Peru has long been recognized as a powerhouse in the mining sector, particularly for copper and gold. Busy working in this region is Vancouver-based mineral exploration company Coppernico Metals (TSX:COPR) (OTCQB:CPPMF).

Peru has made a story of its economic success through its rich mineral resources, favourable investment climate, and strategic geographical advantages. The country specifically presents a compelling case for investors looking to capitalize on copper-gold projects.

Why invest in Peru?

- Rich mineral resources: Peru is the second-largest producer of copper globally and ranks among the top producers of gold, silver, and other essential minerals. The country holds approximately 12 per cent of the world’s copper reserves and 3.9 per cent of its gold reserves, making it a critical player in the global mining landscape.

- Stable economic environment: Peru has demonstrated economic resilience, with a stable macroeconomic framework that has fostered growth and development. The mining sector contributes significantly to the national economy, accounting for about 10 per cent of government revenue and 9.5 per cent of GDP. This stability is attractive to investors seeking long-term opportunities.

- Government support: The Peruvian government actively promotes foreign investment in mining, offering a favorable legal and tax framework. Recent projections indicate that US$40 billion will be allocated to mining projects in the coming years, with copper projects accounting for 73 per cent of this investment.

- Infrastructure and accessibility: Peru’s mining regions are well-connected by roads and ports, facilitating the transportation of minerals. The country’s geographical diversity also means that mining operations can benefit from various climatic conditions, which is advantageous for different types of mining activities.

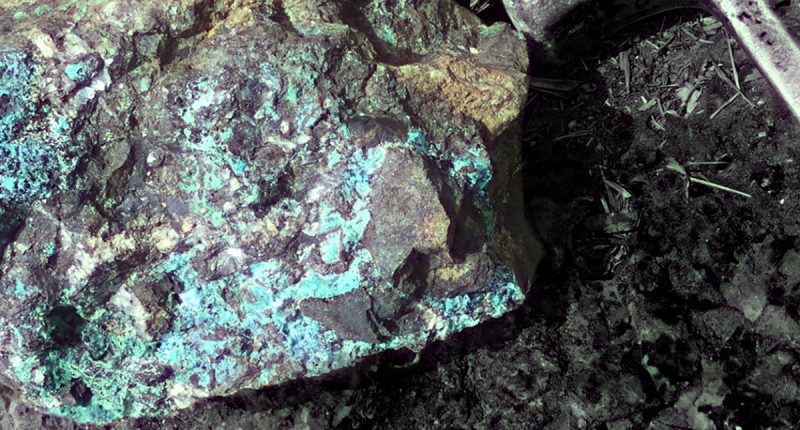

Coppernico recently announced significant progress in its inaugural drilling program at the Sombrero Project in Peru, conducted through its wholly-owned subsidiary, Sombrero Minerales SAC. The company has identified six promising targets within the Ccascabamba target area, with initial drilling revealing encouraging results.

Key highlights from the drilling program

- Drilling results: The first five holes drilled in the Ccascabamba area have shown notable intersections, including:

- Hole 4: 19.15 metres of 0.50 per cent Copper from a depth of 91.95 metres and 27.45 metres of 0.21 per cent Cu from 5.75 metres depth.

- Hole 5: Demonstrated widespread skarn alteration, indicating a robust geological environment.

- Geological insights: The drilling has established a strong correlation between elevated chargeability and increased sulfide content, validating the scale and potential of the Ccascabamba target area. The presence of anomalous Copper and Zinc values further supports this potential.

- Expansion plans: Coppernico is in the process of applying for permits to expand its drilling capacity from the currently permitted 49 holes to approximately 200. This expansion will allow for additional drill rigs, enhancing the pace and flexibility of the drilling operations.

Future projections for copper and gold markets

Copper market outlook: The demand for copper is expected to surge, driven by its essential role in renewable energy technologies, electric vehicles, and infrastructure development. According to forecasts, global copper demand could increase by 70 per cent by 2050, with a compound annual growth rate (CAGR) of 2.6 per cent projected through 2035. In the short term, copper prices are anticipated to experience upward pressure, particularly as the market adjusts to supply constraints and increasing demand from green energy sectors.

Gold market outlook: Gold is also poised for a strong performance, with prices expected to rise significantly in the coming years. The demand for gold as a safe-haven asset during economic downturns further solidifies its attractiveness to investors.

CEO Ivan Bebek’s comments

Ivan Bebek, the company’s chair and CEO, expressed optimism about the drilling program’s early results in a news release, stating, “We are well-financed and in the early stages of our budgeted 30-hole core drill program”… “We are highly encouraged with the early indications of a mineralized porphyry/skarn system”… “we look forward to receiving the results of the next holes.”

Advancing environmental studies

In support of the expanded drilling permits, Coppernico is advancing the Estudio de Impacto Ambiental semidetallado (EIA-SD) permit, with biological and hydrobiological baseline studies currently underway. Completion of these studies is anticipated by Q2 2025.

Pending the usual regulatory approvals, Coppernico has received conditional approval for the trading of its common shares on the OTCQB Venture Market, a U.S. trading platform operated by the OTC Markets Group in New York.

Significance of trading on the OTCQB

Commencing trading on the OTCQB Venture Market is a significant milestone for Coppernico, as it enhances the company’s visibility and accessibility to a broader investor base in the United States.

Why this matters for Coppernico

- Increased investor access: Trading on OTCQB allows Coppernico to reach a wider audience of U.S. investors, facilitating greater participation in the company’s growth story.

- Improved liquidity: With access to a larger pool of investors, Coppernico can expect improved liquidity for its shares. This can lead to more stable share prices and better trading conditions for existing and new shareholders.

- Growth opportunities: The increased visibility and investor interest can provide Coppernico with the capital needed to advance its projects, including ongoing exploration and development initiatives at its Sombrero Project in Peru.

Investment corner

The initial findings from the Sombrero Project are a clear sign of Coppernico’s potential for significant copper and gold discoveries. As the company continues its drilling program, it aims to refine its geological understanding and enhance its targeting capabilities, paving the way for future exploration success.

This update reflects Coppernico’s commitment to advancing its exploration efforts and maximizing shareholder value through strategic drilling and geological analysis. Investors are encouraged to stay tuned for further developments as the company progresses in its exploration endeavors.

Investing in copper-gold projects in Peru offers a unique opportunity for investors looking to tap into the growing demand for these critical metals. With its rich mineral resources, stable economic environment, and supportive government policies, Peru stands out as a prime destination for mining investments. As the global markets for copper and gold continue to evolve, Peru’s advantages position it well for future growth and profitability.

For investors, now is the time to consider this company’s position in Peru’s copper-gold landscape as part of a diversified investment strategy. With the right insights and timing, this investment could yield significant returns in the years to come.

Join the discussion: Find out what everybody’s saying about this stock on the Coppernico Metals Bullboard investor discussion forum, and check out the rest of Stockhouse’s stock forums and message boards.

For more information, please visit Coppernico Metals’ website.

This sponsored article is paid for by Coppernico Metals Inc., which is solely responsible for its contents. Its technical disclosures have been reviewed by Mr. Tim Kingsley, C.P.Geo who is a Qualified Person as defined by Canadian mineral disclosure policies for public companies. For full disclosure about Coppernico and the risks inherent in its business, see its public filings at www.sedarplus.ca. For additional disclaimer details click here.