- Hunter Technology (HOC) has appointed Alain Fernandez as a director

- Mr. Fernandez’s career includes roles with Deloitte, Russell Investments, and the Abu Dhabi Investment Authority

- He holds a BA in Economics from Colgate University

- The private placement will consist of up to 8,333,334 common shares for gross proceeds of up to $2,500,000

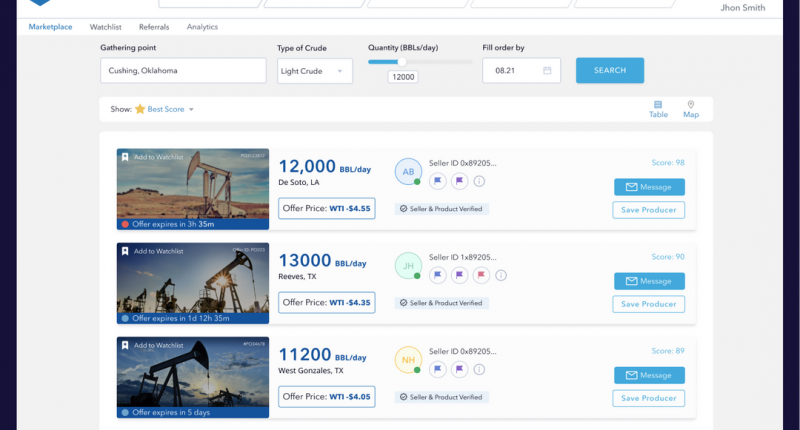

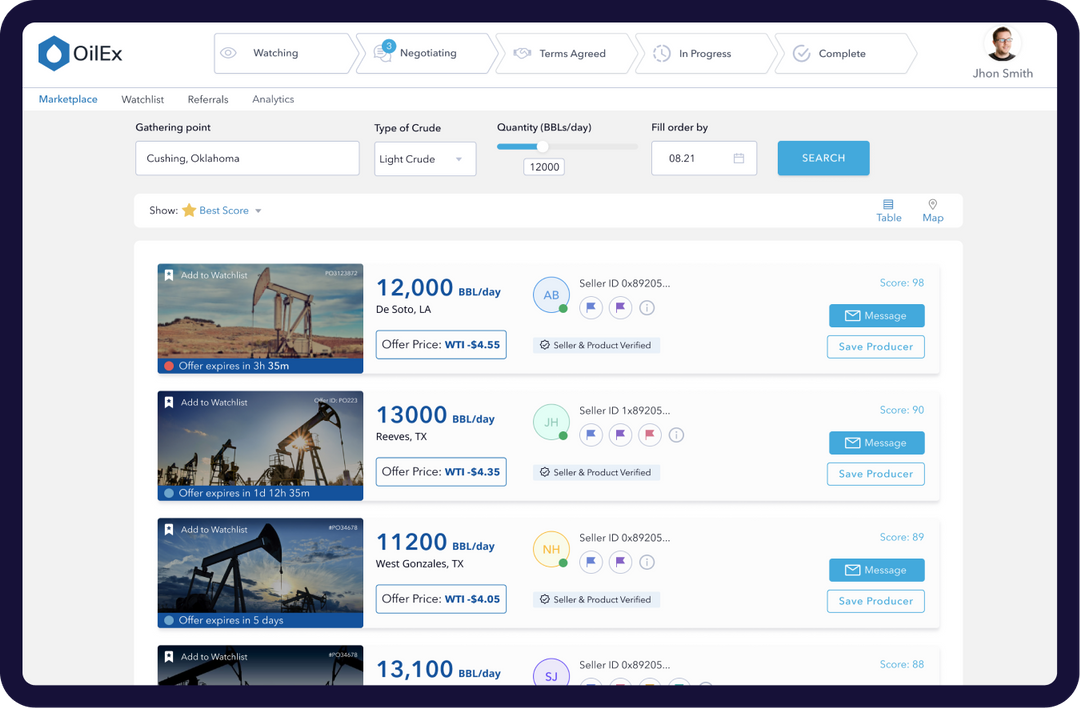

- Hunter Technology is a technology company that provides a physical oil trading platform powered by a proprietary blockchain

- Hunter Technology Corp. (HOC) opened trading at C$0.315 per share

Hunter Technology (HOC) has appointed Alain Fernandez as a director and has announced a non-brokered private placement.

Mr. Fernandez is a global executive with over two decades of global financial services and technology experience. His career spans four countries on three continents and includes names such as Deloitte, Russell Investments, and the Abu Dhabi Investment Authority. He holds a BA in Economics from Colgate University in Hamilton, New York.

“I am excited to welcome Alain to the Hunter board,” said Florian M Spiegl, Chief Executive Officer of Hunter.

“Alain’s outstanding experience uniquely combines expertise in capital markets and scaling software businesses that add great value to our team. We very much look forward to working together on the next chapter for Hunter.”

The private placement will consist of up to 8,333,334 common shares at a price of $0.30 per share for gross proceeds of up to $2,500,000.

Hunter intends to use the net proceeds for working capital and general corporate purposes.

All shares issued in connection with the offering will be subject to a statutory hold period of four months in accordance with applicable securities legislation.

Hunter Technology Corp. develops interactive software platforms powered by blockchain technology that digitalize and streamline physical oil trading.

Hunter Technology Corp. (HOC) opened trading at C$0.315 per share.