The most unacknowledged pillar of the green energy transition is the oil and gas sector, whose widespread infrastructure, tied to the dominant commodities of our time, will make it an essential industry well past 2050, whether or not net-zero goals are met in full.

It follows that decarbonizing oil and gas production must play a significant role in long-term sustainability, and companies that differentiate themselves as stewards of the environment will be more competitive in the marketplace.

This dynamic grants investors a time horizon equivalent to an investment lifetime to identify efficient and responsible oil and gas companies poised to build long-term value.

A Canadian oil and gas leader in the making

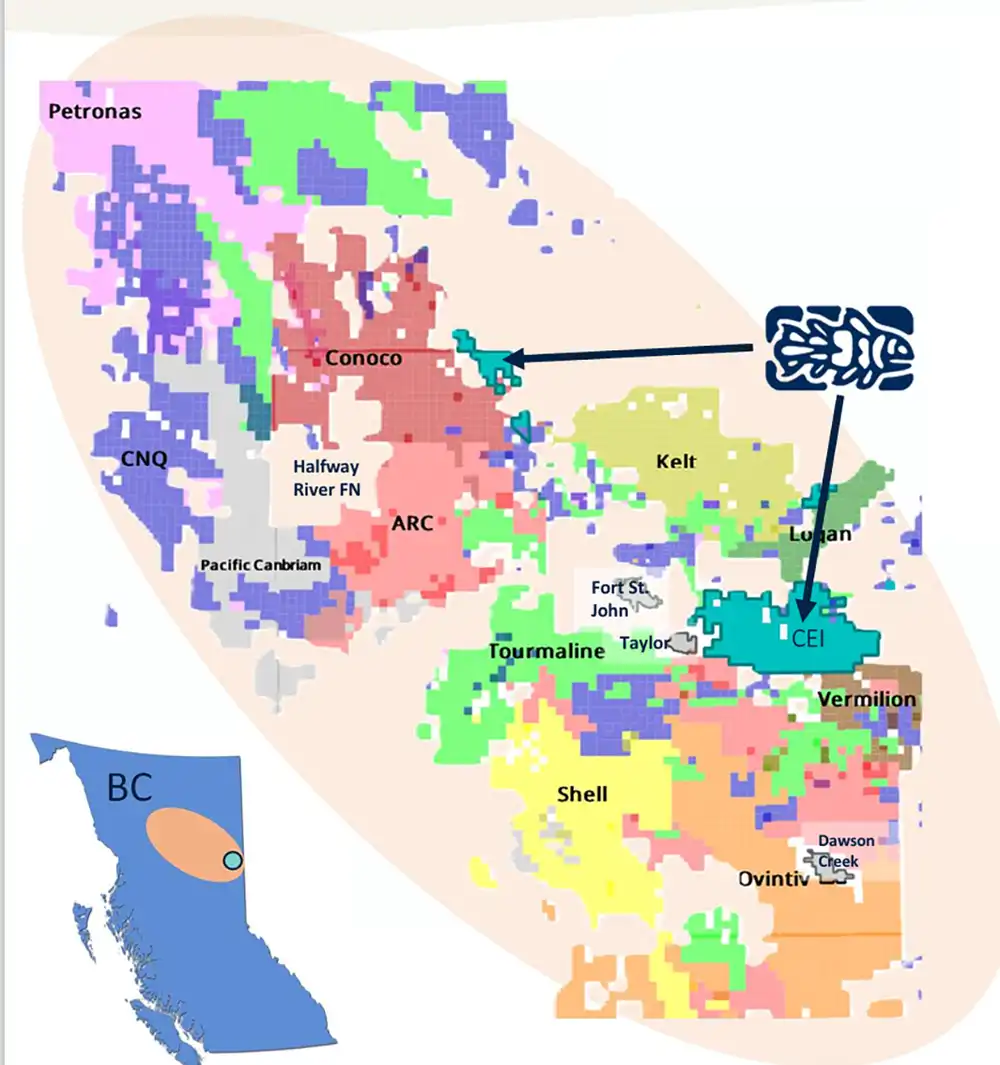

An oil and gas explorer and producer that maps neatly over this green growth thesis is Coelacanth Energy (TSXV:CEI), whose market capitalization is only C$426.40 million, despite advancing a land package that is both the largest in British Columbia’s light oil window and among the top 10 largest in the province’s prolific Montney formation, whose gas resources are estimated at about 450 trillion cubic feet.

This article is disseminated in partnership with Coelacanth Energy Inc. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Surrounded by operators with multi-billion-dollar market caps, including Conoco, Tourmaline Oil and Vermillion Energy, Coelacanth, whose insider ownership stands at 61 per cent fully diluted, has quickly earned its place among these giants thanks to early-stage drilling results and growing production at its flagship Two Rivers project indicative of long-life, high-value potential.

