“We are very excited! We are very, very excited!”

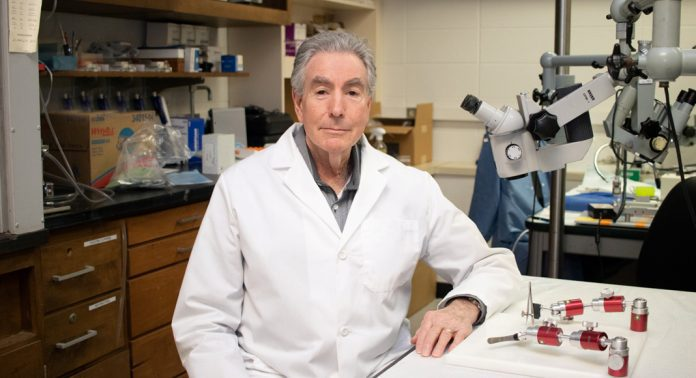

So says Dr. Monica Perez, who is running the first human trial for a potential new wonder drug being developed by a tiny but well-financed life sciences start-up, NervGen Pharma Corp. (TSXV:NGEN; OTCQB:NGENF). Her remarks were made in a recent TV interview by NBC News in Chicago at the trial site, the Shirley Ryan AbilityLab.

The stakes are especially high. NervGen hopes to commercialize the world’s first ever FDA-approved drug to treat spinal cord injuries. In terms of the Big Picture, this drug candidate has the potential to be a revolutionary “blockbuster” treatment for not just spinal cord injuries, but all kinds of nerve and neuron damage, such as MS, stroke and even possibly Alzheimer’s. Notably, no drugs have ever before been approved anywhere in the world for nerve regeneration and for improving plasticity in damaged nerves.

What makes Dr. Perez’s excitement an especially big deal is the fact that some trial patients appear to be recovering from the worst kinds of paralysis. In fact, anecdotal reports of patients in the trial regaining functionality in their legs and feet are already being shared on social media. This is mindful of the fact that the trial patients are asked not to risk tainting the objectivity of the trial by publicly discussing their progress while this first-of-a-kind “proof of concept” trial for humans is still ongoing.

The implications of this sneak peek into this Phase 1b/2a clinical trial are profound for the medical world and for investors alike. This might explain why Dr. Perez – an internationally recognized leader in spinal cord injury research at Shirley Ryan AbilityLab in Chicago – is so amped up about NervGen’s prospective blockbuster drug candidate, NVG-291.

Even the FDA likes what it sees so far. A few months ago, it granted a fast-track designation to NVG-291. In other words, NVG-291 is on the inside track for expedited commercialization, assuming that the current trial proves a success. A readout of the trial data is expected near year’s end.

Are trial patients really regaining the use of their legs?

The trial involves up to 10 patients receiving the trial drug and up to 10 patients receiving a placebo. And so far, much of the excited chatter on social media about this make-or-break trial appears to bode well for the trial’s outcome. For example, at least one trial patient has reportedly been able to get up out of his wheelchair and take his first hesitant steps since being paralyzed from the waist down in an accident.

Among the comments on Reddit was the following that was posted by a person who apparently has a cousin who is also being treated at the same rehabilitation facility where the trial is being conducted (though the cousin is not part of the trial).

How NervGen is quietly preparing for the big league

Even though NervGen has an obvious gag order from the FDA on discussing ongoing trial results, it speaks volumes that the company is publicly talking about pursuing a NASDAQ listing, while also recently engaging a fancy PR firm. Plus, the company recently tripled its treasury with a $23 million equity financing to $34 million. That’s quite a war chest – but an appropriate one for a small startup with big ambitions that seem increasingly attainable.

And just days ago, NervGen appeared to be so confident in the outcome of the spinal cord injury trial that the company announced the advancement of its new NVG-300 molecule to target stroke and ALS. Having what is arguably the world’s best preclinical data for repair of damage from stroke and MS, NervGen is brazenly striking out to aggressively expand its pipeline with multibillion dollar opportunities that may also one day include medical conditions as devastating to society as Alzheimer’s disease – an affliction involving 6 million Americans, which costs the U.S. $350 billion a year to manage.

