- Indigo Exploration (IXI) has disclosed its intention to undertake a non-brokered private placement of up to 10,000,000 units

- The company intends to issue the units at a price of $0.06 to raise total gross proceeds of up to $600,000

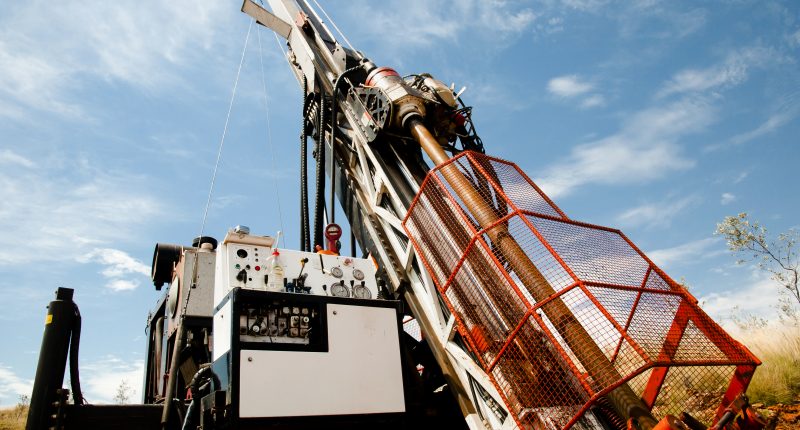

- The company plans to use the gross proceeds for work programs on its exploration properties and for general working capital

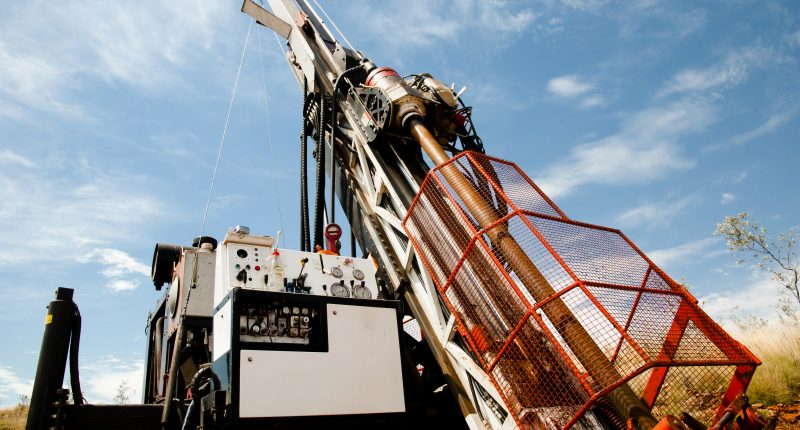

- Indigo Exploration is a junior natural resource company which holds a 100-per-cent interest in 18 metallic and industrial minerals permits in central Alberta

- Indigo Exploration (IXI) was down 13.043 per cent, trading at $0.10 per share

Indigo Exploration (IXI) will undertake a non-brokered private placement of up to 10,000,000 units.

The company intends to issue the units at a price of $0.06 to raise total gross proceeds of up to $600,000.

Each unit will be made up of one common share and one-half of one warrant. Each whole warrant will entitle the holder to purchase one common share for a period of two years at a price of $0.10.

The company plans to use the funds for work programs on its exploration properties and for general working capital.

The units will be offered to qualified purchasers in reliance upon exemptions from prospectus and registration requirements of applicable securities legislation.

All securities issued and sold under the offering will be subject to a hold period expiring four months and one day from their date of issuance.

Completion of the offering remains subject to the receipt of all necessary regulatory approvals, including the approval of the TSX Venture Exchange.

Indigo Exploration is a junior natural resource company which holds a 100-per-cent interest in 18 metallic and industrial minerals permits in central Alberta.

Indigo Exploration (IXI) was down 13.043 per cent, trading at $0.10 at 1:05 pm ET.