As we discussed in part one of this three-part series, the gold price is touching unforeseen heights, surpassing US$4,200 per ounce on October 15, sending companies across the mining lifecycle into the spotlight as they seek to leverage investor enthusiasm for the yellow metal by translating operational milestones into shareholder value.

The gold catalyst is, in turn, stimulating investors’ sixth sense for prospective opportunities, nudging them to search for miners built to outshine competitors thanks to high-quality assets, rational business plans and accomplished leadership teams worthy of long-term trust.

This is where Walker Lane Resources (TSXV:WLR) enters the picture, offering the market a high-conviction gold exploration thesis in the earliest stage of development, with the stock down by 28 per cent since inception in March 2025, despite an abundance of leads towards potential discoveries in an established mineral district.

This article is disseminated in partnership with Walker Lane Resources Ltd. It is intended to inform investors and should not be taken as a recommendation or financial advice.

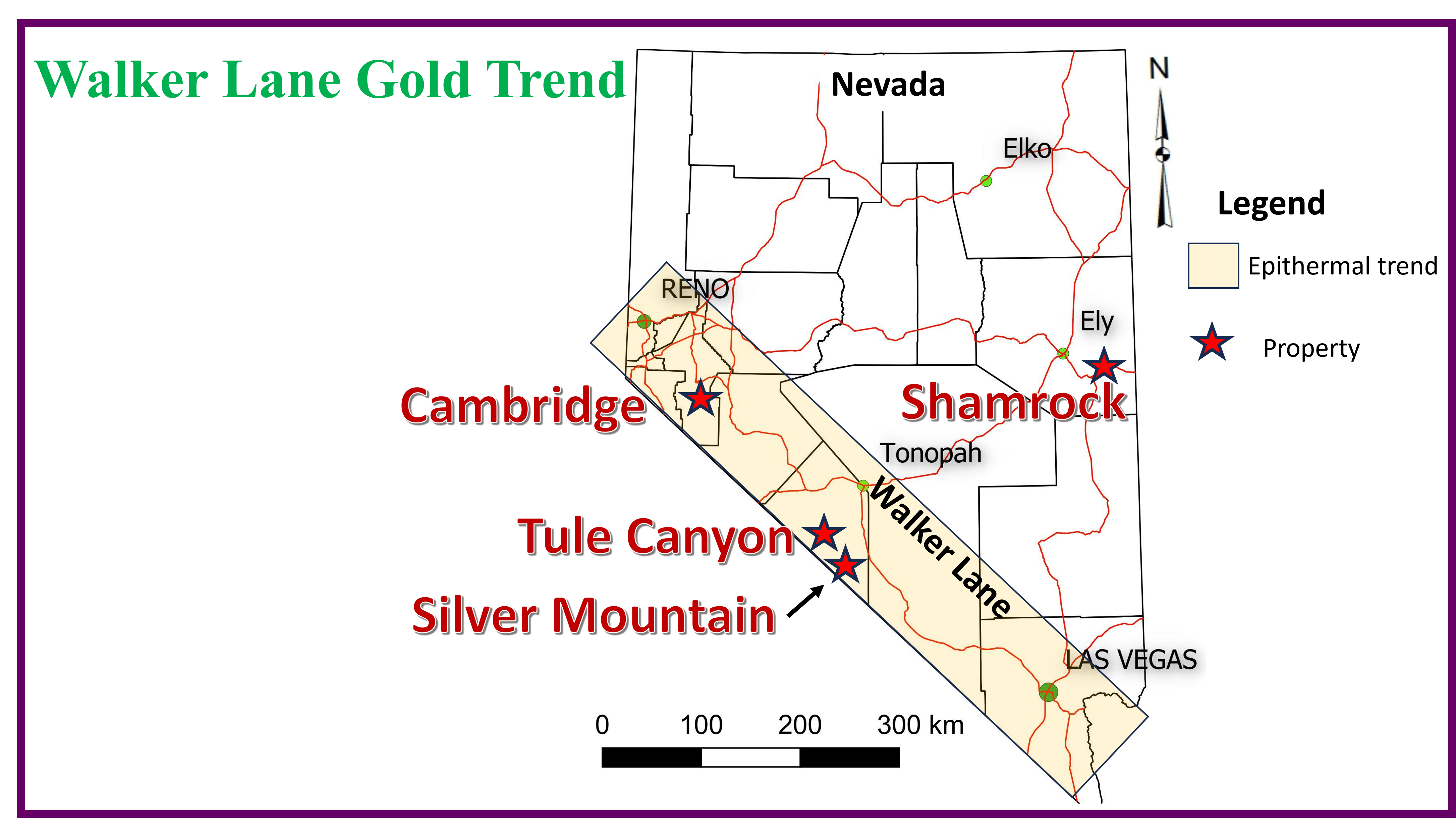

The company is named after and active on a trio of projects in Nevada’s Walker Lane trend, a tier-1 mining jurisdiction that has yielded company-making gold, silver and copper deposits for more than a century, despite minimal modern exploration, opening the door for Walker Lane Resources to rigorously identify untapped exploration upside and make its presence felt in the region as a US$5,000 ounce gradually grows within reach.

The miner’s flagship Tule Canyon project, as delineated in part 1, is its nearest-term catalyst towards adding its name to its eponymous trend’s long list of successful operators, boasting a broad selection of high-grade, drill-ready targets across a ~4 km corridor sampling up to 37.3 grams per ton (g/t) of gold and 4,320 g/t silver. Leadership believes the corridor holds the potential to yield compliant resources in 12-24 months – beginning with upcoming 2025 drilling – and stoke the stock into an outsized re-rating.

