- New Found Gold Corp. (NFG) has announced a bought-deal offering of charity FT common shares for gross proceeds of approximately $50,000,000

- A syndicate of underwriters, led by BMO Capital Markets, has agreed to buy 6,250,000 charity flow-through common shares at $8.00 per share

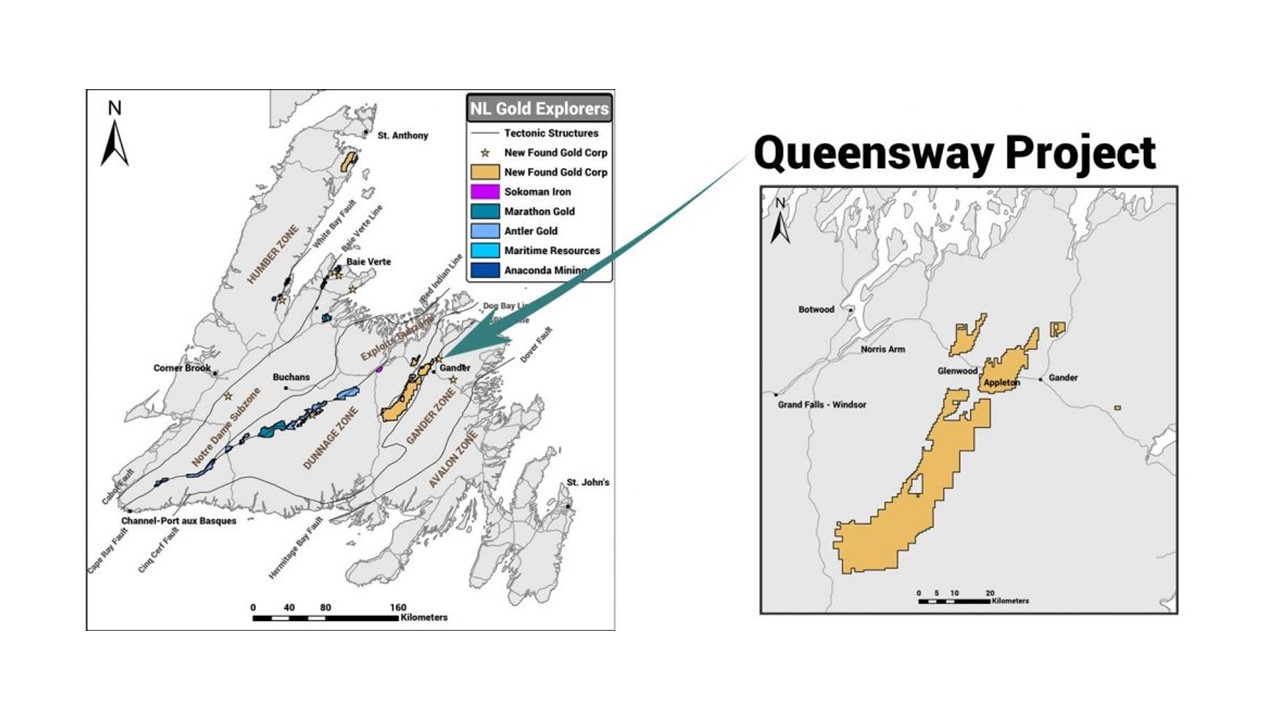

- Net proceeds will be used to continue its exploration and drilling efforts at the company’s Queensway Project

- The offering is expected to close on or about December 14, 2022

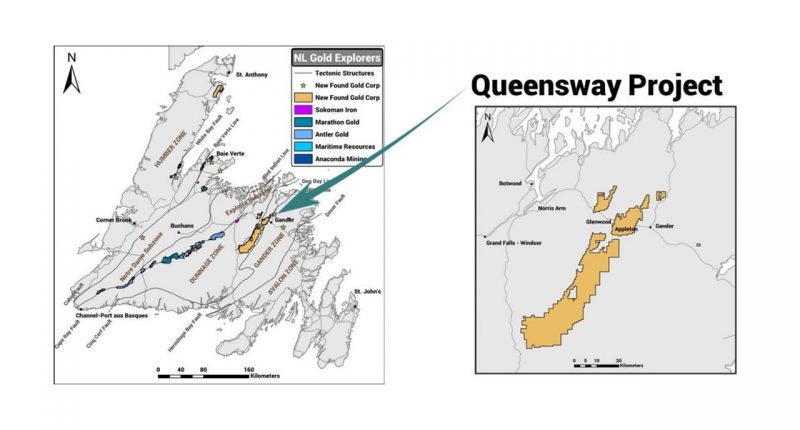

- New Found Gold is a mineral exploration company engaged in the acquisition, exploration and evaluation of resource properties with a focus on gold properties

- New Found Gold Corp. (NFG) opened trading at C$6.22

New Found Gold (NFG) has announced a bought-deal offering of charity FT common shares for gross proceeds of $50,000,000.

A syndicate of underwriters, led by BMO Capital Markets, has agreed to buy, on a bought-deal basis, 6,250,000 charity flow-through common shares at $8.00 per share.

The company has granted the underwriters an over-allotment option to purchase up to an additional 15 per cent of the shares issued under the offering.

Net proceeds will be used to continue its exploration and drilling efforts at the company’s Queensway Project.

The offering is expected to close on or about December 14, 2022, and is subject to all necessary regulatory approvals, including the approval of the TSX Venture Exchange and the NYSE American.

New Found Gold is a mineral exploration company engaged in the acquisition, exploration and evaluation of resource properties with a focus on gold properties located in Newfoundland and Ontario. New Found holds a 100 per cent interest in the Queensway Project in Newfoundland.

New Found Gold Corp. (NFG) opened trading at C$6.22.