Shares related to artificial intelligence continue to be a major focus in the market, even though the initial euphoria has subsided somewhat recently. Critical voices are increasingly warning of setbacks or even a significant correction. Among these skeptics is the well-known investor Michael Burry, who is said to have bet on falling prices for Nvidia and other industry peers. At the same time, shares linked to critical metals and their industrial end users have once again moved into the spotlight since the turn of the year. This is because tech specialists and AI infrastructure providers are under pressure to meet extremely high requirements in terms of energy supply, computing capacity, speed, and reliability. As a result, further opportunities are emerging for selected stocks. We highlight a few of these potential plays.

This article is disseminated in partnership with Apaton Finance GmbH. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Almonty Industries – Tungsten becomes a game changer

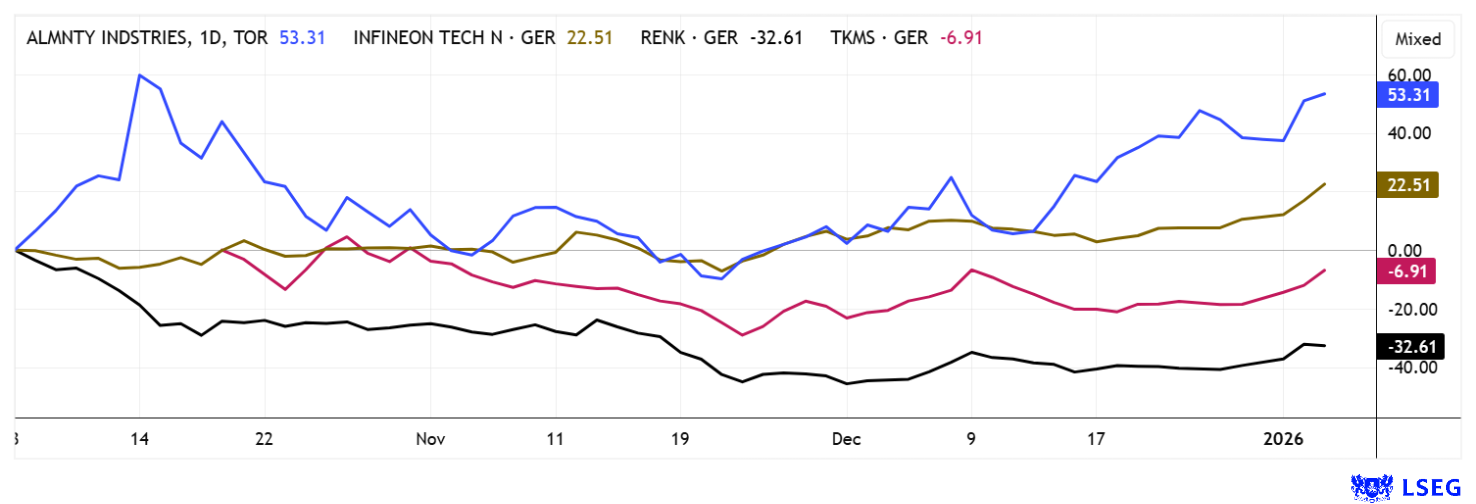

The good news at Almonty Industries (TSX:AII) shows no sign of abating. Under the leadership of dynamic CEO Lewis Black, the Company announced in December that it had commenced first-stage production activities at the Sangdong mine in South Korea, the largest tungsten mine outside China and a key strategic project for Western raw material security. Just weeks earlier, Almonty completed an important tungsten M&A deal in Montana, USA, strategically expanding its presence in North America. Just weeks earlier, Almonty completed a major tungsten M&A deal in Montana, strategically expanding its presence in North America. This expansion comes at a time when the price of tungsten is rising sharply again after a prolonged sideways phase. While the reference price (APT China) rose by almost 140 per cent to more than USD 70,000 per metric ton of WO₃ in the course of 2025, it has even accelerated to over USD 88,000 in recent days. The drivers remain unchanged: demand impulses from the defense, semiconductor, and AI industries. Could this be the next explosive driver for this already scarce raw material? Due to its extreme heat resistance and low erosion rates, tungsten remains indispensable for future technologies such as nuclear fusion, which further strengthens its long-term desirability.

With China’s export restrictions, the markets are currently struggling with many unusual movements, most visibly in the silver market, where physical prices and paper notes are sometimes more than 50 per cent apart. The king is the one who can supply the raw material. In the case of Almonty Industries, we are talking about 3 to 5 active deposits over the next few years, and who knows what CEO Lewis Black is still planning in the back of his mind! With Sangdong, Almonty is positioning itself precisely in this area of tension between booming demand and geopolitical scarcity. The mine has tungsten grades that are well above the global average, which significantly reduces production costs and the carbon footprint in international comparison. This enables Almonty to achieve margins on par with leading Chinese producers, but operating in an OECD jurisdiction, which offers investors a politically stable environment. The Panasqueira mine in Portugal serves as a reliable cash base and is being elevated to the next level of production through an ambitious drilling program. With the planned US activities starting in the second half of 2026, a transatlantic tungsten supply chain will be created, establishing Almonty as the only Western player with three independent locations.