The Two Rivers Montney project

Coelacanth’s Two Rivers project, encompassing 150 contiguous sections in the BC Montney formation, houses a multi-zone resource across the Upper, Lower and Basal Montney benches for the company to scale, with flexibility to market demand, on the road to reliable and sustainable oil and natural gas production.

As estimated in an independent report by GLJ, the project’s resource, on a Petroleum Initially In Place basis, stands at total discovered oil of 6.9 billion barrels (Bbbl) and total undiscovered oil of 8.3 Bbbl, in addition to total discovered gas of 5.9 trillion cubic feet (Tcf) and total undiscovered gas of 7.1 Tcf.

Two Rivers reserves, for their part, are comprised of 27.3 million barrels of oil equivalent (boe) proved and probable, which the report values at C$488.3 million, outweighing Coelacanth’s market cap.

A firm foundation for long-term production

Coelacanth’s initial wells at Two Rivers have exceeded leadership’s expectations, significantly de-risking the project’s path to materially increasing bookable commodities, thanks to high-rate, commercial-quality production across multiple Montney benches with an in-demand mix of 33 per cent light oil and 67 per cent natural gas liquids.

Pad 10-08 at Two Rivers West yielded two Upper Montney wells brought onto production in Q4 2023, including well C10-08, which was re-tested after four months at 1,284 boe/d (35 per cent light oil, 65 per cent natural gas liquids).

Pad 5-19 on Two Rivers East is a highlight when it comes to proven productivity, with Lower Montney wells D5-19, E5-19 and F5-19 posting standout initial rates of 1,037 boe/d (30 days), 1,346 boe/d (30 days) and 1,323 boe/d (22 days), respectively. The pad’s 9 total wells collectively tested for more than 11,000 boe/d, a more than tenfold increase from the 923 boe/d Coelacanth produced in Q4 2023.

Environmentally conscious production

Guided by a leadership team with 17 per cent insider ownership and a president and chief executive officer, Robert J. Zakresky, who has orchestrated six successful investment outcomes in the energy industry – see slide 10 of the October 2025 investor deck – Coelacanth is systematically bringing Two River East’s 9 wells into production before pursuing further drilling.

The company generated 1,210 boe/d in Q2 2025 and plans to ramp up exponentially from there, while deploying an environmental strategy that positions it to usher the oil and gas industry into a more efficient future. Coelacanth makes its operations greener through:

- Greenfield drilling pads and infrastructure to limit carbon emissions.

- Multi-well pads to minimize surface footprint.

- Using instrument air to power its equipment.

- Dynamic gas blending, which allows a diesel engine to replace up to 70 per cent of diesel with natural gas, cutting fuel costs by up to 30 per cent while preserving performance.

- Eliminating fugitive methane emissions.

- Water recycling, with a final strategy to be determined.

- Targeted annual asset retirement obligation spending of C$1 million.

Coelacanth is well advanced when it comes to transforming its robust resources and green operations into long-term profitable growth, having completed a 16,000 boe/d processing facility and a 23-mile pipeline network in June, both of which are generating cash flow through connections to major gathering systems, with processing for up to 60 million cubic feet of natural gas per day (mmcf/d) and 100 mmcf/d of gas takeaway contracted to date.

A clear line of sight to exponential growth

A drilling update in Q4 2025 substantiated further progress, with production from 4 of 9 wells at Two Rivers East, plus legacy wells at Two Rivers West, reaching 4,400 boe/d, with Coelacanth stock sporting a 45 per cent return since inception in June 2022 tracking disciplined operational growth.

Leadership expects the remaining 5 wells on the 5-19 pad to enter production between November and year-end 2025, ramping up total operational output to about 8,400 boe/d.

Looking ahead, three additional Lower Montney wells have been drilled and are expected to be placed on stream by February 2026, which should allow production to surpass the 10,000 boe/d mark.

Backed by strong relationships with First Nations and surrounding communities, Coelacanth expects exponential sales growth to generate positive adjusted funds flow over the near term, allowing it to increase pad development and strategic land purchases, leveraging step-out drilling and multi-frac technology to continue harvesting upside and reinforcing its Montney leadership position.

Look out for part 2 in this 3-part series over the coming weeks, where we’ll take a detailed look at how Coelacanth’s production growth puts it on a path to significant and sustained profitability.

Join the discussion: Find out what investors are saying about this oil and gas stock on the Coelacanth Energy Inc. Bullboard and make sure to explore the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.