When investors shop for top investment prospects, they typically look at companies that offer a good value with plenty of room to grow.

Each quarter is better than the last for environmental services provider, Vertex Resource Group Ltd. (TSXV:VTX), which continues to report record-breaking performances.

Vertex offers a unique combination of environmental consulting and environmental field services and equipment and in its latest financial and operational results for Q3 2023, the company showcased robust performance. The team pointed to its solid financial position and optimistic outlook within the environmental services industry. Since 2021, Vertex has reported record-breaking numbers after record-breaking numbers in its financial performance. Was Q3 2023 any different?

Highlights

In its quarter ending Sept. 30, 2023, Vertex Resource Group Ltd. witnessed impressive financial results during Q3 2023, demonstrating its ability to navigate challenges and capitalize on opportunities:

Revenue growth: The company reported a significant increase in revenue compared to the same period last year, driven by strong demand for its environmental services. In its highest gross, and net revenue in company history for any quarter, Vertex earned C$68.3 million and C$66.8 million respectively.

Net revenue was C$185.9 million, the highest in company history for a nine-month period, compared to C$158.5 million for the same period of 2022.

The company’s record adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) amounted to C$30.2 million for the nine months of 2023 compared to C$24.6 million in 2022.

Profitability: Vertex’s profitability remained healthy, with a notable 26.5 per cent rise in net profit from 25.0 per cent for the nine months ending Sept. 30, 2023.

Cash flow: The company maintained a strong cash flow position, allowing for continued investments in new technologies, equipment, and expansion initiatives. Cash used in financing activities was C$7.3 million in the quarter compared to cash provided by financing activities of C$5.3 million in Q3 2022.

For the nine months ended Sept. 30, cash used in financing activities was C$32.7 million compared to cash provided by financing activities of C$1.7 million in the same period of 2022.

Believing that the company’s underlying value was not being fully reflected in the current market price of its shares, Vertex’s Board of Directors also initiated a normal course issuer bid to repurchase and cancel up to 5 per cent of outstanding stock to help drive shareholder value.

Depending upon future price movements and other factors, the board has determined that the shares may represent an attractive investment to the company and in the best interests of the business and its shareholders.

Operational highlights

Vertex Resource Group continued to solidify its position as a leading provider of comprehensive environmental services. Key operational highlights for Q3 2023 include:

Diversified service offerings: Vertex expanded its service portfolio, offering a wide range of environmentally sustainable solutions to meet the evolving needs of its clients. These services include site assessments, site remediation, waste management, and spill response.

Geographic expansion: The company successfully expanded its operations into new geographic regions.

Strategic partnerships: Vertex signed strategic partnerships and collaborations to enhance its service capabilities, broaden its customer base, and foster innovation within the environmental industry.

Technology adoption: Embracing digital transformation, Vertex leveraged advanced technologies and data analytics to optimize operational efficiency, improve project management, and deliver enhanced customer experiences.

Outlook and future prospects

As we approach Q4 and plan for 2024, the company maintains an optimistic outlook for the future, driven by various factors:

Growing environmental awareness: The increasing global focus on environmental sustainability and regulatory compliance bodes well for Vertex’s long-term growth prospects.

Market expansion: With the company’s successful entry into new markets, Vertex anticipates continued geographic expansion, benefiting from increased demand for environmental services.

Infrastructure investments: Governments and private entities continue to invest in infrastructure development, which will generate a demand for Vertex’s services in construction and maintenance projects.

Mergers and acquisitions: Vertex keeps an eye on potential merger and acquisition opportunities, aiming to strengthen its market position and diversify its service offerings further.

With an eye locked on cross-selling its services throughout the lifecycle of their clients’ projects in various industries, Vertex has been expanding its environmental services in the United States by opening three locations in Montana, North Dakota and Colorado during late Q2.

The company believes this expansion will allow it to service more of its existing customers in these markets, while developing new clientele. The team anticipates these growth initiatives will contribute positively to its 2024 operations.

Investment corner

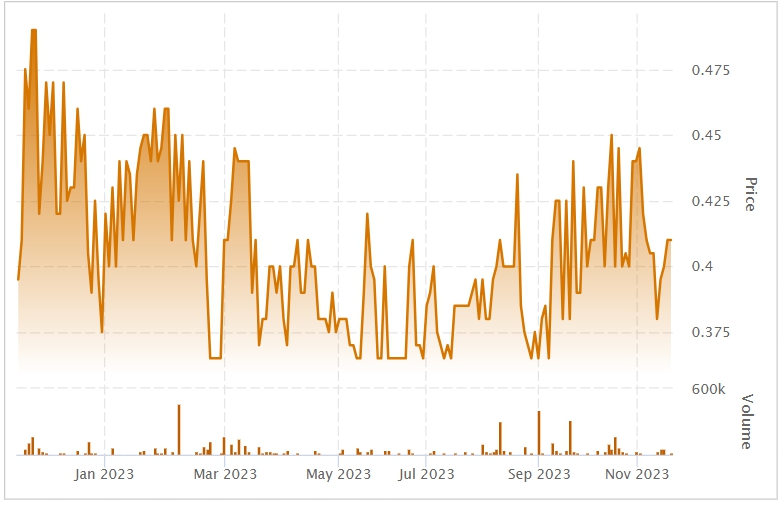

Investors take note, while it has been a bumpy ride this year, Vertex stock has risen 3.79 per cent since this time last year and is trading around $0.39 per share.

The company’s positive outlook, coupled with the increasing global focus on environmental sustainability, positions Vertex as a key player in the industry.

Based out of Sherwood Park, Alberta, Vertex Resource Group has created a compelling value proposition with its latest financial and operational results. This showcases the company’s ability to deliver strong performance in the environmental services sector.

With its diversified service offerings, geographic expansion, strategic partnerships, and technology adoption, Vertex is well-positioned for future growth.

To keep up with the latest company updates, visit vertex.ca.

This is sponsored content issued on behalf of Vertex Resource Group Ltd., please see full disclaimer here.