- Vista Gold Corp. (TSX:VGZ) announced interim results from Phase 2 of its 2024 drilling program at the Mount Todd gold project in Northern Territory, Australia.

- Phase 2 drilling commenced in July 2024 with near-surface drilling in the South Cross Lode zone.

- Vista Gold’s Mount Todd gold project is an advanced development-stage gold deposit in a low risk, Tier-1 mining friendly jurisdiction.

- Shares of Vista Gold Corp. (TSX:VGZ) are down 2.11 per cent, trading at C$0.93 as of 12:48 pm ET.

Vista Gold Corp. (TSX:VGZ; NYSE-A:VGZ) on Tuesday announced interim results from Phase 2 of its 2024 drilling program at the Mount Todd gold project in Northern Territory, Australia.

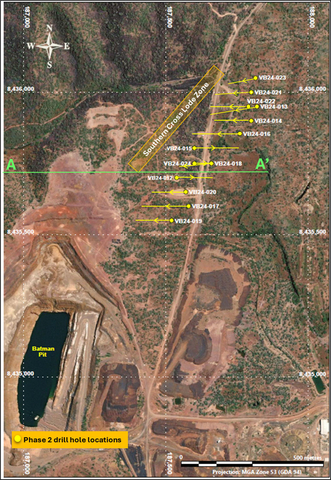

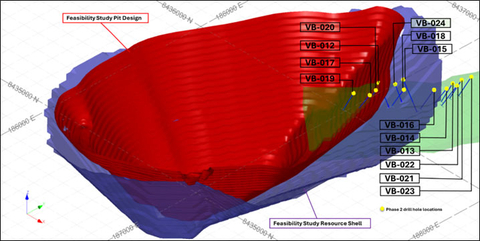

According to a news release, Phase 2 drilling commenced in July 2024 with near-surface drilling in the South Cross Lode zone (aka SXL), a known mineralized structure with high-grade intercepts that intersects the Batman deposit and extends up to 400 metres northeast.

Vista Gold stated that Phase 2 drilling has so far focused on the shallow portion of the SXL, and about half of the strike length drilled is within the limits of the resource shell, with eight holes drilled (see Figures 1 and 2) in an area previously classified as waste in the 2024 Feasibility Study. The overall objective of Phase 2 drilling is to better understand the structure and mineralization of the SXL.

“Interim results from the second phase of our Mount Todd drilling program are very encouraging and support our belief that the mineralization in the SXL zone is distinct to the Batman deposit,” Frederick H. Earnest, Vista Gold’s president and CEO, said in a statement. “The SXL zone is host to more discreet and in certain zones, wider high-grade veins with thicknesses that exceed 1 metre, compared to the thinner, more closely spaced sheeted veins typically observed in the Batman deposit. Drilling in the SXL included several holes that intersected higher-grade mineralized veins within the limits of our resource pit. Phase 2 of the drilling program is expected to be completed by the end of this year.

Phase 2 drill hole highlights

VB24-014 – 9.4 meters @ 3.35 grams of gold per tonne (“g Au/t”) from 102.8 metres down hole, including

- 0.5 metres @ 50.0 g Au/t from 111.7 metres down hole (grade thickness of 25.0 g Au/t per meter (“g Au/t – m”)

VB24-015 – Returned three intervals of greater than 1 g Au/t, ranging 3-9 metres thick, including

- 8.0 meters at @ 1.82 g Au/t from 132.0 meters down hole, including 1.0 metre @ 12.57 g Au/t from 132.0 metres down hole (grade thickness of 12.57 g Au/t – m)

VB24-016 – Returned three intervals of greater than 1 g Au/t, ranging 6 – 22 metres thick, including

- 22.0 metres at @ 1.74 g Au/t from 146.0 metres down hole, including 2.3 metres @ 7.93 g Au/t from 150.7 metres down hole (grade thickness 18.24 g Au/t – m)

VB24-022 – Returned two intervals of greater than 1 g Au/t, with thickness up to 4 metres

- 4 metres at @ 7.18 g Au/t from 106.0 metres down hole, including 1.0 metre @ 25.89 g Au/t from 106.0 metres down hole (grade thickness of 25.89 g Au/t m)

- 3.8 metres at @ 3.25 g Au/t from 136.4 metres down hole, including 0.6 metres @ 18.13 g Au/t from 136.4 metres down hole (grade thickness of 10.88 g Au/t – m)

VB24-024 – near surface high-grade interval of 5.0 metres @ 2.18 g Au/t from 9.0 metres down hole, including

- 1.1 metres @ 6.37 g Au/t from 12.9 metres down hole (grade thickness of 7.01 g Au/t – m)

“At the conclusion of the 2024 drilling program, we plan to update the Mount Todd mineral resource estimate,” Earnest said. “We will leverage the results of prior technical studies to advance evaluations of a development scenario for Mount Todd, initially targeting 150,000 to 200,000 ounces of annual gold production, with a raised cut-off grade of 0.45 to 0.50 g Au/t. We are targeting a mineral reserve grade of approximately 1 g Au/t and an initial capex of less than $400 million, while preserving the option for expansion at some future time.”

Vista Gold’s Mount Todd gold project is an advanced development-stage gold deposit in the low risk, Tier-1 mining friendly jurisdiction of Australia. Vista seeks to position Mount Todd as a leading development opportunity within the gold sector. Mount Todd offers significant scale, development optionality, growth opportunities, advanced local infrastructure, community support, and demonstrated financial strength.

Shares of Vista Gold Corp. (TSX:VGZ) are down 2.11 per cent, trading at C$0.93 as of 12:48 pm ET.

Join the discussion: Find out what everybody’s saying about this stock on the Vista Gold Corp. Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo of Vista Gold’s flagship Mount Todd asset in Northern Territory, Australia: Vista Gold Corp.)