- Voyageur (VM) has upsized its non-brokered private placement offering

- The company will now offer up to 17,142,857 units for gross proceeds of up to $1,200,000

- It expects to complete one or more tranches in January 2023

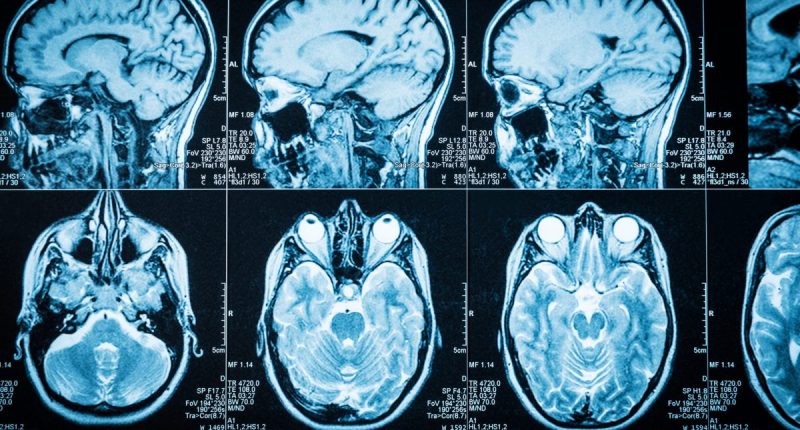

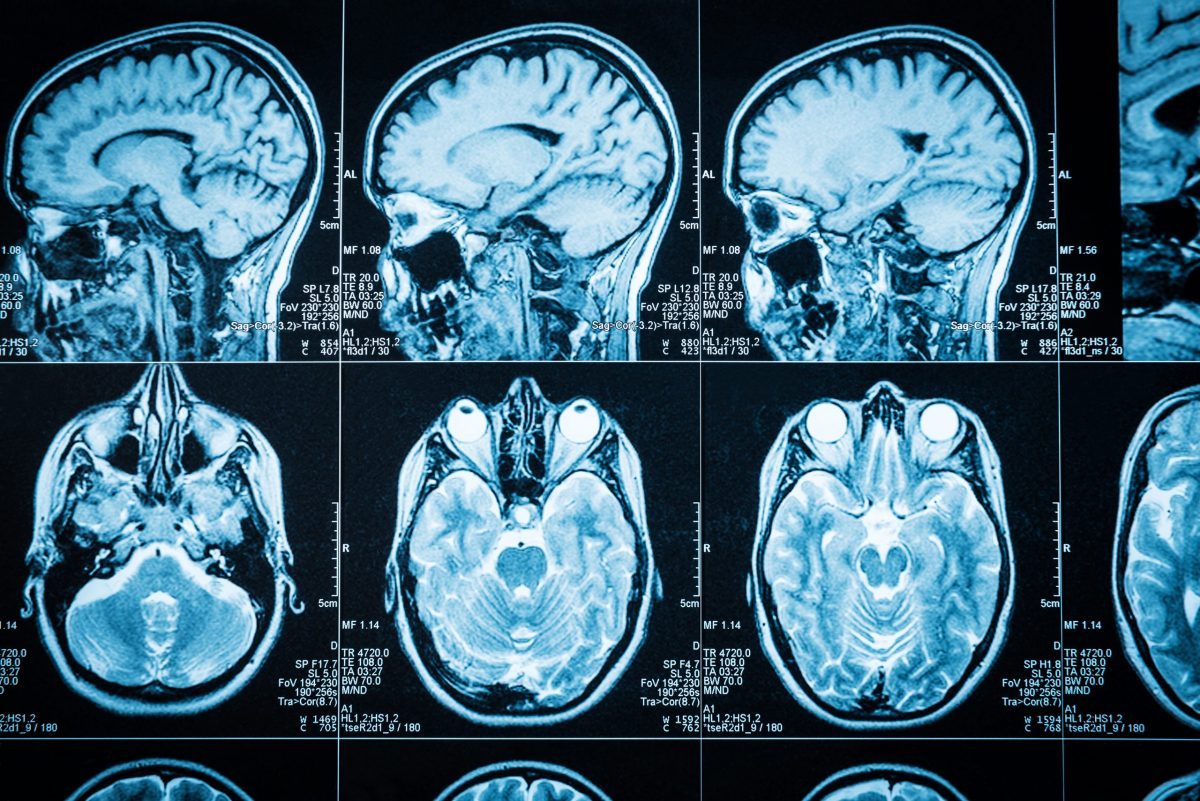

- Voyageur is focused on the development of barium and iodine APIs, as well as imaging contrast agents for the medical imaging marketplace

- Voyageur Pharmaceuticals (VM) is up 5.56 per cent, trading at $0.095 per share at 10 am ET

Voyageur (VM) has upsized its previously announced non-brokered private placement offering.

Under the upsized offering, the company will issue up to 17,142,857 units for gross proceeds of up to $1,200,000.

Each unit is being offered at a price of $0.07 and is comprised of one common share and one common share purchase warrant.

Each warrant entitles the holder to purchase one common share for $0.12 for two years from the date of issuance.

Voyageur expects to complete one or more tranches in January 2023.

It will allocate the proceeds in the following order:

| Commissions and offering costs | $60,000 |

| SmoothX and corporate marketing | $250,000 |

| FDA EMA testing | $250,000 |

| Legal | $340,000 |

| Auditing fees | $50,000 |

| Corporate G&A | $280,000 |

| Total | $1,200,000 |

Voyageur is focused on developing barium and iodine APIs, as well as imaging contrast agents for the medical imaging marketplace.

Voyageur Pharmaceuticals (VM) is up 5.56 per cent on the day, trading at $0.095 per share at 10 am ET.