- Independence Gold (IGO) is seeking to raise C$1.5 million by issuing warrants and common shares

- Units and flow-through shares will be offered at a price of $0.10

- The company will use the proceeds for an exploration program at its 3Ts Property slated for February 2022

- Independence Gold is a mineral exploration company with projects in B.C. and the Yukon

- Independence Gold (IGO) is up by 21.43 per cent and is currently trading at $0.085 per share

Independence Gold (IGO) is seeking to raise C$1.5 million by issuing warrants and common shares.

It will offer a maximum of 15,000,000 shares in the form of units or flow-through shares. Both units and flow-through shares will be offered at a price of $0.10.

Each unit consists of one common share and one-half of one common share purchase warrant.

Each warrant entitles the holder to purchase one additional share for $0.15 for a period of 24 months.

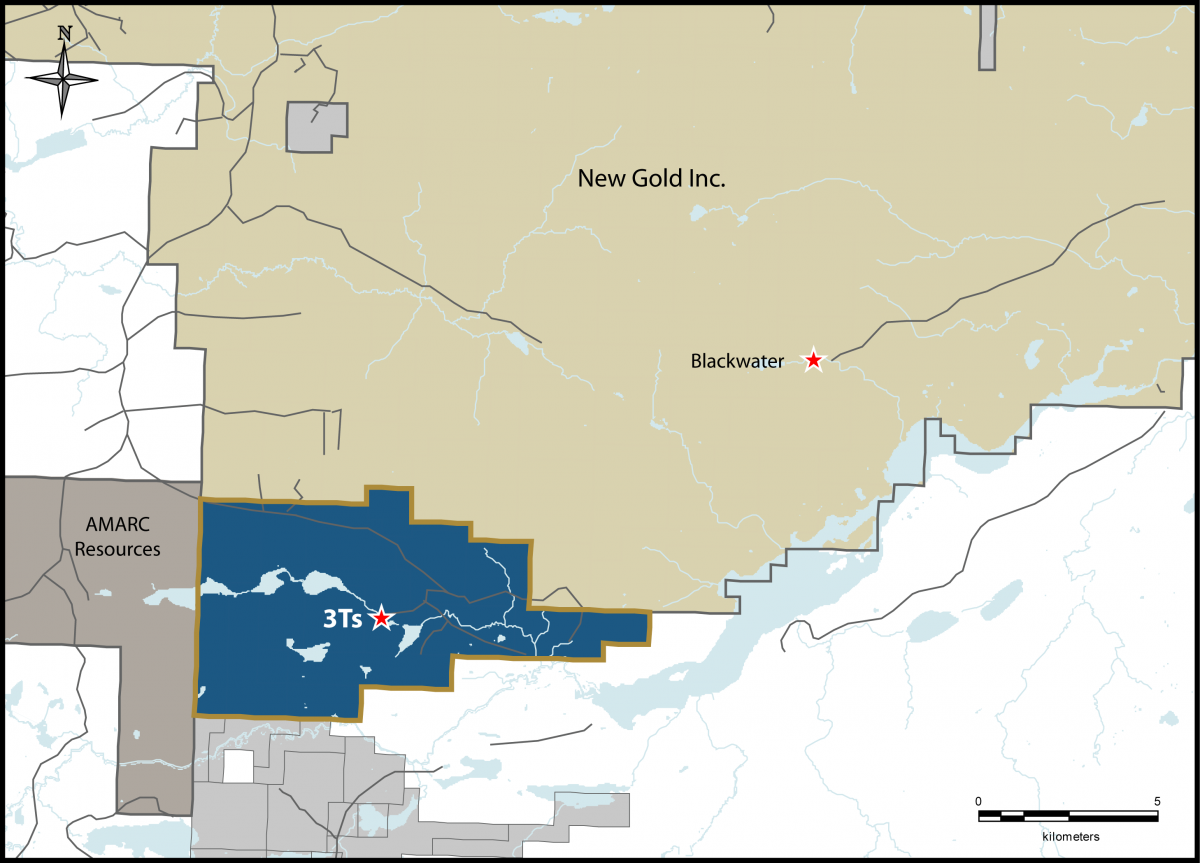

The company will use the proceeds to fund a winter exploration program at its 3Ts Property in central B.C. slated for February 2022, as well as for general and administrative purposes.

Independence Gold is a mineral exploration company with projects in B.C. and the Yukon. Its portfolio ranges from early-stage grassroots exploration to advanced-stage resource expansion projects.

Independence Gold (IGO) is up by 21.43 per cent and is currently trading at $0.085 per share as of 11:02 am EST.