If you’re unfamiliar with antimony, and even less so with how to pronounce it – accent on the a – you are not alone, because the metal’s multi-faceted roles across the industrial landscape have yet to hit the mainstream, as have lithium and copper, whose household names often obscure attractive investment opportunities in other equally critical minerals.

With a global market expected to grow from US$2.62 billion in 2025 to US$4.83 billion by 2033, posting a compound annual growth rate of 7.9 per cent, antimony represents one such opportunity, thanks to its ability to harden and strengthen certain metals integral to the technology, defense and decarbonization industries, and in so doing reinforce national security for governments successful at identifying a reliable supply. Let’s briefly introduce the critical metal’s key applications:

- Military: Used in ammunition, explosives, nuclear weapons, night vision goggles, laser sighting devices and communications equipment.

- Flame retardants: Used to prevent combustion in everything from plastics to textiles to electronics.

- Semiconductors: Used in microelectronics destined for diodes, infrared detectors, thermal imaging cameras, as well as optoelectronic devices, with the overall market expected to more than quintuple from 2025 to 2032.

- Batteries: For cathode material and superior heat resistance in lead-acid, molten salt and liquid metal batteries (LMB) for vehicles and backup power. LMB batteries, though only in the development phase, have shown data-driven potential to outlast lithium-ion batteries, especially in large-scale applications, while reducing costs thanks to a simpler manufacturing process and stronger safety profile, avoiding the much-publicized drawback of potential self-ignition.

Given antimony’s prevalence across essential industries, major Western economies with no domestic production, including the United States, Canada and countries in the European Union, have officially recognized it as a critical mineral, prioritizing projects across the mining lifecycle for permitting and expedited development.

The conflict-free gap in the global antimony market

Besides antimony’s industrial utility, the most important factor motivating the scramble for domestic supply is China’s leadership position in the market, controlling approximately 48 per cent of global production (and more than 60 per cent of US imports) in 2024, a position it moved to fortify with export restrictions in August 2024 that sent the price per ton shooting past US$20,000 – up from just over US$10,000 in January, according to FastMarkets – representing the highest increase in more than half a century.

Conflict-prone Tajikistan, Turkey, Burma and Russia fill out the top 5 producers, highlighting the pressing need for North America to reduce reliance on foreign supply and protect their defense, technology and manufacturing industries, especially as prices have continued to climb relative to Asian product. According to imarc, a pound of antimony will run you about US$27.35 in Asian markets, a bargain compared to US$42.04 in Europe and US$44.99 in North America.

With demand for renewable energy expected to rise to meet the UN’s goal of global net-zero emissions by 2050, and demand for technology underpinning military readiness expected to rise in tandem with global conflicts, North America’s pursuit of security, innovation and economic growth depend on identifying and developing new sources of antimony in conflict-free jurisdictions, where long-term, mutually beneficial relationships can be set in stone.

This gap in the antimony market, in turn, positions investors to benefit by identifying miners that stand up to due diligence, showing clear evidence of high-quality assets and leadership teams well-equipped to deliver on the disciplined unlocking of shareholder value.

Introducing NSJ Gold

A junior antimony miner already delivering exponential returns is NSJ Gold (CSE:NSJ), market capitalization C$2.61 million, whose stock has added 120 per cent since optioning its flagship Antimony 2.0 project in New Brunswick in July 2025, where multiple discovery prospects position the company to play a foundational role in strengthening North American antimony independence.

This article is disseminated in partnership with NSJ Gold Corp. It is intended to inform investors and should not be taken as a recommendation or financial advice.

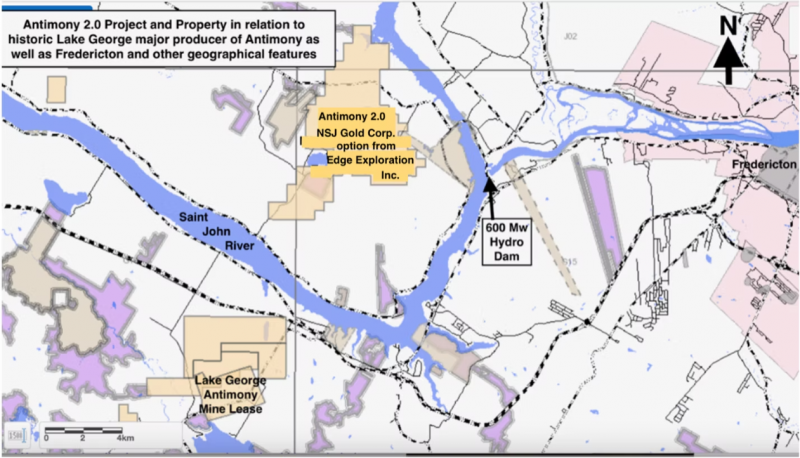

From a bird’s eye view, the 35-square-kilometre project resides in one of Canada’s most mining-friendly provinces, where an accommodative permitting regime and strong government support, plus easy access to roads and hydroelectric power, serve as a firm base for mineral exploration.

