- Xali Gold (XGC) has completed the first tranche of its non-brokered private placement for gross proceeds of $219,000

- For the first tranche, Xali issued 3,665,000 units priced at $0.06 per unit

- The net proceeds of the private placement will be used to further permitting and targeting drilling programs, working capital and general corporate purposes

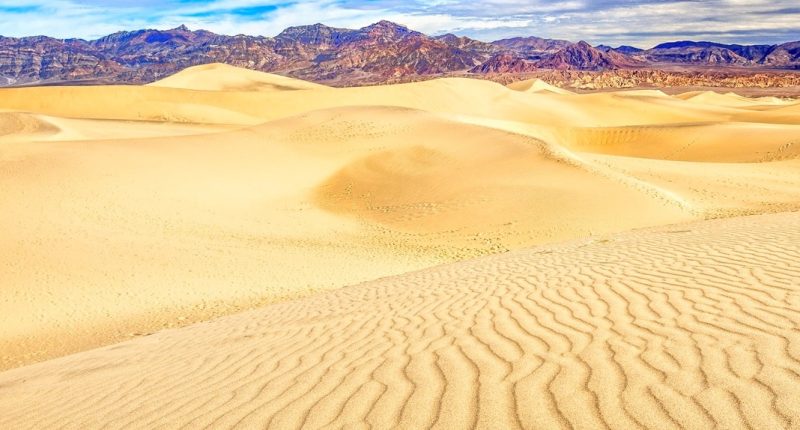

- Xali Gold is a mineral exploration company engaged in the exploration of mineral right interests in Mexico and Peru

- Xali Gold Corp. (XGC) opened trading at C$0.06 per share

Xali Gold (XGC) has completed the first tranche of its previously announced non-brokered private placement for gross proceeds of $219,000.

For the first tranche, Xali issued 3,665,000 units priced at $0.06 per unit.

Each unit consists of one common share and one-half share purchase warrant. Each whole warrant will be exercisable for one additional share at a conversion price of $0.12, subject to an acceleration provision.

Securities issued will be subject to a mandatory four-month hold period.

The net proceeds of the private placement will be used to further permitting and targeting drilling programs, working capital and general corporate purposes.

Xali Gold is a mineral exploration company engaged in the exploration of mineral rights interests in Mexico and Peru. Its projects include El Oro, El Dorado, Cocula and Tres Marias.

Xali Gold Corp. (XGC) opened trading at C$0.06 per share.