- Bitfarms (NDAQ,TSX:BITF) a global Bitcoin mining stock, will receive C$60 million in U.S. institutional capital through a private placement

- Funds will go toward acquiring additional cryptocurrency miners, expanding infrastructure, and improving the company’s working capital position

- Bitfarms, established in 2017, is a global Bitcoin mining company

- Bitfarms stock (NDAQ,TSX:BITF) has soared by 83.72 per cent year-over-year, lagging behind Bitcoin’s 133.28 per cent return, but remaining well ahead of the S&P/TSX Composite Index’s -1.12 per cent return over the period

Bitfarms (NDAQ,TSX:BITF) a global Bitcoin mining stock, will receive C$60 million in U.S. institutional capital through a private placement.

Funds will be primarily allocated to additional cryptocurrency miners, expanding infrastructure, and improving the company’s working capital position.

The company will issue 44,444,446 common shares priced at C$1.35, along with warrants to purchase up to 22,222,223 common shares. The warrants can be exercised for C$1.61 (US$1.17) per share over three years.

The transaction is slated to close by Tuesday.

The fundraising milestone for the C$438 million market cap company coincides with a resurgence in the crypto space catalyzed by:

- The December 2022 arrest of Sam Bankman-Fried, the former head of crypto exchange FTX, who was later found guilty of stealing billions in customer funds

- The growing enthusiasm for the U.S. Security and Exchange Commission’s (SEC) approval of the country’s first spot Bitcoin ETF, despite recent deferrals, representing potentially hundreds of millions in new investments

- The US$4 billion settlement between the U.S. government and the Binance cryptocurrency exchange, whose founder, Changpeng “CZ” Zhao, stepped down as CEO and pleaded guilty to anti-money laundering and sanctions violations earlier this week, including allegedly facilitating transactions for Al Qaeda and ISIS

These three drivers have helped to foster greater trust in the crypto space as of late, propelling Bitcoin to a 133.28 per cent gain year-over-year, with Ethereum rising by 79.12 per cent, and piquing the interest of an increasing number of retail and institutional investors with capital to speculate.

Click here to read about Stockhouse’s top 5 picks for cryptocurrencies to buy in 2023.

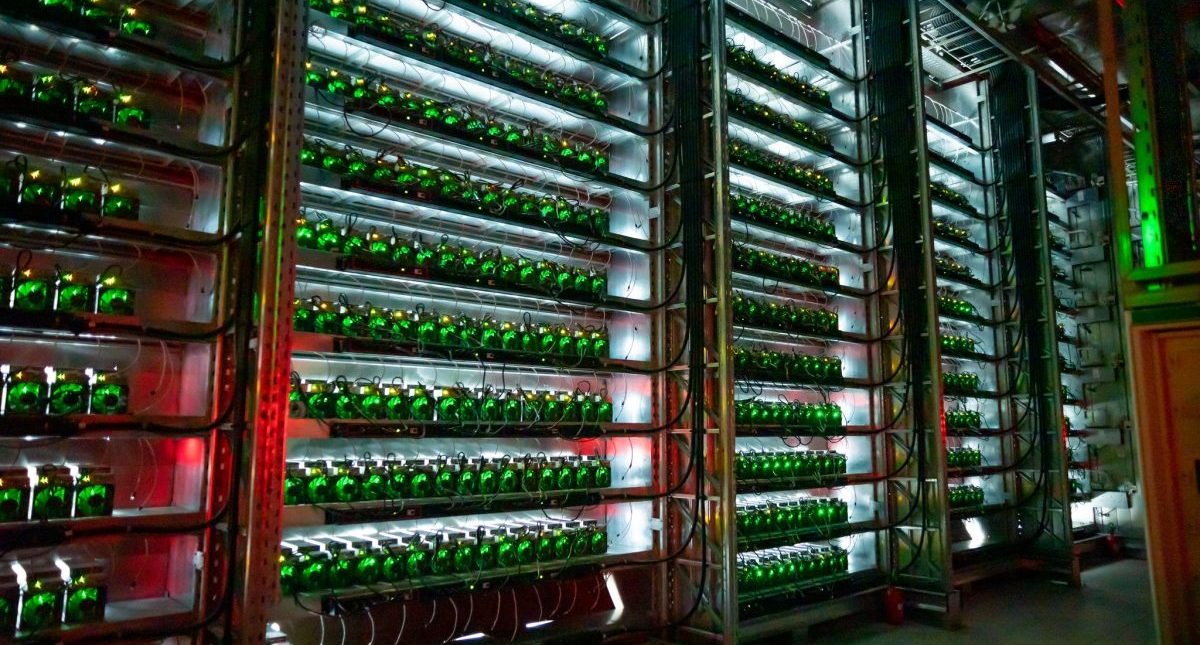

Bitfarms, established in 2017, is a global Bitcoin mining company. It develops, owns and operates vertically integrated mining farms run by a proprietary best-in-class data analytics system. Eleven farms are currently in operation across Canada, the United States, Paraguay and Argentina.

Bitfarms stock (NDAQ,TSX:BITF) last traded at C$1.58 per share. The stock has soared by 83.72 per cent year-over-year, lagging behind Bitcoin’s 133.28 per cent return, but remaining well ahead of the S&P/TSX Composite Index’s -1.12 per cent return over the period.

Join the discussion: Find out what everybody’s saying about this Bitcoin mining stock on the Bitfarms Bullboard, and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.