- Neodymium demand is soaring as it powers critical technologies—EVs, wind turbines, AI hardware, and defense systems—making it one of the most strategically important rare‑earth elements

- MP Materials (NYSE:MP) stands out in the U.S., operating the Mountain Pass mine (the only major U.S. rare‑earth source) and expanding into downstream magnet production through its new Texas facility, backed by partnerships with GM, Apple, and the U.S. Department of Defense

- The stock offers high‑growth potential but carries execution and valuation risks, as MP scales production, builds a fully integrated supply chain, and navigates volatile rare‑earth pricing and geopolitical competition

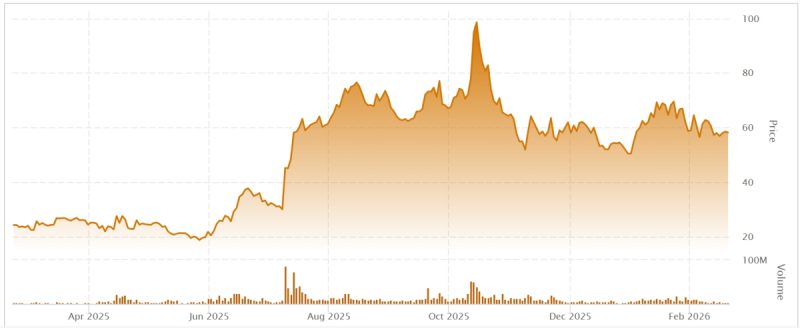

- MP Materials Corp. (NYSE:MP) stock last traded at US$57.70

Neodymium isn’t just another rare earth—it’s the core ingredient in the world’s strongest permanent magnets (NdFeB), essential for electric vehicles, wind turbines, robotics, defence systems, and more.

As global demand for these magnets skyrockets, MP Materials Corp. (NYSE:MP) is emerging as the only vertically integrated U.S. player—from mine to magnet.

This article is a journalistic opinion piece that has been written based on independent research. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Mountain Pass: America’s rare-earth powerhouse

- Mountain Pass (California) is the only large-scale rare-earth mine in the U.S., producing ~6 per cent TREO grade and holding ~1.9 million tonnes of contained rare-earth oxides.

- In 2024, MP hit a record 45,000 tonnes of rare-earth oxide concentrate, including ~1,300 tonnes of NdPr oxide.

- In Q3 2025, NdPr output surged 120 per cent year-over-year to 721 tonnes, with REO production at ~13,254 tonnes.

Mountain Pass supplies over 10 per cent of global rare-earth content, making it what you would call a “strategic asset”.

Independence (Texas): From ore to magnets

- In January 2025, MP began commercial NdPr metal production and trial NdFeB magnet production at its new Independence facility in Fort Worth

- Initial capacity: 1,000 tonnes/year, with potential to scale to 2,000–3,000 tonnes

- Customers include General Motors (NYSE:GM), and the plant is part of a fully integrated U.S. supply chain—from mine to magnet

Partnerships and price support

- In July 2025, the U.S. Department of Defense invested $400 million and guaranteed a 10-year price floor of $110/kg for NdPr—critical protection against volatile Chinese pricing

- MP also signed a magnet supply deal with Apple (NASDAQ:AAPL), funded by prepayments to support expansion

- Analysts highlight MP’s fully integrated supply chain and strategic positioning as key differentiators

Stock snapshot: Momentum meets risk

| Metric | Value / Insight |

| 1-year return | +148 per cent—outpacing peers and the S&P 500 |

| Analyst sentiment | 3 recent ratings: 1 Buy, 2 Overweight; avg target ~$76 (range $71–82) |

| Valuation | Trades at ~43× sales—well above sector average (~3.8×), reflecting high expectations |

| Technical outlook | Testing bullish trendline; historically, similar setups led to ~17 per cent gains in a month |

| Short interest | ~17–18 per cent of float—signals potential volatility |

Risks and what to watch

- Execution risk: Scaling magnet production and integrating downstream operations is complex

- Commodity cycles: NdPr prices surged to ~$123/kg—well above the $110 floor—but may correct

- Valuation pressure: High multiples mean any hiccup could trigger sharp pullbacks

Further reading: The critical mineral fuelling AI—and why Canada is suddenly relevant to investors

The sole U.S. rare-earth flagbearer

MP Materials isn’t just mining neodymium—it’s rebuilding a domestic supply chain, from Mountain Pass to Texas magnets. With government backing, strategic partnerships, and record production, it’s positioned at the heart of the rare-earth renaissance.

For investors, MP offers high upside—but also execution and valuation risk. If you believe in the long-term demand for NdFeB magnets and U.S. supply chain independence, MP is a standout—but it’s not a low-risk play.

MP Materials Corp. (NYSE:MP) stock opened trading at US$57.70 and has risen 135 per cent since this time last year.

Join the discussion: Find out what the Bullboards are saying about Metals and Mining and MP Materials, and make sure to explore the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.