By way of initial target markets, the global nerve repair and regeneration market was valued at US $8.2 billion in 2022, according to research data. And it is expected to grow to US$23.05 billion by 2031. Plus, with no existing treatments on the market to remedy nerve damage, NervGen enjoys the prospect of pioneering and dominating this new therapeutic class of drugs.

Even NervGen’s scientists can’t contain their excitement

Big moves in the business world are often preceded by big announcements. And even though NervGen’s trial results are not expected to be announced until late in 2024, the company appears to be really struggling to keep a lid on seemingly dramatic developments during the trial.

In fact, their comments are beginning to echo those of Meghan Morrow, who is a project manager for NervGen’s trial. In a past interview, she tellingly said: “It is a double-blind trial. So no one knows anything, except the pharmacist … But I will say that obviously there is speculation when we see individuals making gains. And then we get really excited …”

These incredibly encouraging comments seemed to have also impacted NervGen’s Chief Medical Officer, Dr. Dan Mikol, who was quoted in a Feb. 15 news release as saying: “… we look forward to the prospect of delivering positive results later this year.”

This bold, confident statement by Dr. Mikol is seemingly predicting a positive outcome for the trial results. His hints of great things to come seem all the more prescient now that Dr. Perez is gushing to the mainstream media about how well the trial is going.

Also, it should be noted that the primary endpoint of the clinical trial is an improvement in electrophysiology – essentially an increase in the electrical conductivity of the trial patients’ nervous systems. While this may seem to be a low bar, this has apparently never been achieved before in a spinal cord injury clinical trial, according to NervGen. And if people are actually experiencing functional improvement such as increased movement of limbs or improved bladder or sexual function, then the primary endpoint will have been easily achieved, making this trial a roaring success.

Investment summary

It’s been a tough market for startup biotech stocks in recent years, with most of them emphatically underperforming. Yet, NervGen’s share price has mostly held steady during this time, which suggests that a technical break-out on big news is very plausible. In fact, NervGen’s share price did exactly that a few weeks ago. But the powerful rally was short-lived because it was merely a response to social media speculation that the trial is actually “healing” some of the patients. The company appropriately stayed quiet about this speculation (mindful that the trial is ongoing) and the rally soon fizzled. And that’s when the short sellers smelled blood and pounded the share price down.

All told, the odds of NervGen officially declaring the trial to be a success later this year appear to be very encouraging. In such an instance, a sustained rally in NervGen’s share price would be very much in the offing. And how big can the rally go? Well, consider this: Investment newsletter writer Chen Lin told followers earlier this month that NervGen has the potential to become as big a success story as Eli Lilly (LLY:NYSE). Chen has a solid track record for stock selections. Hence, Chen’s comments have some influence among risk-tolerant investors.

In spite of Chen’s enthusiasm and all the buzz on social media, NervGen’s stock is still under the radar for most investors – especially being that it does not (yet) trade on a major U.S. exchange. Hence, its share price remains compressed, and in a tight trading range, albeit with a well-supported technical baseline.

NervGen therefore looks like an undervalued stock. And if all the positive buzz around the trial is validated with a positive trail readout, then NervGen is primed for a game-changing break-out that promises to gather considerable momentum in 2025 in the wake of the trial’s published findings.

Meanwhile, the advent of more anecdotal reports about trial patients walking away from their wheelchairs, or similarly remarkable outcomes (such as regaining bowel, bladder or sexual function), promises to continue to heat up the share price. And with the looming prospect of strong Phase 2 data and the potential for an accelerated approval to market for NVG-291, NervGen’s stock has a lot of room on its next leg up – and beyond. This should prompt many shrewd investors to want to get onboard before the next share price breakout – long before any news-driven parabolic moves to the upside.

Disclosure: The author of this article or members of his household or family, do not own shares in NervGen at this time. However, he may from time to time buy or sell shares in companies that are profiled in his various investment articles. Additionally, he is not compensated by the company directly or indirectly. His commentary is therefore based solely on his personal research and understanding of the life sciences sector. It is not intended as investment advice.

Disclaimer: This is third-party content provided by Knox Communications. Please see full disclaimer here.

Join the discussion: Find out what everybody’s saying about this company on the NervGen Pharma Corp. Bullboard, and check out other hot topics about stocks at Stockhouse’s stock forums and message boards.

(Top photo of Dr. Monica Perez: NBC5 Chicago screenshot)