- Mountain Boy Minerals (MTB) has increased its oversubscribed non-brokered private placement of flow-through units from $500,000 to $626,000

- Mountain Boy has also arranged a non-brokered private placement of units for gross proceeds of $119,880

- Mountain Boy Minerals Ltd is an exploration company

- Mountain Boy Minerals Ltd. (MTB) opened trading at C$0.11

Mountain Boy Minerals (MTB) has increased its oversubscribed non-brokered private placement of flow-through units from $500,000 to $626,000.

Each flow-through unit, priced at $0.12, will consist of one common share. Each FT warrant will entitle the holder to purchase one additional common share for a period of 29 months following the closing date of the offering.

Mountain Boy has also arranged a non-brokered private placement of units for gross proceeds of $119,880. Each unit, priced at C$0.12, will consist of one common share and one common share purchase warrant. Each warrant will entitle the holder to purchase one common share for a period of 24 months following the closing date of the offering.

Finder’s fee of 7 per cent cash and finder’s warrants will be payable to certain finders.

The closings of the flow-through offering and unit offering are subject to receipt of all necessary regulatory approvals.

All shares issued will be subject to a statutory four-month hold period.

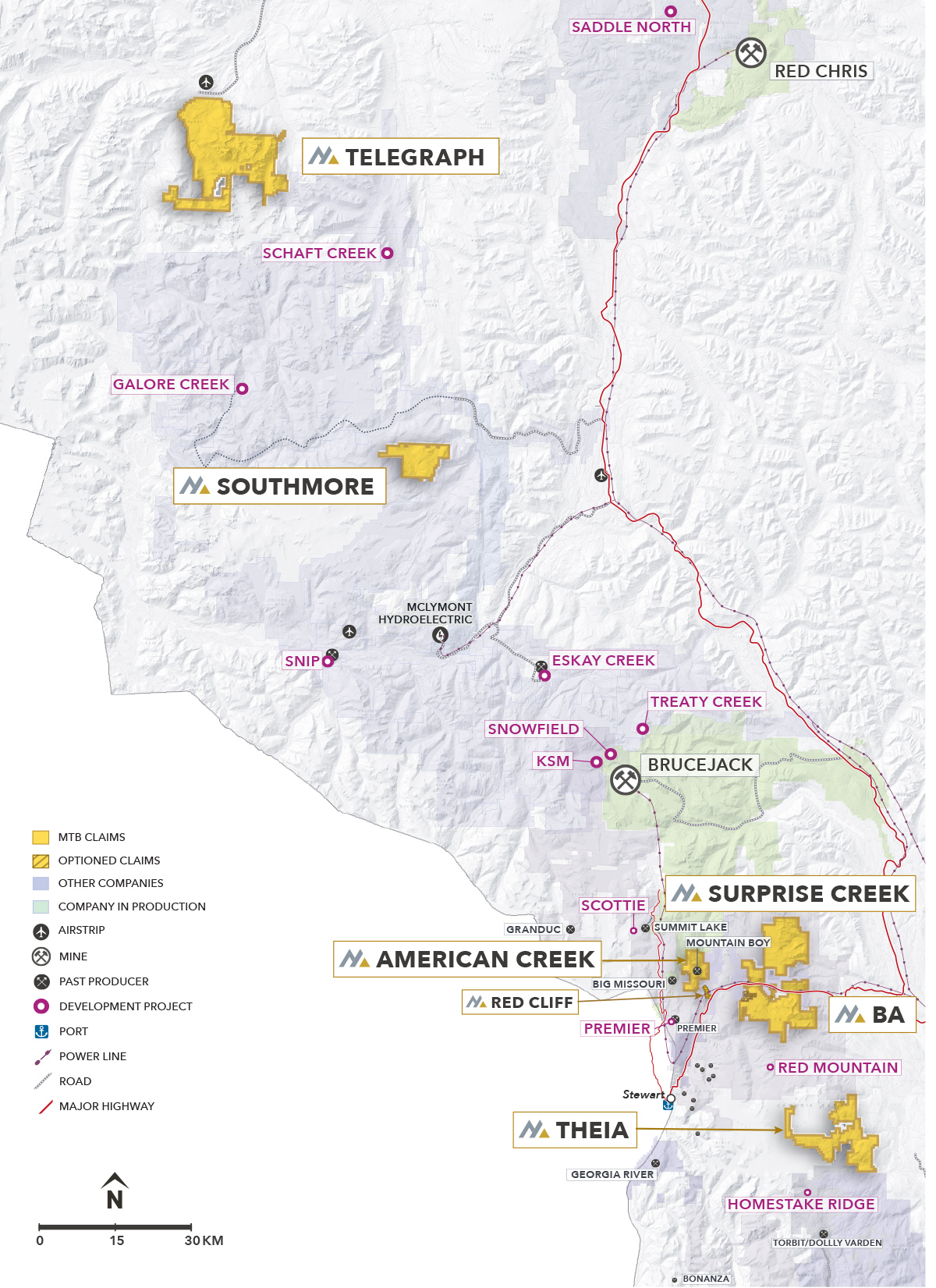

Mountain Boy Minerals is an exploration company with six active projects spanning 650 square kilometres (64,960 hectares) in the prolific Golden Triangle of northern British Columbia.

Mountain Boy Minerals Ltd. (MTB) opened trading at C$0.11.