- K9 Gold Corp. (KNC) has announced a non-brokered private placement for gross proceeds of up to $2.75M

- The company will issue up to 10,000,000 flow-through units and up to 5,000,000 non-flow-through units

- Each unit and FT Unit will consist of one common share and one share purchase warrant

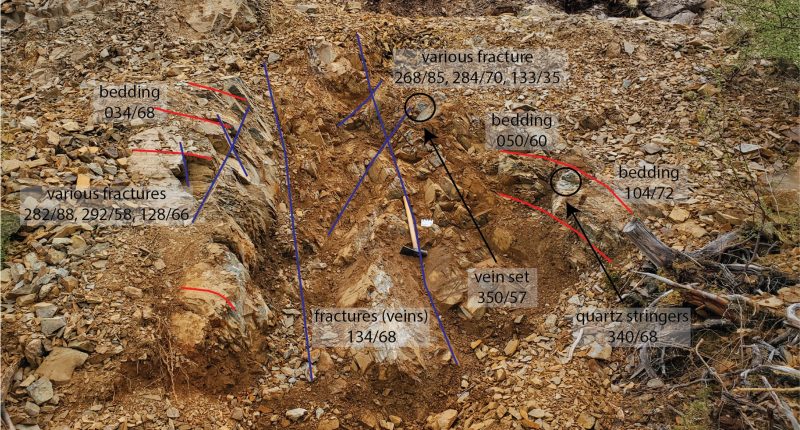

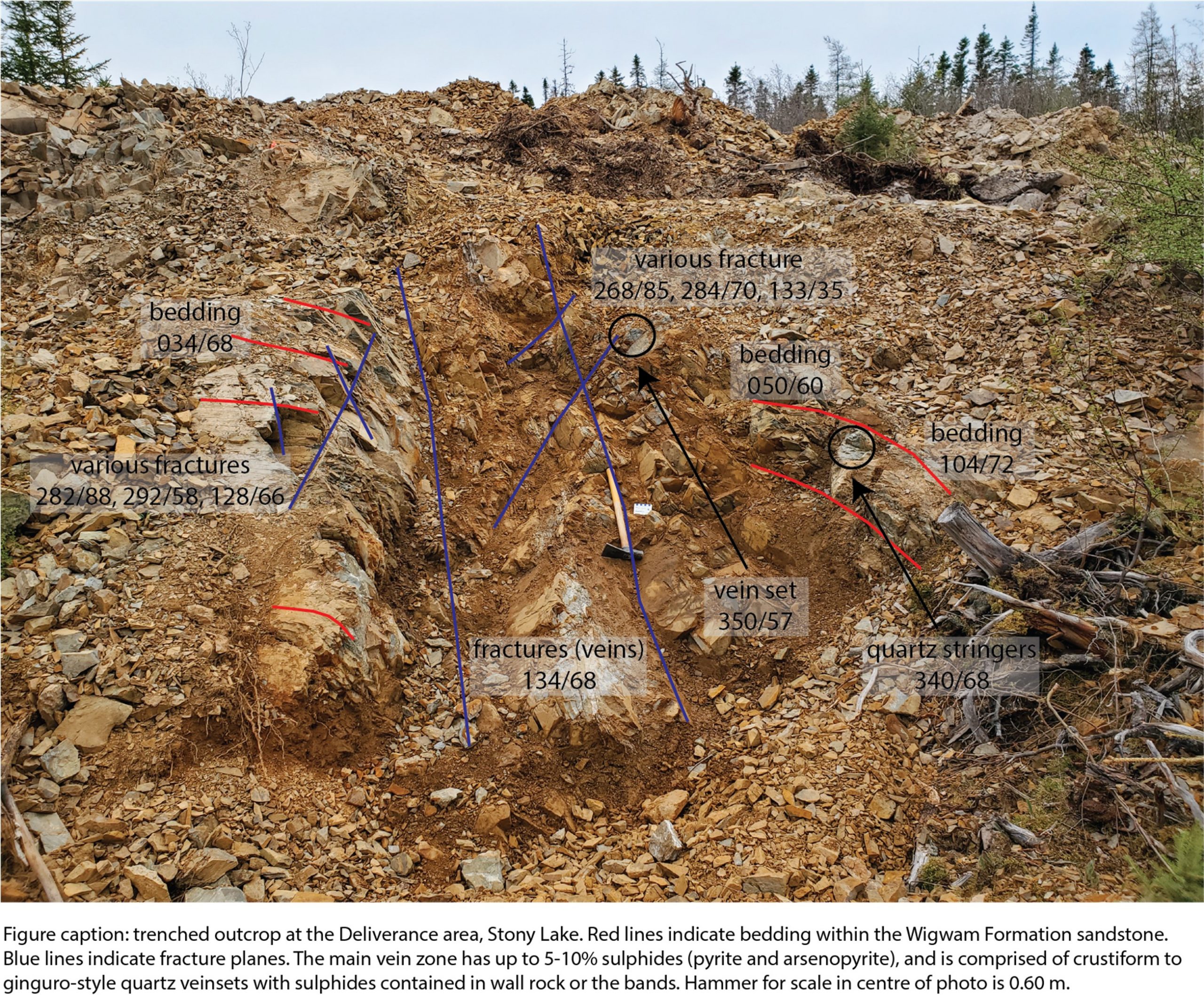

- Proceeds will be used for drilling and exploration on the Stony Lake Gold Project in Newfoundland

- K9 Gold is a mineral exploration company with interests in Utah and Newfoundland

- K9 Gold Corp. (KNC) opened trading at C$0.165 per share

K9 Gold Corp. (KNC) has announced a non-brokered private placement for gross proceeds of up to $2.75 million.

The company will issue up to 10,000,000 flow-through units and up to 5,000,000 non-flow-through units.

Each unit and FT Unit will consist of one common share and one share purchase warrant, with each whole share purchase warrant being exercisable for a period of two years at a price of $0.25 per share.

Proceeds will be used for drilling and exploration on the Stony Lake Project in Newfoundland.

All securities issued pursuant to this financing are subject to a four-month hold period from the date of issuance.

K9 Gold is a mineral exploration company with interests in Utah and Newfoundland.

K9 Gold Corp. (KNC) opened trading at C$0.165 per share.