Many readers of The Market Herald are now familiar with CIBT Education Group (TSX:MBA/OTC:MBAIF). We have previously dubbed CIBT “the counter-cyclical bellwether in real estate”, and with good reason.

How does demand look in the broader real estate market today? A February 22nd headline sums up the picture for the enormous U.S. residential real estate market.

Home purchase applications plunge to 28-year low as mortgage rates jump

The “housing boom” is over. A major housing bust is just beginning. The slump in the commercial real estate market began even sooner – thanks to Covid – as indicated in this September 2020 article.

Commercial real estate flounders as housing market booms

CIBT reports stellar operating results

Then we have CIBT Education Group, a leader in the student rental housing market. The company’s most recent quarterly results (January 2023) paint a robust picture.

- ~100% occupancy of student housing units

- 27% y-o-y increase in student housing rental revenue

- Rental rates per square foot (PSF) at the highest level in CIBT’s history

Full occupancy, strong revenue growth, and maximum pricing (per square foot). It doesn’t get any better than that if rental housing is your business.

Roughly a month later, CIBT announced its King Edward student housing facility is nearing full completion. A major boost to both CIBT’s top and bottom line. And already a waiting list for these new rental units.

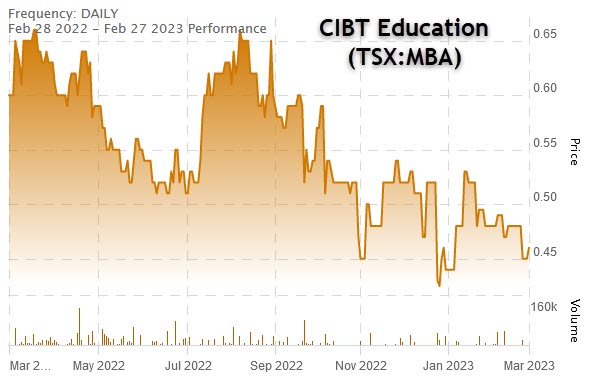

Incredibly, despite these two strong pieces of news, CIBT has gotten no love from our increasingly dysfunctional, algorithm-driven markets.

Like many quality, small-cap stocks, CIBT has been pushed to a 52-week low, despite already being substantially undervalued and despite a strong performance from the company’s student rental housing division, Global Education City Holdings Inc. (GEC).

CIBT offers the best value proposition in real estate today

Compare the underperformance of CIBT stock with a chart of U.S. large-cap homebuilder stocks.

Despite the train wreck that is just beginning in the U.S. (and Canadian) residential real estate market, homebuilder stocks haven’t even begun to feel the pain here. Delusional valuations.

Housing affordability ends 2022 at record low

Thanks to soaring interest rates, the total purchase price (including interest payments) of a residential housing unit has exploded higher – from what was already record bubble prices – even as the actual value of these housing units starts to crumble.

Home prices are finally falling. But how low will they go? (October 2022)

The combination of soaring prices and falling value is in the process of torpedoing History’s largest real estate bubble. Valuations for everything from REITs to homebuilding stocks appear destined for a major crash.

Then there is the CIBT value proposition.

CIBT’s President and Chief Executive Officer, Toby Chu, is a keen observer of the Canadian real estate market, in general, and the student rental housing market, in particular. He recently touched base again with The Market Herald – and had some very interesting insights to share.

In particular, the CEO wanted to shine a spotlight on the impact of rising interest rates and the new (January 2023) “rent controls” introduced into British Columbia – the focal point of CIBT’s student rental housing business.

The Vancouver market is well-known as one of the most-overpriced residential housing markets on the planet. But Vancouver is also a favourite global destination for international students, the backbone of CIBT’s demand for student rental housing.

