- Green River Gold (CCR) provided an update on its 2022 exploration program at its Quesnel Nickel/Magnesium/Talc project

- The first hole (Hole DD-22-05) drilled 11 metres and results from XRF testing show elevated nickel and chromium concentrations starting at surface

- Nickel readings average 0.197 per cent and chromium readings average 0.136 per cent

- The first phase of this year’s drilling program will consist of 10-12 holes

- Green River Gold (CCR) opened trading at $0.065 a share

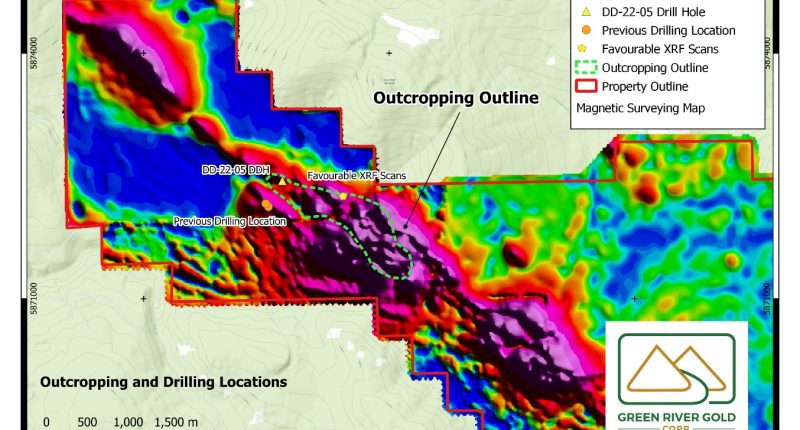

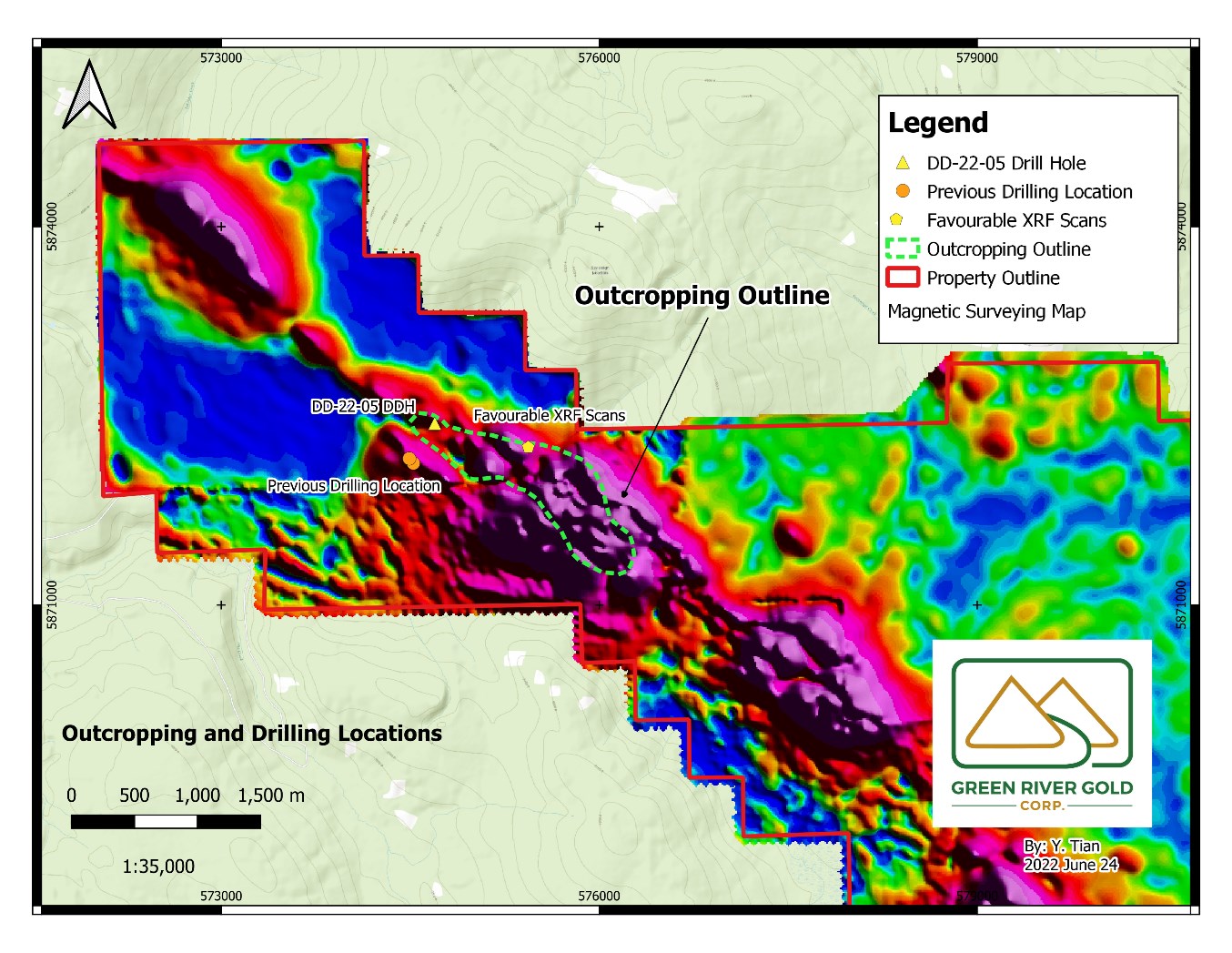

Green River Gold (CCR) provided an update on its 2022 exploration program at its Quesnel Nickel/Magnesium/Talc project in British Columbia.

The first hole (Hole DD-22-05) drilled 11 metres and results from X-Ray Fluorescence (XRF) testing show elevated nickel and chromium concentrations starting at surface, nickel readings average 0.197 per cent and chromium readings average 0.136 per cent.

The first phase of this year’s drilling program will consist of 10-12 holes.

Green River’s President and CEO, Perry Little, stated that the higher nickel and chromium results in the XRF numbers so far represents a significant improvement over earlier results.

“The UAV-MAG survey steered us toward this large outcropping and thus far, following those directions appear to be paying off. It is also encouraging to see that we still have this amount of talc in the drill core so far from the original drilling location. The combined economics of nickel and talc in one location are quite compelling.”

Green River Gold Corp. (CCR) is a Canadian mineral exploration company focused on its wholly owned high-grade Fontaine Gold Project, Quesnel Nickel/Magnesium/Talc Project, and Kymar Silver Project which are located in British Columbia.

Green River Gold (CCR) opened trading at $0.065 a share.