The investment story is thus clearly defined: While competitors such as Xiamen Tungsten and Masan Resources have their own challenges to overcome, Almonty offers high-grade, secure, and high-margin tungsten. With a capital increase of USD 129 million in December, which was enthusiastically received by the market, and a capitalization of over USD 2 billion, Almonty is financially well positioned to join the league of leading Western tungsten producers in 2026. The price targets on the LSEG platform still range between CAD 9.00 and CAD 13.50. With yesterday’s prices around CAD 13.50, it is currently apparent that the conservative targets will not be sufficient for the momentum in the new year. Only Sphene Capital has already demonstrated good foresight in mid-2025. It will be exciting to see how the price targets will soon adjust to the new market situation. Followers such as American Tungsten, similar to Almonty, have had a sparkling start to the year. The market is hot, and there is much to suggest further price increases!

In an interview with IIF presenter Lindsay Malchuk, CEO Lewis Black shares some impressions of the US tungsten deal in Montana.

Infineon – The AI wave has now arrived in Munich

Specialty chip manufacturer Infineon is currently enjoying a clear tailwind. In recent weeks, the Munich-based company has proven that it was not affected by the abrupt end of the tech trend in December. On the contrary, at around EUR 42, the DAX stock reached a new 5-year high in January. In an interview with Handelsblatt at the beginning of the year, CEO Jochen Hanebeck reiterated the group’s ambitious growth targets. These are expected to benefit primarily from chips used in the energy systems of modern AI data centers. Demand there continues to rise significantly and, according to management estimates, is likely to remain high in the coming years. At present, Infineon is barely able to meet customer demand.

This development is being driven by the ongoing expansion of cloud and AI infrastructure by corporations such as Microsoft and Google. At the same time, many countries are investing in their own AI locations and large-scale facilities, with even Germany seeking to position itself in this area. Infineon considers the risk of a speculative bubble to be low. The majority of investments are financed from current revenues, not through loans. Hanebeck is convinced that these expenditures will pay off in the long term. Productivity gains through AI are already noticeable within the Company itself. Those who focus solely on the risks today run the risk of missing out on a fundamental structural change. In addition to data centers, Infineon also sees potential in microcontrollers that can execute AI functions directly on the chip. The Company also expects demand in the renewable energy sector to remain high, as AI data centers require enormous amounts of electricity and traditional energy sources are reaching their limits. Although 23 of 27 analysts on the LSEG platform are also positive, the calculated growth rates are likely still outdated and need to be adjusted to the new situation. At EUR 43.10, the average price target is currently only slightly above the last price. Infineon shares are highly interesting in the expected consolidation setbacks!

RENK and TKMS – Technical correction perfectly executed

The shares of defense specialists RENK and TKMS have completed their consolidation with a correction of roughly 40-50 per cent from their respective peaks at the end of the year. The Augsburg-based company fell from EUR 90 to EUR 47, while newcomer TKMS fell from an opening price of around EUR 95 to a low of EUR 57. It is impressive to see how even high flyers are sometimes forced to take a technical break when the pressure cooker has built up too much steam. Now, in January, the defense euphoria is back, as all the West’s peace efforts have intensified the Kremlin’s bombardment of Ukraine. Whether the numerous negotiations and summit meetings will actually produce a viable result remains questionable. In any case, NATO has set its sights on defense in 2025 and has budgeted a cumulative EUR 3 trillion for the defense sector over the next 10 years.

For RENK, TKMS, and other defense stocks, this has led to renewed demand from investors, who are now keeping a close eye on potential new orders that could be announced. Analysts on the LSEG platform expect RENK’s revenue to increase from EUR 1.14 billion to EUR 2.57 billion through 2029. Sales of special gearboxes and other technical defense applications are therefore expected to more than double in five years, with an estimated P/E ratio of 34.5 in 2026 and a fourfold revenue valuation. That is no bargain! TKMS has indeed received several new naval contracts worth billions in recent weeks. However, for capacity reasons, these will also be spread over the next five years. Analysts already expect full capacity utilization in the near future. The LSEG platform has announced average 12-month targets of EUR 69 and EUR 82 for RENK and TKMS, respectively. That means 10 to 15 per cent upside potential from the current share price for the newcomer. Given the high valuation ratios, this is not really a big carrot.

Critical metals, AI, and defense remain hot topics in the still-fresh new year. Whether this will inevitably lead to euphoric valuations remains to be seen. A correction in the first quarter, followed by record highs during the dividend season, is also conceivable. Almonty Industries already made history as a top performer in 2025, and this could continue seamlessly in 2026 if tungsten now also proves to be an innovation wild card for nuclear fusion. Defense stocks carry a high risk due to possible negotiation successes in Ukraine. Good diversification across many sectors and countries protects against large portfolio swings.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a “Transaction”). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.