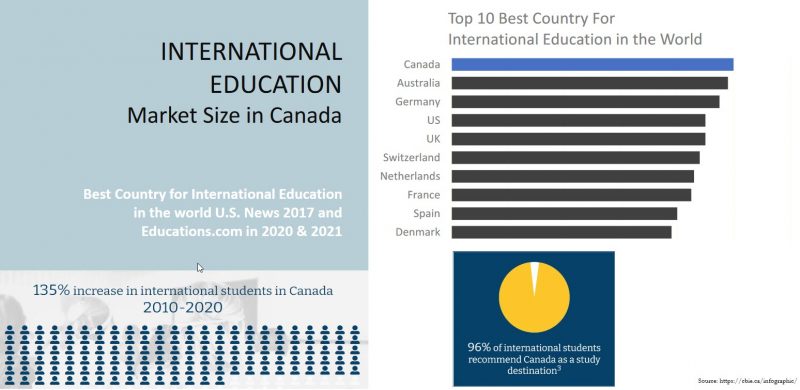

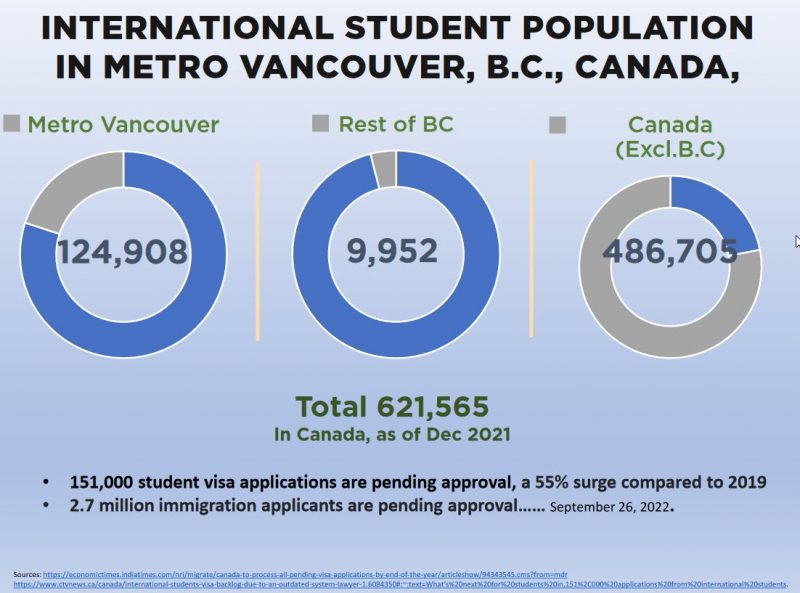

Canada is already the #1 global destination for international students. Vancouver attracts a disproportionate share of this robust demographic.

Looking ahead, student visa applications in Canada have risen 55% compared to pre-Covid numbers. Many of those 151,000 visa applicants will be looking for student rental housing in Vancouver.

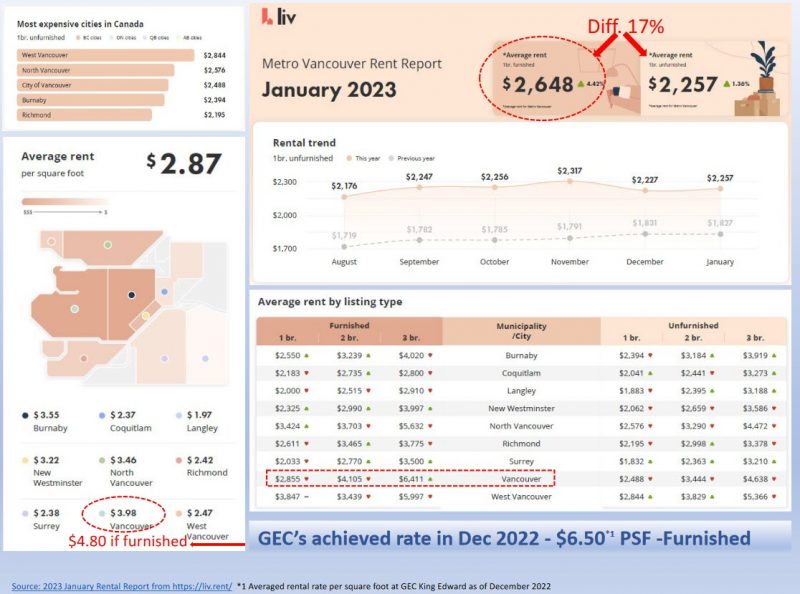

How are dramatically higher interest rates and new rent controls impacting this red-hot rental housing market? Toby Chu shared this data:

