- Alpha Exploration (ALEX) has announced a non-brokered private placement for gross proceeds of up to $3,600,000

- The company will offer a maximum of 5,142,857 units for $0.70 per unit

- Alpha Exploration expects to close the private placement on or before September 8, 2022

- The company will use the net proceeds of the private placement to fund ongoing exploration work on the Kerkasha project

- Alpha is a Canadian exploration company focused on the discovery of gold and base metals deposits in the prospective Arabian-Nubian shield, on either side of the Red Sea

- Alpha Exploration Ltd. opened the day’s trading at $0.57 per share

Alpha Exploration (ALEX) has announced a non-brokered private placement for gross proceeds of up to $3,600,000.

The company will offer a maximum of 5,142,857 units for $0.70 per unit.

Each unit includes one common share and one common share purchase warrant. Each warrant will entitle the holder to acquire one additional share at an exercise price of $1.05 per warrant share for a period of 24 months immediately following the closing date.

Alpha Exploration expects to close the private placement on or before September 8, 2022.

Alpha may pay certain arm’s length parties a cash finder’s fee payment equal to up to 6.0 per cent of the units sold to subscribers introduced by such parties.

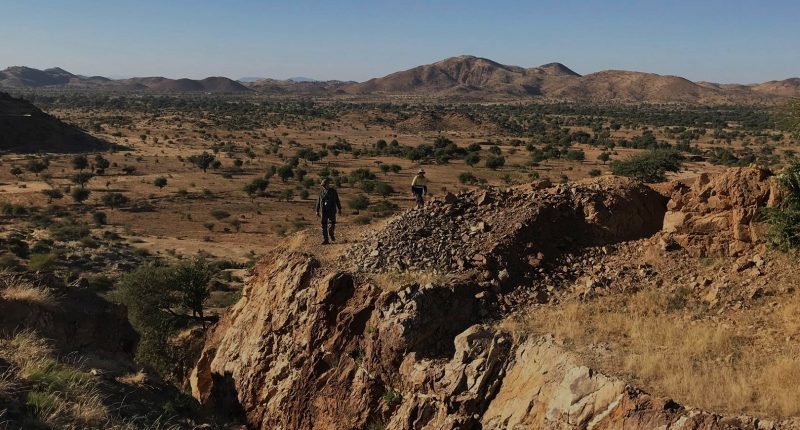

The company plans to use the net proceeds of the private placement to fund ongoing exploration work on the Kerkasha project located in Eritrea. It will also use the proceeds for operating and administrative expenses, working capital and general corporate purposes.

The corporation has received a binding commitment from Crescat Portfolio Management LLC for subscriptions totalling C$700,000.00 in the private placement.

Alpha is a Canadian exploration company focused on the discovery of gold and base metals deposits in the prospective Arabian-Nubian shield, on either side of the Red Sea.

Alpha Exploration Ltd. opened the day’s trading at $0.57 per share.