- West Point Gold Corp. (TSXV:WPG) has acquired 100 per cent of the Baxter Spring Project in Nevada’s Manhattan Mining District by purchasing Baxter Gold Corp. and its U.S. subsidiary

- The project boasts significant historical drilling, including standout results like 12.2 m at 60.3 g/t gold and 3.0 m at 240 g/t gold, with over 12,850 metres drilled across 128 holes

- 13.5 million shares were issued to Baxter shareholders, subject to a statutory hold until February 2026 and staggered contractual release through October 2027; the deal awaits final TSX Venture Exchange approval

- West Point Gold stock (TSXV:WPG) last traded at $0.48

West Point Gold (TSXV:WPG) has officially completed the acquisition of a 100 per cent interest in the Baxter Spring Project, located in Nevada’s Manhattan Mining District. The acquisition was executed through the purchase of Baxter Gold Corp., a private Canadian company, and its U.S. subsidiary, under a share purchase agreement.

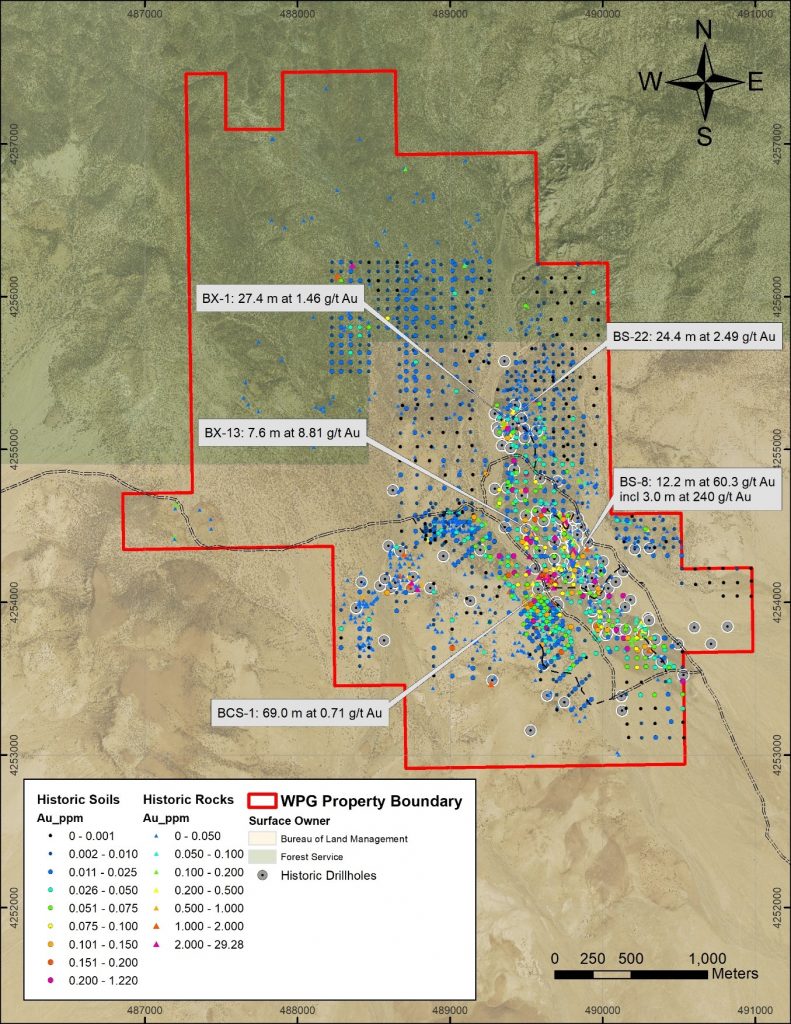

Via a media statement, the team stated that the Baxter Spring Project lies approximately 40 kilometres south of Kinross Gold’s Round Mountain Mine and West Point Gold’s Jefferson Canyon project in Nye County. The site has a rich exploration history, with 128 drill holes totaling over 11,000 metres of reverse circulation drilling and 1,850 metres of core drilling. It also includes extensive surface geochemical and geophysical surveys.

Notable historical drill results include:

- 24.4 metres at 2.49 g/t gold (BS-22, Homestake Mining, 1982)

- 12.2 metres at 60.3 g/t gold, including 3.0 metres at 240 g/t gold (BS-8, Homestake Mining, 1982)

- 27.4 metres at 1.46 g/t gold (BX-1, Naneco, 1988)

- 7.6 metres at 8.81 g/t gold (BX-13, Naneco, 1988)

- 69.0 metres at 0.71 g/t gold (BCS-1, Homestake Mining, 1984)

To complete the acquisition, West Point Gold issued 13.5 million common shares at a price of $0.435 per share to Baxter shareholders.

The transaction is pending final approval from the TSX Venture Exchange. West Point Gold’s vice president of exploration, Robert Johansing, M.Sc. Econ. Geol., P.Geo., reviewed and approved the technical content of the acquisition announcement. While the historical data has not been independently verified to current NI 43-101 standards, it is believed to have been collected using industry-standard practices at the time.

CEO Quentin Mai emphasized that while the Gold Chain project remains the company’s flagship asset, Baxter Spring offers a strategic opportunity to expand in a premier mining jurisdiction. The company plans to initiate low-cost exploration programs at Baxter Spring in Q4 2025, with drilling anticipated in 2026.

“We believe the replacement cost of the work completed to date far exceeds the value of the shares West Point Gold is paying to acquire the project,” he said in an earlier news release. “This opportunity is largely the result of Baxter Spring being a secondary project held by several other companies, where it had not seen recent work.”

West Point Gold Corp. is focused on gold discovery and development at four prolific Walker Lane Trend projects covering Nevada and Arizona.

West Point Gold stock (TSXV:WPG) last traded at $0.48 and has risen 50.00 per cent since the year began.

Join the discussion: Find out what the Bullboards are saying about West Point Gold and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.