- Over just the past 10 months, the Canadian prime rate has soared by 140%, with the negative impact from this massive increase just beginning to impact housing sales and prices.

- On January 1, 2023, the provincial government of British Columbia introduced a 2% per year rent control on all rental housing units.

CEO Toby Chu connects the dots here.

As the cost of adding a new rental housing complex to the Vancouver housing market is soaring dramatically higher (due to much higher financing costs), the return from such a massive investment is now flat.

Translation: there is zero commercial incentive to add new rental housing supply to the British Columbia rental market. This is (inevitably) one of the consequences of imposing rent controls.

Then the CEO laid out the picture for CIBT with this new rent control in place.

- B.C. rent controls have no impact on CIBT’s rental pricing for student housing units.

- B.C. rent controls will significantly reduce competition for CIBT (i.e. new alternative supply) in this rental housing market.

Rent controls restrict rent increases for ongoing residential tenancies. However, as each school term ends, so does the tenancy for that particular student (and rental unit).

When a new student signs a new rental contract for the vacant unit (in the next school term), CIBT sets the new rental rate on that unit at “the market rate” for rent. No impact from rent control.

Meanwhile, while there are already large barriers to entry for bringing new (dedicated) “rental housing” properties to market, there is now a major barrier to entry for the other competition for CIBT: the general rental housing market in Vancouver.

In short, the overall impact on CIBT Education Group from the combination of soaring interest rates and new rent controls is actually minor after the new rental rates take effect in the pursuing quarters.

That’s how you earn the title “counter-cyclical bellwether.”

More top-and bottom-line growth from GEC King Edward

On February 21, 2023, CIBT announced that its GEC King Edward student rental housing facility “is near completion.”

CIBT (and GEC) are benefitting from rising rental rates on their portfolio of student housing facilities. With the Vancouver student rental housing market ‘tighter’ than ever (and unaffected by rent controls), rental rates here appear poised to continue rising.

However, the biggest boosts to both revenues and earnings for CIBT come from bringing new facilities online.

With GEC already boasting substantial revenue growth from its existing portfolio of 7 operational buildings, moving to full occupancy at GEC King Edward will provide a significant increase in rental revenues as CIBT progresses through fiscal 2023.

Part of the reason why GEC’s PSF is now at an all-time high comes from the premium pricing of King Edward’s new, highly desirable student housing units:

- Central city location, proximate to one university campus (University of British Columbia) and hundreds of public and private colleges located in downtown Vancouver and Richmond

- Immediately adjacent to (<100 meters from) Vancouver’s primary rapid transit (SkyTrain)

- The “GEC Advantage” for student tenants: fully furnished with flexible lease terms

CIBT Education, and its GEC subsidiary, possess strong pricing power as the premier (private sector) provider of rental housing in Vancouver’s dynamic student housing market.

Initial leasing at GEC King Edward is already producing strong margins for CIBT, with GEC King Edward’s $6.50 price-per-square-foot (PSF) nearly 40% above the average for furnished Vancouver rental units.

As new rent controls put the brakes on bringing new rental buildings to market, the PSF (and bottom-line margins) for CIBT’s student housing units can only go higher – as a huge influx of new students into Vancouver compete for limited accommodations.

CIBT’s student rental housing units don’t command a premium versus other rental accommodations solely due to prime locations. The strong student demand for the Company’s student rental housing is also due to “the GEC Advantage”.

