Mining investors like to see their resource investments reporting “record production.” But there is a caveat attached.

As the mining company ramps up production, it depletes the mineral resources previously defined – and reduces mine life.

Alphamin Resources (TSXV:AFM/JSE:APH) has provided its shareholders with the best of both worlds with two recent news releases.

First, on January 30, 2023, the company reported “record annual tin production and EBITDA guidance.” Why is this major news? Two reasons.

Alphamin is a giant in the tin industry, producing ~4% of the total global supply. And the company’s Mpama North Tin Mine, based in the Democratic Republic of Congo, boasts the world’s highest grade tin resource: ~4.5% tin.

For its full-year 2022 results, Mpama North announced record tin production of 12,493 tonnes, a 14% y-o-y increase. Record output was boosted by a strong Q4. Alphamin exceeded its guidance of 3,000 tonnes of production with 3,113 tonnes of tin.

Full-year EBITDA for 2022 is now estimated at US$222 million (another record) based on management’s guidance.

The icing on the cake for shareholders is that Alphamin has also just announced both increased size and increased quality of its tin resources for Mpama South. On February 10, 2023, the company announced a total increase of resources of 286%, up to 3.26 million tonnes of tin.

Mpama South, located ~1 kilometre from Mpama North, offers investors enormous blue-sky potential. The company currently estimates that Mpama South will be ready to launch commercial production at the end of 2023.

A 2022 PEA for the Project estimates annualized tin production of 7,232 tonnes at Mpama South. That would represent nearly a 60% increase on the “record production” that Alphamin just reported.

For astute mining investors who follow the tin market, Alphamin’s double-barreled good news could not have come at a better time. After a wild roller-coaster ride for the tin market in 2022, tin appears poised for another bull-market run in 2023.

What happened in 2022? First came a huge spike in the price of tin.

Tin Prices Surge as Traders Battle Historic Supply Squeeze

Yet no sooner had tin soared to a record price of nearly US$44,000 per tonne than the market dramatically reversed.

What caused that? A March 2022 NY Times article provides a strong hint.

China’s Covid Lockdowns Set to Further Disrupt Global Supply Chains

Tin remains a key raw material in the global economy. Used as a coating to prevent corrosion in metals, tin is important in both the steel and aluminum industries. On top of that, most window glass requires tin as a production input.

Now the tin market appears about to reverse again – this time higher. The tin market is currently showing contango conditions, as represented by LME tin contracts.

Longer-dated contracts reflect market expectations of a rising tin price. What’s fueling these expectations can be spelled with five letters: C-H-I-N-A.

As China abandons zero-Covid, what will the economy look like in 2023?

China is both the world’s largest steel producer and the world’s largest aluminum producer. Think that the “re-opening” of China’s economy will be good for the tin market?

That’s the demand picture for tin. But the supply side looks equally interesting.

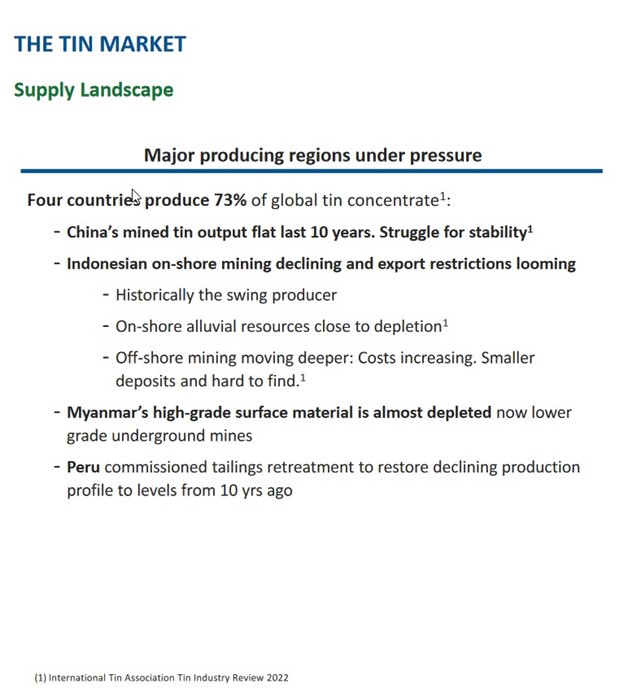

As a major global tin producer, Alphamin Resources follows the tin market closely. Outside of its own production, the company sees “flat” or even declining production from other major tin suppliers.

Investors connecting the dots here may very well conclude that the “historic supply squeeze” (and price spike) at the end of 2021 and into early 2022 was due to this flat supply picture.

With China re-opening and Mpama South’s new production not due to come online until the end of this year, will we see another major spike in the price of tin?

Even if that’s not the case, Alphamin’s ultra-high grades at Mpama North offer investors strong downside protection in the unexpected scenario of further weakness in the tin market.

Despite a “weak average tin price” in Q4 2022 of only US$21,436 per tonne, the company still generated a 41% EBITDA margin.

Huge growth potential. Strong downside protection. A tin market that looks ready to rebound.

Alphamin Resources offers a very strong investment profile. With mining stocks generally depressed (and due for a rebound), Alphamin will be hard to resist for many mining investors.

DISCLOSURE: This is a paid article by The Market Herald.