Author: Dr Ryan D. Long

A recent site visit to Mink Ventures Corporation’s (TSXV:MINK) Warren Nickel-Copper-Cobalt Project has led to a dramatic reinterpretation of the project’s geology, which could transform the company’s future if results from the upcoming drill programme, due to commence early in 2026, support the new geological model.

The Warren Project

Located on the western edge of the Timmins Mining Camp, the Warren Project contains a series of zones of surficial nickel-copper-cobalt mineralisation over 1.6 km strike length. While these outcrops have proved to be laterally extensive, no continuity at depth has been demonstrated from the work completed to date.

Kevin Filo, Senior vice president of exploration for Mink, and company prospector Robert Bailey visited the Project in October 2025. During the visit, the pair discussed something that had been gnawing away at the back of Mr Filo’s mind for some time, something that just did not make sense.

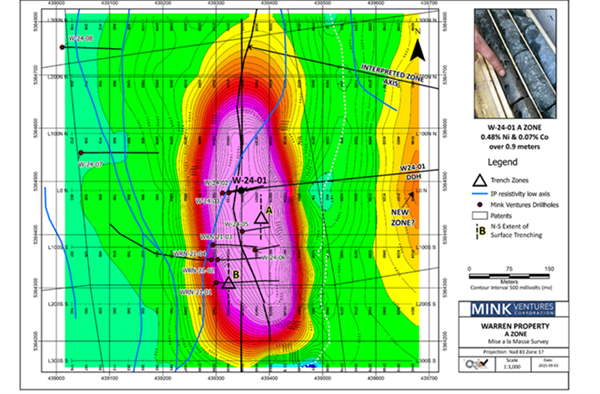

Mink completed a mise-à-la-masse survey at Warren in August 2025. The survey defined a 500 m by 200 m anomalous response of over 16,000 mV at the A Zone (Figure 1). To give some context, a 100–1,000 mV response is indicative of a moderately conductive body, and a 1,000–20,000 mV response is considered an excellent conductor response.

Figure 1: Mise-À-La-Masse Anomaly at the A Zone.

Typically, a response in the range of 16,000 mV indicates that a large fraction of the injected current is channelled through a highly conductive body in electrical contact with the electrode; this would suggest massive sulphide mineralisation.

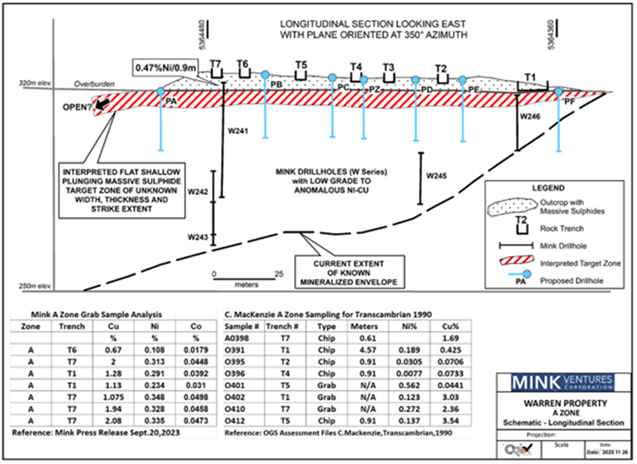

The A Zone mise-à-la-masse anomaly was also coincident with a magnetic high, a resistivity low and a 120 m-long gossan shown to contain semi-massive to massive sulphide in a programme of trenching completed several years ago; the trenched gossan zone hosted significant copper and nickel values (Figure 4).

Mink drilled the A Zone before the mise-à-la-masse survey, and results showed positive indications of mineralisation; however, nothing that would justify the strong mise-à-la-masse anomaly over such a large area, or that matched the high grades seen in trenching. Previous drill results include:

- 7.2 m at an average grade of 0.18% nickel (Ni) and 0.2% copper (Cu) from 17.3 m (W-24-01)

- 10.5 m at an average grade of 0.15% Ni and 0.06% Cu from 39.0 m (W-24-01)

- 7.5 m at an average grade of 0.12% Ni and 0.08% Cu from 60.5 m (W-24-02)

- 6.5 m at an average grade of 0.07% Ni and 0.1% Cu from 64.0 m (W-24-03)

- 3.5 m at an average grade of 0.16% Ni and 0.14% Cu from 56.5 m (W-24-04)

- 11.1 m at an average grade of 0.09% Ni and 0.18% Cu from 30.9 m (W-24-05)

- 3.0 m at an average grade of 0.09% Ni and 0.15% Cu from 11.0 m (W-24-06)

- (Reference: MNDM Mink Ventures Assessment File Report, T. Keast, P.Geo, 2024)

After some discussion with Todd Keast, the company’s nickel consultant, Kevin and Robert headed into the field, with mixed thoughts but fresh eyes, to try to make sense of a geological riddle. Hole W-24-01 was particularly perplexing, located next to the significant results from Trench 7; the hole returned two intervals of disseminated copper-nickel-cobalt mineralisation but only a short interval of semi-massive sulphide grading 0.47% Ni over 0.9 meters. Similarly, Hole W-24-06, located 120 meters south along strike from hole W-24-01 and collared less than 5 meters from Trench 1, which also contained substantial massive sulphide with excellent nickel-copper values, again failed to intersect massive sulphide in the drill core.

On the face of it, Hole W-24-01 and W-24-06 should have returned something significant. So why didn’t they? Why was the mise-à-la-masse anomaly so high, yet assay results from the drilling were low-grade? What were they missing?

