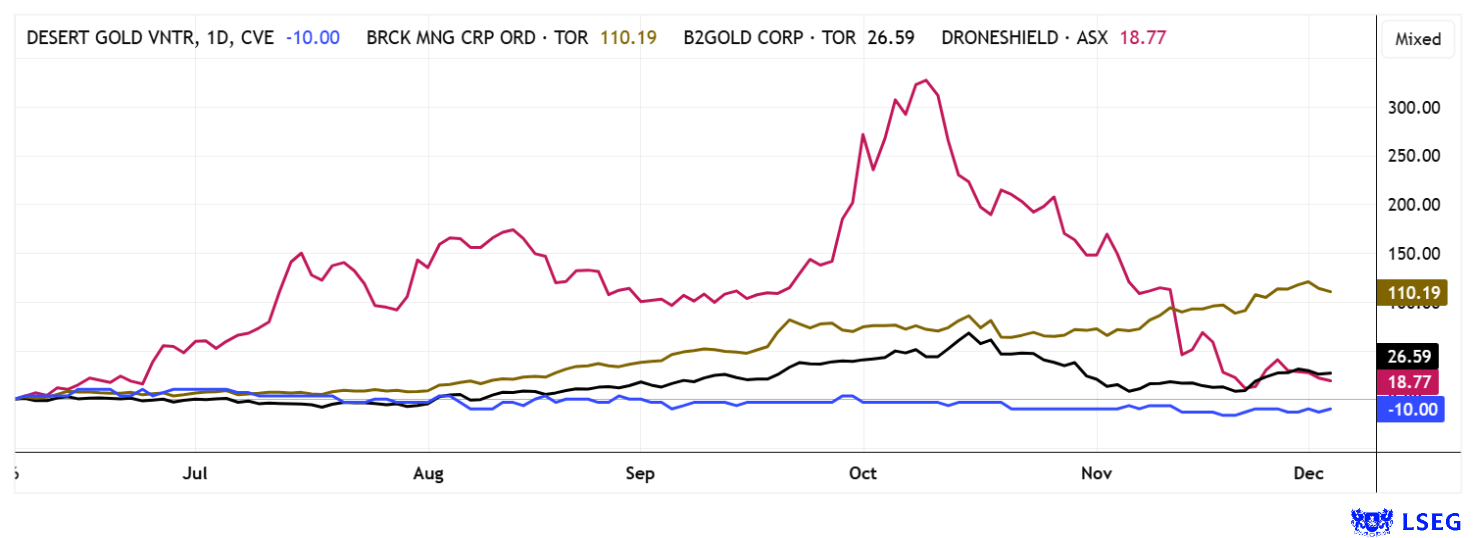

Who would have thought it? Gold and silver are the clear winners among defensive assets in the 2025 investment year. Protection against inflation, geopolitical risks, and fiscal-policy uncertainty has made precious metals shine, which, despite all the doom and gloom from tech stock market traders, were able to generate high double-digit returns of 57% and 82%, respectively. Of course, a 10% drop in the US dollar is weighing on returns in euros, but there is still a nice profit left in the account. Gold and silver mining stocks and, selectively, some explorers performed even better. In today’s peer group, we turn our attention to the African continent, where important changes in the regulatory and economic environment could transform local producers into potential cash machines in 2026.

Barrick Mining and B2Gold – Finally a solution in Mali

Who would have thought that normality would return here? The Mali problem at Barrick and B2Gold has been resolved. This milestone was reached at the end of November after tough negotiations and gave the gold producers’ shares a noticeable boost. Barrick recently officially confirmed the agreement with the Malian government on the Loulo-Gounkoto complex, according to which the Company will regain full operational control. In return, Barrick is withdrawing its arbitration case before the World Bank tribunal, and Mali is dropping all charges against Barrick and its employees, as well as the detention of four employees. A key component is a one-time payment of around USD 430 million, of which a good 30% will be paid promptly within six days of the contract being signed. The license for Loulo-Gounkoto, which was due to expire in February 2026, will be extended by a full 10 years, ensuring long-term stability not only for Barrick Mining.

