- Strathmore Plus Uranium (SUU) announced a non-brokered private placement to raise proceeds of $2,000,000

- The company will issue up to 5,000,000 units at $0.40 per unit

- Proceeds will be used for general working capital purposes

- Strathmore Plus is a uranium exploration company

- Strathmore Plus Uranium Corp. (SUU) opened trading at C$0.415

Strathmore Plus Uranium (SUU) announced a non-brokered private placement to raise proceeds of $2,000,000.

The company will issue up to 5,000,000 units at $0.40 per unit. Each unit consists of one common share and one-half common share purchase warrant. Each whole warrant entitles the holder to purchase an additional common share at a price of $0.50 per share for a period of 24 months.

Proceeds will be used for general working capital purposes.

The securities will be subject to a statutory four-month hold period from the date of issue of the units.

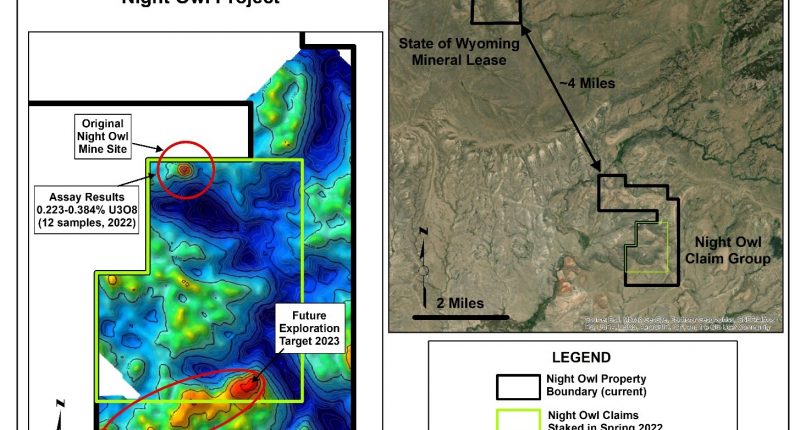

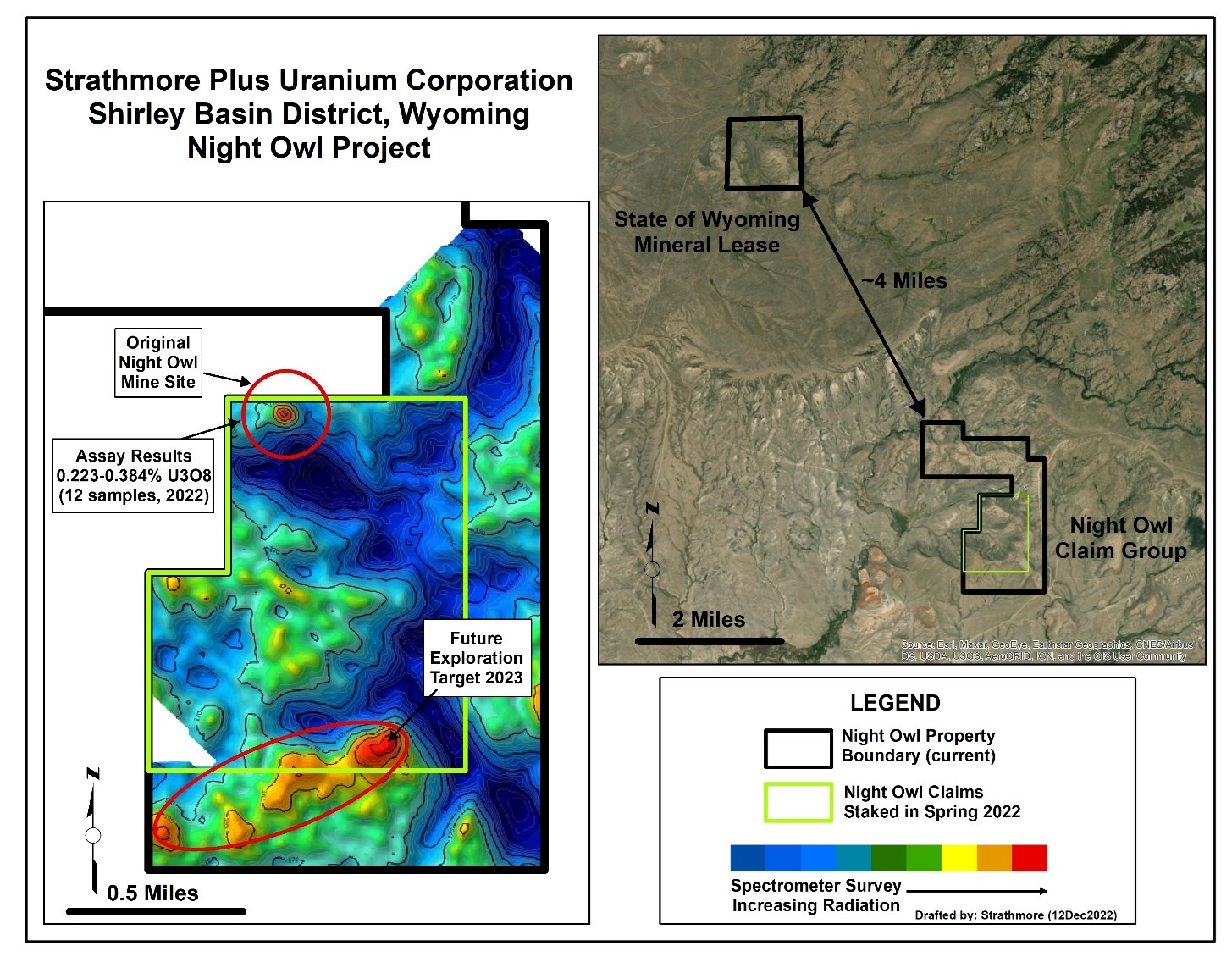

Strathmore Plus is a uranium exploration company focused on in-situ recoverable uranium deposits in Wyoming.

Strathmore Plus Uranium Corp. (SUU) opened trading at C$0.415.