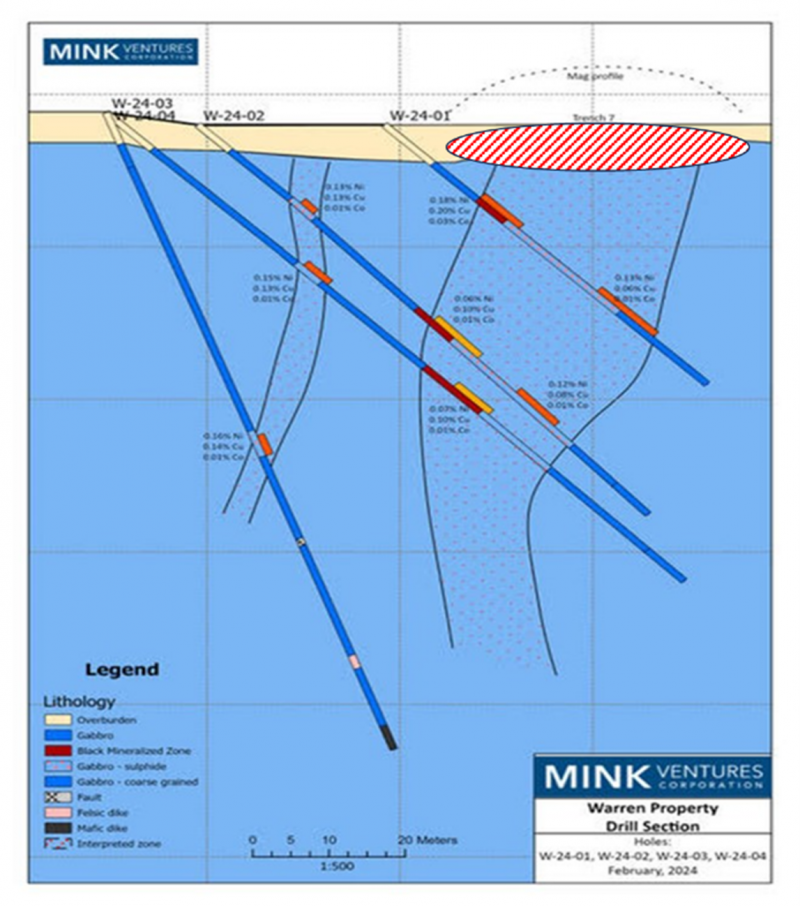

The majority of the holes drilled into the A Zone were completed at an angle of -45o, Hole W241 included, with one hole at -70o (Figure 2), and the mineralisation was previously interpreted to occur in near-vertical bodies.

Figure 2: Cross Section of Previous Drill Results and Previous Geological Interpretation, Potential Location of Massive Sulphides Shown in Red Stripes.

While in the field, Kevin and Robert began speculating about whether the mineralisation had a different geometry, what if, rather than vertical, it was horizontal and close to the surface (red striped oval shown in Figure 2).

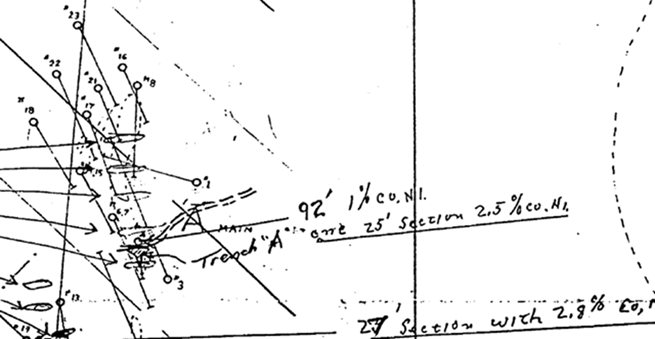

Upon returning from the field, Filo and Keast began to speculate on field observations and that perhaps rather than extending vertically, the main massive sulphide body extends to the north and to the south, forming a blanket below the gossan. This suggested that Mink’s previous programme had drilled into an underlying stringer or disseminated zone, missing the overlying massive sulphide mineralisation (Figure 3).

Figure 3: Field Sketch Showing How Historical Drilling May Have Missed the Massive Sulphide Zone.

This would explain why Mink did not hit a significant body of mineralisation but had a strong mise-à-la-masse anomaly; they had drilled underneath it and into the disseminated mineralisation below it.

Armed with this new theory and following a thorough reinterpretation of previous data, Mink is confident that the higher-grade mineralised zone is a broad, flat-lying body with a shallow plunge to the north (Figure 4).

Figure 4: Long Section Showing the New Interpretation of the Geology.

Conclusion

The exploration process is fluid, and it is rarely a straight line to discovery. Understanding evolves as more data is obtained; each negative result can be analysed and assessed, improving the possibility of success in the next phase of work. Countless discoveries have been made from re-evaluating negative results to guide future research and the reinterpretation of geological models.

Mink is now planning to drill a series of shallow vertical holes (Figure 4) to test the coincident mise-à-la-masse anomaly and surface exposure of the A Zone. This programme is likely to commence early in the new year and could be transformative for the company if they can prove their latest exploration theory.

Like and Share this Article

If you enjoyed reading this article, please give it a like and share it with your network.

Subscribe

Subscribe to the Junior Mining Insights Newsletter on LinkedIn https://lnkd.in/eCs-6ji7

Disclaimer

This newsletter has been published by Mining and Metals Research Corporation (“the Company”). The information used to compile the article has been collected from publicly available sources, and the Company cannot guarantee the 100% accuracy of those sources. This communication is intended for information purposes only and does not constitute an offer, recommendation, or solicitation to make any investments. Nothing in this communication constitutes investment, legal, accounting or tax advice, or a personal recommendation for any specific investor. The Company does not accept liability for loss arising from the use of this communication. This communication is not directed to any person in any jurisdiction where, by reason of that person’s nationality, residence or otherwise, such communications are prohibited. The Company may derive fees from the production of this newsletter.

*MMRC holds 163,000 shares in Mink Ventures Corporation.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.