As Walker Lane Resources focuses on Tule Canyon’s value proposition of resource growth, keen to maximize dollars in the ground and progress towards feasibility, the company is looking out further ahead, keen to monetize the above-average exploration upside of its Cambridge project to the northwest.

The Cambridge Mine property

The Cambridge gold and silver property, located 33 km south of Yerington in Lyon County, Nevada, makes for an ideal secondary property for the company to unlock value and add to the Walker Lane trend’s burgeoning institutional interest, as gold and silver (also reaching a record high in October) continue to capture investor attention and greater portfolio allocations driven by expectations of falling interest rates and market projections muddled by US tariff policy.

The road-accessible property’s exploration history dates back to the 1860s, with Henry Blasdel, Nevada’s first state governor, purchasing the Cambridge Mine to the southeast in the 1870s, prompting production of about 10,000 tons grading 0.3 ounces per ton at a nearby mill into the late 1800s. Besides a reactivation by Cambridge Mining Corp. from 1940 to 1942, and a brief period of exploration in the 1960s, there has been no major mining on the property ever since.

Walker Lane Resources secured a 100-per-cent option on Cambridge from Silver Range Resources in June 2025, granting it exposure to substantial exploration inventory, including high-grade quartz vein gold targets and more than 40 historical workings across the land package, with mineralization traced to a depth of 137 metres.

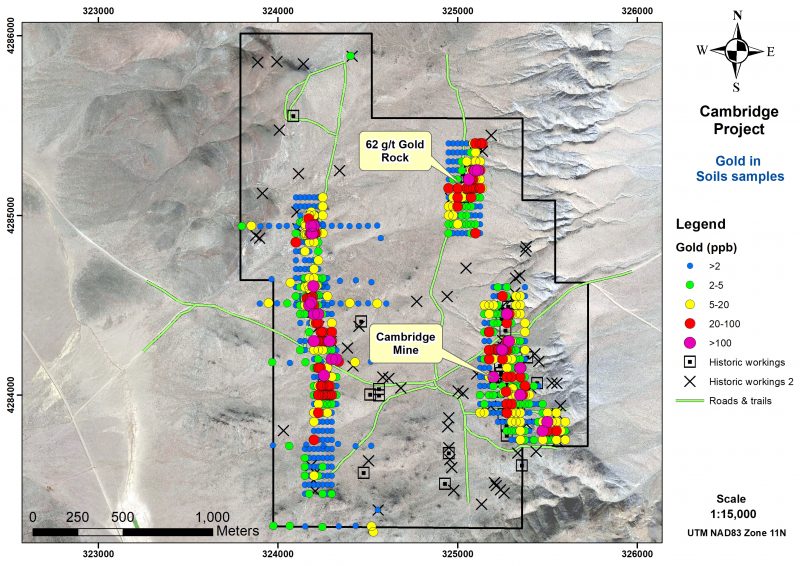

Cambridge’s quartz veins are up to 20 centimetres wide in sparse exposed areas and up to 2 m wide in select mine workings, and are hosted in faults or shears individually measuring up to 1,500 m in strike length, supporting the property’s significant prospectivity. This has been demonstrated by numerous exploration highlights, including:

- An airborne magnetic field and radiometric survey conducted in 2020 delineating structural trends coincident with known gold mineralization in the western portion of the property.

- 68 grab samples in 2020-2021, including 20 (29 per cent) assaying more than 5 g/t gold with a highlight of 93.8 g/t gold.

- 29 trench samples in 2022 highlighted by 3.2 m grading 14.65 g/t gold.

- Numerous strong and coincident gold-in-soil anomalies greater than 100 parts per billion.

- Associated silver mineralization up to 274 g/t silver, in addition to the presence of associated lead, copper and antimony.

These promising results take the shape of three known gold zones – North, Price Lode and Cambridge Mine – representing a robust 2.7 kilometres in strike length that remains open and is notable for multiple instances of visible gold, indicating widespread high-grade potential to be drill-tested after Tule Canyon’s value proposition is given a chance to bear more fruit.

Captained by a leadership team with the foundations to deliver exploration success – including president and CEO Kevin Brewer’s experience with designing and executing multi-million-dollar exploration campaigns, chairman John Land’s founding of driller Flamingo Drilling, and project geologist Cesar Symonds’ 15-year track record with the likes of Sonoro Gold (TSXV:SGO) and First Majestic Silver (TSX:AG) – Walker Lane Resources is ideally positioned to advance the Cambridge project along its untapped exploration pathway, which is shaping up to become another memorable chapter in the Walker Lane trend’s mineral-rich history.

As per the existing Cambridge option agreement, the company will put an exploration program in place designed to yield an NI 43-101 compliant resource estimate on or before December 31, 2033. Contingent on financing, supported by the flexibility of only 19.56 million shares outstanding, this sets the stage for years of positive news flow ahead, granting the gold and silver stock plenty of fuel to surpass its current nano market capitalization.

Stay tuned for the third and final installment in this article series, in which we’ll take a deep dive into the Silver Mountain project, Walker Lane Resources’ third exploration prospect along the Walker Lane trend, whose runway towards resource definition is highlighted by a pair of claim areas that have yielded 7 of 16 sample assays greater than 100 g/t silver, with the Gulch Showing producing a chip sample of 1,415 g/t silver and 0.48 per cent copper, and the Old Cabin Showing producing high-grade grab samples up to 3,270 g/t silver within a 400-m area of historical workings.

Join the discussion: Find out what investors are saying about this polymetallic gold stock on the Walker Lane Resources Ltd. Bullboard and make sure to explore the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.