To ensure our company’s long-term competitiveness, we need to make difficult decisions. We commit to support our teams throughout these changes,” Umicore’s CEO, Bart Sap said in a news release. “While these decisions were not made lightly, they set us on the right path for us to be better positioned to seize future opportunities. In these transformative times, I want to especially thank our teams for their support and commitment to our Group.”

In conjunction with this announcement, Umicore detailed cost-cutting measures aimed at achieving savings of €40 million (approximately US$42.94 million) by 2025. These measures will impact around 260 positions, with 100 of those in Belgium, as the company seeks to streamline its operations. Umicore employs a total of 12,000 workers globally.

The company has begun consultations with trade unions regarding these changes, particularly focusing on resizing its workforce in the battery materials division, primarily at its production plant in Jiangmen, China. Additionally, Umicore plans to reduce research and development activities at its facility in Hørsholm, Denmark.

As the electric vehicle market continues to grow, Umicore’s strategic decisions reflect the complexities and challenges faced by companies in the battery materials sector. The pause in construction highlights the need for careful planning and adaptability in a rapidly evolving industry.

Umicore develops technologies and produce materials for solar cells used in satellites, rechargeable batteries, LED applications, catalysts, etc. It recycles and extract precious metals from laptops and mobile phones, among other things.

Umicore stock (OTC Pink:UMICF) last traded at US$12.30 per share.

Join the discussion: Find out what everybody’s saying about this stock on the Umicore Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.