Daimler Truck must reduce forecasts

It is a challenging time for transportation companies. By 2030, fleet operators in the EU will have to meet specific requirements to reduce CO2 emissions. The EU has introduced stricter CO2 standards for heavy-duty vehicles, requiring a reduction in emissions of 45% between 2030-2034 compared to 2019 levels. The question is how companies intend to implement this, as electric trucks are not yet designed for long distances. Daimler Truck (XE:DTG; OTCPK:DTRUY) has recognized these challenges and now also has hydrogen trucks in development, as the refuelling times are significantly shorter and thus meet the needs of the transportation industry.

In Daimler Truck’s interim report for the second quarter, the key figures show a significant decline compared to the previous year. Group sales amounted to 112,195 units, a decrease of 15%, while revenue fell to EUR 13.3 billion, 4% below the previous year. EBIT fell by 22% to EUR 1,076 million, burdened by a value adjustment of EUR 120 million on investments in China. Adjusted EBIT fell by 18% to EUR 1.17 billion, and consolidated net profit amounted to EUR 789 million, a drop of 21% or EUR 0.93 per share. Accordingly, the management had to revise its annual forecasts for revenue and profit downwards.

For the full year 2024, Daimler Truck expects sales of 460,000 to 480,000 units and revenue of between EUR 53 and 55 billion. In addition, an adjusted return on sales in the industrial business of 8% to 9.5% is forecast. These adjustments reflect the challenges on the markets, where demand is more subdued due to the uncertainties. Despite the disappointing figures, there were seven analysts who, without exception, rated the share as a “buy”. The price targets are between EUR 46 and EUR 56. The share last traded at EUR 33.44.

DynaCERT meeting with Ursula von der Leyen

If a transportation company wants to take decisive steps now to reduce its emissions, it can do so. The patented HydraGEN™ technology from DynaCERT (TSX:DYA) offers an efficient solution to reduce the fuel consumption of diesel vehicles by up to 10% and, at the same time, significantly reduce harmful emissions such as CO2 and Nox through the use of hydrogen and oxygen. The system can be retrofitted. With low installation costs and a quick ROI of less than a year, the use of this innovative technology is particularly beneficial for companies that want to position themselves as environmentally conscious at an early stage.