This article is disseminated in partnership with Apaton Finance GmbH. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Production has been back on track since October, and at full capacity, the complex is one of Africa’s top 10 mines, producing 723,000 ounces annually. The agreement comes after two years of disputes involving abstruse tax claims, gold seizures, and government receivership. Barrick’s Africa risk is now significantly reduced, shifting the focus back to the North American spin-off. The research firm Jefferies immediately lifted its 11% EBITDA warning. On the LSEG platform, CIIBC, National Bank, and Cormark also followed suit with upgrades and price targets between CAD 68 and CAD 75. The Mali play is thus reviving, and the local mood is also improving for B2Gold. The Company operates the Fekola complex, which was largely spared from the military government’s license revocations. All permits and licenses remain valid, and B2Gold is sticking to its forecast of 515,000 to 550,000 ounces of gold for 2025. Fekola is a low-cost, high-grade mine with competitive AISC below USD 1,400/ounce and is one of B2Gold’s cash flow generators. Both stocks remain attractive even at this level. Buy!

Desert Gold – Cash flow in Mali, exploration in Côte d’Ivoire

Desert Gold (TSXV:DAU) also has reason to celebrate the situation in Mali. CEO Jared Scharf recently made significant progress with the updated PEA for the Barani and Gourbassi deposits of his wholly-owned SMSZ project, reporting an after-tax NPV of USD 61 million and an IRR of 57% at a gold price of USD 2,850 per ounce. The study envisages a doubling of monthly production to 36,000 tonnes and a modular, cost-efficient processing strategy to be implemented first at Barani and later at Gourbassi. A total of approximately 113,100 ounces of gold is planned over a mine life of ten years, while the project could even achieve an NPV of USD 124 million and an IRR of 101% at current gold prices. Management further emphasizes that less than 10% of the total land area in the SMSZ area was considered in the PEA, indicating significant expansion potential. The low investment costs of around USD 20 million in the first phase and the robust production planning underscore the project’s good return on investment.

Desert Gold is also strengthening its regional position with the Tiegba Gold project in Côte d’Ivoire, which, despite the lack of drilling, already gives cause for celebration based on extensive surface anomalies. The stable political situation and favorable conditions in Côte d’Ivoire support the prospect of developing both projects in a complementary manner. The latest analysis by GBC AG highlights that Desert Gold, with its two core assets, the advanced SMSZ project and the virgin Tiegba area, is trading well below its intrinsic value. GBC’s experts use the spot NPV of USD 124 million as a basis and, taking the Tiegba project into account, calculate a combined asset value of around USD 133.5 million. With a clear “Buy” rating, the experts therefore assign a price target of CAD 0.81 by the end of 2026. At CAD 0.07, the stock can be collected with confidence! Our top explorer tip for the coming year.

DroneShield – Defense stock suffers from a self-service mentality

Australian drone defense company DroneShield, once hailed as a beacon of hope in the field of military and security technology anti-drone systems, is increasingly the subject of critical discussion. After a spectacular price increase of over 600% in just three months and a temporary total valuation of over AUD 6 billion, numerous illusions were shattered in November. The market reacted with shock when it became known that leading managers and supervisory board members had sold shares on a large scale immediately after reaching key revenue targets and option milestones in the range of AUD 200 million. These events gave the impression that management and insiders had primarily used the momentum to take profits for themselves.

The parallel exercise of more than 44 million options, followed by sales of considerable amounts, suggested a pronounced self-serving mentality. It was particularly irritating that CEO Oleg Vornik, Chairman Peter James, and Director Jethro Marks acted in a coordinated manner at almost the same time. Officially, the Company cited tax reasons, but this did little to convince free shareholders. They also sold, sending the share price from EUR 3.80 to below 80 cents, a decline of 80%. The fact that confidence in corporate governance was severely shaken is also evident from the pitiful attempts at recovery to just EUR 1.07.

According to insiders, there are also striking parallels with the failed Australian dairy company Halo Food Co., where Chairman James had also been responsible for generous option programs. Bergen Asset Management, the same financial group that laid the foundation for DroneShield, was also involved as an early investor in this case. Despite this drastic correction, the Company is still ambitiously valued with a price-to-sales ratio of 8 for 2025. According to analysts, profits are not expected until 2030 at the earliest, while the current expansion and research are still burning through liquidity. Hands off!

The financial markets still have 10 trading days to determine the correct year-end values. Investors can already see after 11 months that this is not always successful. Defense and AI stocks clearly won the return race, although many valuations appear very ambitious. Gold and silver stocks have been appreciating strongly, especially since October. Here, we expect the rally to continue seamlessly in 2026, while the tech sector is also likely to see a decent correction!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a “Transaction”). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.