- Paycore Minerals (CORE) has announced a bought deal offering to raise gross proceeds of $8 million

- The company will issue 4,950,000 common shares of Paycore for $1.63 per share

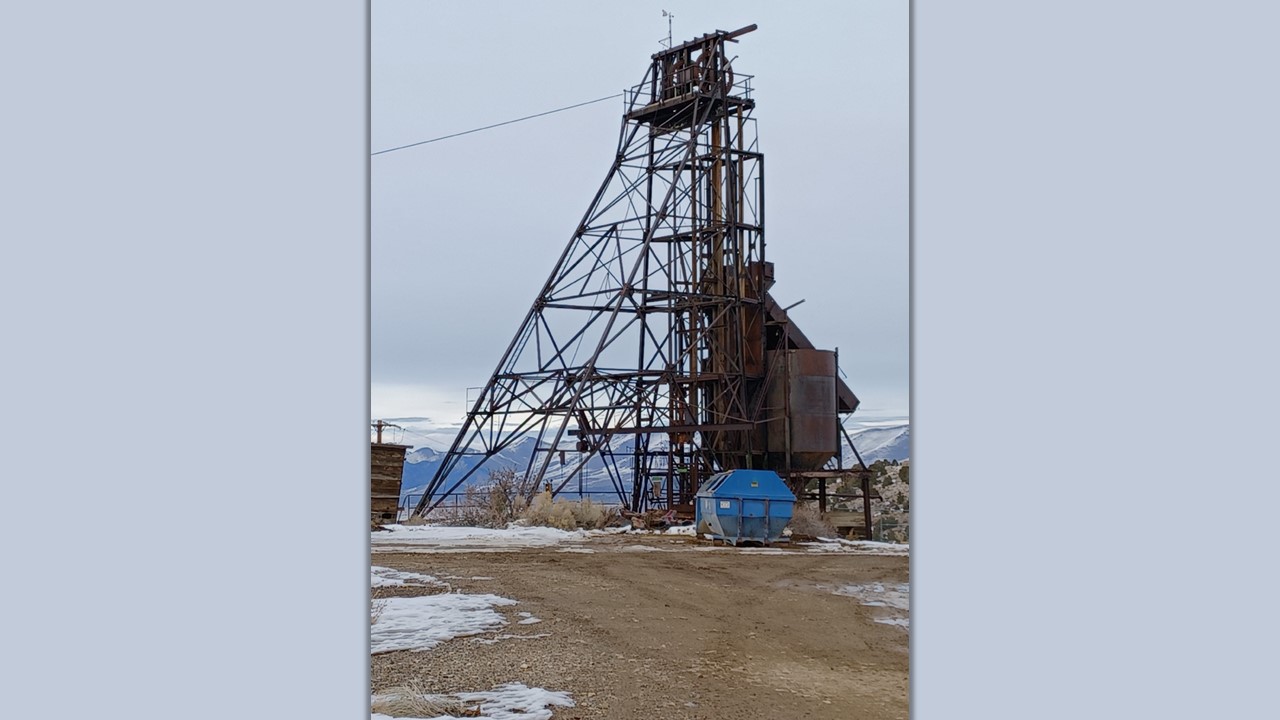

- The net proceeds from the offering will be used for development and permitting activities at its 100 per cent owned FAD Property in Nevada

- Paycore is a mineral exploration company

- Paycore Minerals Inc. (CORE) opened trading at C$1.85

Paycore Minerals (CORE) has announced a bought deal offering to raise gross proceeds of $8 million.

The company has entered into an agreement with PI Financial Corp. and CIBC Capital Markets, as lead underwriters and co-bookrunners, on behalf of a syndicate of underwriters, to purchase 4,950,000 common shares of Paycore for $1.63 per share.

The underwriters have been granted an over-allotment option.

The net proceeds from the offering will be used for development and permitting activities at its FAD Property in Nevada for working capital and general corporate purposes.

The offering is expected to close on or about February 9, 2023, and is subject to the receipt of all applicable regulatory approvals, including approval of the TSX Venture Exchange.

Paycore is a mineral exploration company that holds a 100 per cent interest in the FAD Property located in Nevada. The FAD Property was previously owned by Barrick Gold.

Paycore Minerals Inc. (CORE) opened trading at C$1.85.