- ExGen Resources (EXG) has announced a $2,000,000 non-brokered private placement offering

- The company will issue up to 20,000,000 common shares at a price of $0.10 per share

- The offering is scheduled to close on or around December 3rd, 2021

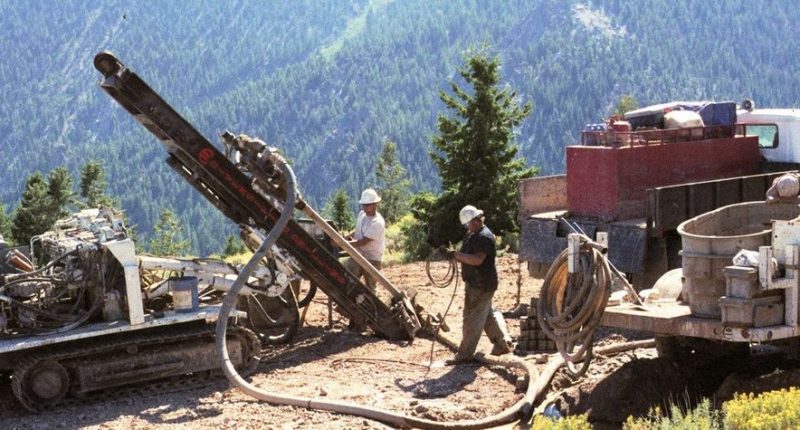

- Net proceeds will be used for potential exploration and development on ExGen’s properties including the Empire Mine Project

- ExGen Resources Inc. is a project accelerator building a portfolio of projects across exploration stages and various commodity groups

- ExGen Resources Inc. (EXG) is down 8.70 per cent on the day, trading at C$0.105 per share at 11:30 am ET

ExGen Resources (EXG) has announced a $2,000,000 non-brokered private placement offering.

The company will issue up to 20,000,000 common shares at a price of $0.10 per share.

The offering is scheduled to close on or around December 3rd, 2021.

A finder’s fee of up to 7 per cent of the gross proceeds may be paid in conjunction with the placement.

Net proceeds will be used for potential exploration and development on ExGen’s properties including the Empire Mine Project, potential future acquisitions and general working capital.

ExGen Resources Inc is a Canada-based exploration-stage company that seeks to fund exploration and development through joint ventures and partnership agreements, significantly reducing the technical and financial risks for ExGen, while maintaining exposure to new discoveries and potential cash flow. ExGen currently has 5 projects in Canada and the US.

ExGen Resources Inc. (EXG) is down 8.70 per cent on the day, trading at C$0.105 per share at 11:30 am ET.