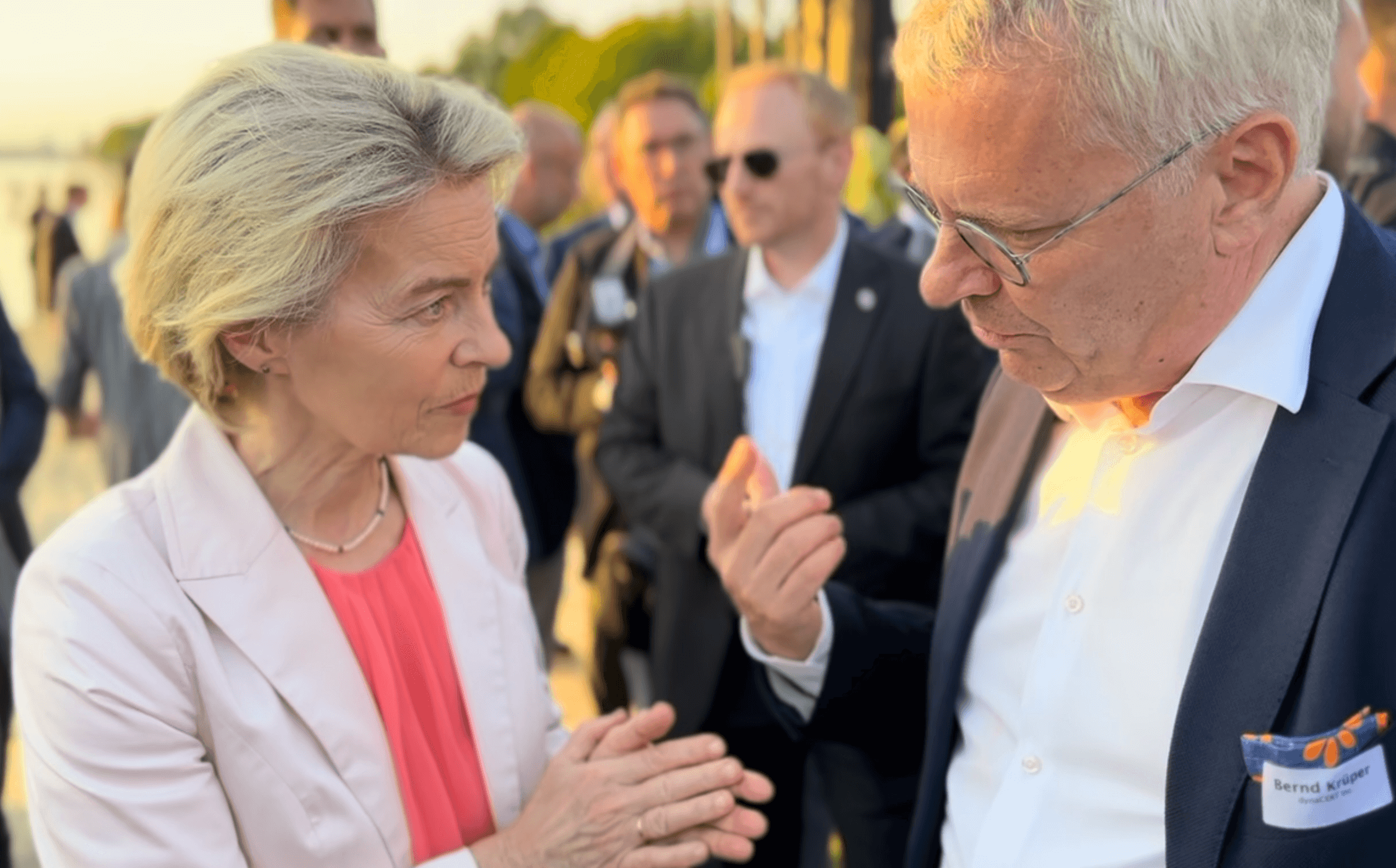

On May 13, DynaCERT announced that it had appointed top German manager Bernd Krüper as president. In this position, he has been instrumental since the summer in leading the company towards global growth and innovation, particularly in the field of environmentally friendly technologies and hydrogen technology. In the course of this, Krüper attended the summer party of the employers’ associations in Hanover, and spoke on-site with the president of the European Commission, Ursula von der Leyen, about the products and the associated opportunities of DynaCERT. Ms. von der Leyen expressed interest, and the event will likely expand DynaCERT’s network.

The company is still awaiting Verra’s approval of its certification under the Verified Carbon Standard (VCS). This certification would not only open up a new revenue stream for DynaCERT through CO2 certificates, but would also be a selling point for the technology, as it would also confirm CO2 savings for customers. The investment in Cipher Neutron is also slowly bearing fruit. In the fourth quarter, the company is to begin developing and building two 250 kW electrolysers for Simon Fraser University. The shares closed trading on Friday at C$0.21.

Plug Power disappoints again

An infrastructure is needed for the introduction of hydrogen technology. Plug Power (NDAQ:PLUG) aims to provide this by building a comprehensive ecosystem for green hydrogen that includes production, storage, delivery, and energy generation. Plug Power has installed over 69,000 fuel cells and more than 250 refuelling stations worldwide and plans to build a hydrogen highway in North America and Europe. Through innovative production facilities and strategic partnerships, Plug Power aims to drive the decarbonization of the economy and support industrial applications.

However, what sounds promising is much more challenging to implement in practice. The company disappointed with its latest quarterly figures. Turnover in the second quarter amounted to US$143.4 million, around 45% less than the previous year and well below the forecast of US$186 million. As a result, the Company recorded a loss of US$0.36 per share, which fell well short of the market expectation of US$0.30 per share. Despite increased production capacity at the Georgia plant and strategic price increases, there has been no sustained improvement in margins. The net loss rose by US$26 million compared to the same period last year, now reaching US$262.3 million.

Despite the disappointing quarterly figures, Plug Power is trying to look to the future with optimism. CEO Andy Marsh emphasizes the progress made in increasing production capacities and strategic partnerships, including major projects such as the expansion of electrolyser production and the green ammonia project in Australia. The company is also planning to install a further 100 MW of electrolysers by the end of the year. One ray of hope could be the possible adjustment of the U.S. tax credits for hydrogen, which could provide significant relief for Plug Power. The very good news in the first quarter should have been reflected in the figures. Unfortunately, this did not happen, and the share marked a multi-year low of US$1.93. The share is currently trading at US$1.97.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a “Transaction”). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

Join the discussion: Head over to the Bullboards at Stockhouse’s stock forums and message boards to share your market outlook and hear what everyone is saying about these and other stocks.

This article is submitted contributor content. The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image: Pixabay)