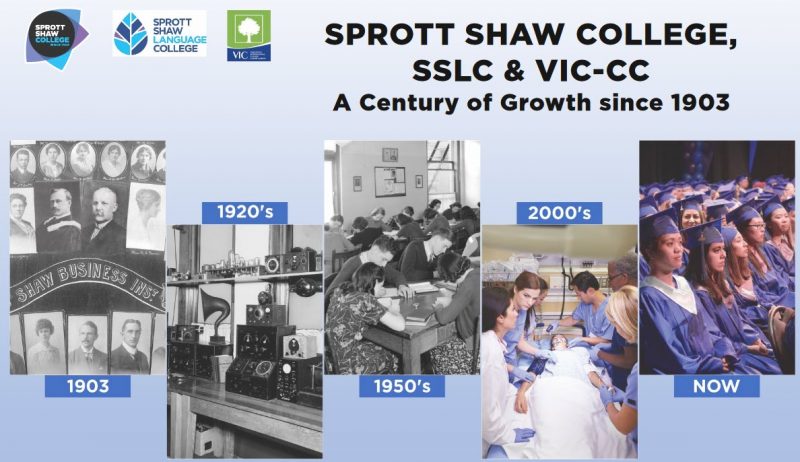

Why is CIBT so successful in designing and renting student housing units? Because CIBT Education Group knows students. CIBT has been an education provider for nearly 30 years through its subsidiary college, Sprott Shaw College (since 1903).

With nearly three decades of hands-on experience in educating students, no corporation understands the housing needs of students better than CIBT.

The Company’s Education Services division (with ~10,000 students each year) is more than a strong and stable business in its own right, with annual education-related revenues of CAD$46+ million.

It provides enormous synergies with CIBT’s primary revenue driver: its thriving student rental housing business. Yet, arguably, its value is not being reflected in the Company’s current market cap – at all.

In addition to serving CIBT’s own schools, the Company also provides its housing services to 92 other schools in Metro Vancouver, which eliminates the single-customer risk.

CIBT: extremely undervalued and poised for sharp revaluation

How undervalued is CIBT? Which metric do you want to use to illustrate this, as this high-growth stock sits with a current valuation of only CAD$31.5 million?

- Real estate portfolio of CAD$1.3 billion (existing properties and development budgets), comprised of 7 buildings fully operational, 6 under construction or at the rezoning phase, and 1 “under contract”

- Total assets: CAD$478 million

- Annual consolidated revenues of CAD$73 million

- Q1 2023 Adjusted EBITDA of CAD$3.1 million1

- Q1 2023 Gross profit of CAD$10.3 million1

The Company’s CAD$1.3 billion rental housing portfolio represents more than a huge asset base (in relation to CIBT’s market cap). With only roughly half of these buildings currently operational, the pipeline represents enormous future revenue growth.

Thanks to our perverse markets, CIBT is currently trading at only a tiny fraction of its asset value. As noted, its robust Education Services division is receiving little-to-no recognition in CIBT’s current market cap.

As for revenues, what does it mean in rational markets if investors see a stock trading at less than ½ revenues? It means “the market” either doesn’t see those revenues as being sustainable or margins are weak.

What does it mean when a stock with strong current revenue growth, enormous future revenue growth potential within its pipeline and strong margins is trading at less than ½ revenues? It means that investors have identified a steal for their portfolio.

In absolute terms, CIBT Education Group offers investors a unique investment opportunity at an incredibly attractive valuation.

However, in comparison to other real estate-based investments today, CIBT stands alone. The company is positioned in a high-growth niche as other (overvalued) real estate investments are facing steep declines.

The counter-cyclical bellwether in real estate.

1 “Gross profit” and “Adjusted EBITDA” are Non-IFRS Financial Measures.

DISCLOSURE: This is a paid article by The Market Herald. The writer holds shares in CIBT Education Group.