Let’s dig deeper into Antimony 2.0 to better understand why NSJ is likely in the early stage of harvesting significant exploration upside and potentially becoming a top antimony producer.

NSJ’s Antimony 2.0 project

Antimony 2.0’s underexplored land package, located only 25 km from capital Fredericton, is only 15 km from the historic Lake George antimony mine, which operated intermittently from the 1860s to 1998 and served as North America’s only primary antimony producer, supplying up to 4 per cent of global demand from 1970 through 1992.

Antimony 2.0 backs up Lake George’s robust regional discovery precedent with highly anomalous mineralization identified by vendor Edge Exploration through magnetic survey and more than 400 soil samples. Highlight findings encompass three robust anomalies with the same geology as Lake George, which NSJ is preparing to follow up on with 5 km of induced polarization geophysics and a Winter 2025 drilling program to test for economical mineralization.

The project’s prospective exploration leads, strengthened by its globally relevant, past-producing neighbor, grant NSJ a persuasive case for unlocking value well beyond the option agreement‘s asking price – 2.45 million shares and C$3.25 million in expenditures over five years – providing the market with further justification to fuel the stock’s ongoing ascent.

Leadership that de-risks the path to discovery

NSJ’s ability to foster shareholder value through the drill bit is supported by leadership steeped in experience across the mining lifecycle, including meaningful contributions to bringing the Lake George mine into production. Let’s meet the team now:

- Jag Sandhu, Founder, Director and Chief Executive Officer, has built a more than 25-year career in capital markets, primarily in corporate finance and development with a focus on capital raising, strategic planning and mergers and acquisitions. He has raised more than $250 million for numerous Canadian and international mining companies, a handful of which surpassed $1 billion in market capitalization, and has held various senior executive positions with listed companies.

- Dallas Davies, P.Eng., FEC, FGC, recently appointed as Vice President of Exploration, brings more than 50 years in mining and exploration geology, project management and public policy, including nine years as the head of non-renewable resource planning and policy with the New Brunswick Government. Across Davies’ prolific career, which has spanned 27 countries, his most relevant assignment for our purposes was overseeing the feasibility study that ushered the Lake George antimony mine back to production in the 1980s. Other career highlights include:

- Making a discovery that added eight years of life to the Falconbridge Wesfrob copper and iron mine in BC.

- Introducing Homestake to Malaysia Mining Corporation, leading to the former’s billion-dollar acquisition of the latter’s controlling interest in Plutonic Resources, a 500,000-ounce-per-year gold producer in Australia.

- Diamond exploration in Quebec in the year 2000, resulting in the first gem-quality diamond to be cut and displayed in the Quebec City museum, leading to client Twin Mining winning Quebec Prospector of the Year.

- Davies also served as a Director of the Prospectors and Developers Association of Canada (PDAC) from 1970-73.

- Paul Grewal, CPA, CA, Chief Financial Officer, has served as CFO for companies active in a diversity of industries, including numerous publicly listed junior mining companies in Canada, under which he’s gained wide-ranging financial management experience. Grewal joined Heming, Wyborn & Grewal Chartered Accountants in 2005 and was promoted to Partner in 2009.

- Rodney Stevens, CFA, Director, Vice President of Corporate Development, is a capital markets veteran of more than a decade, beginning his career as an investment analyst with Salman Partners, under which he became a top-rated analyst by StarMine in 2007. Stevens later progressed into merchant and investment banking, as well as portfolio management with Wolverton Securities, assisting in financings and mergers and acquisitions worth more than $1 billion in transaction value. He is currently Vice President, Director and Interim CFO at Discovery Harbour Resources (TSXV:DHR), a junior miner active in Nevada’s Walker Lane and Northumberland Gold trends.

- Chris Zerga, Director, has amassed 35 years of exploration, development and production expertise across the United States, spanning all ore types and recovery methods, having served as a senior executive for both major and junior miners throughout his career, including Freeport McMoran (NYSE:FCX), AngloGold Ashanti (NYSE:AU), Newmont (NYSE:NEM), Scorpio Gold (TSXV:SGN) and Minorco SA, which merged with Anglo American (OTCQX:NGLOY). Zerga is currently General Manager for Rawhide Mining, an open-pit heap leach operation producing gold and silver doré in Nevada backed by EMX Royalty (NYSE/TSXV:EMX), which owns a 19.9 per cent stake.

- Kim Eckhof, Director, is a mining equity capital markets expert who has occupied the role of Executive Director at London-based Medea Natural Resources since 2017. She is a former Non-Executive Director for ASX-listed Latitude Consolidated and spent five years at RFC Ambrian in London focused on capital raising, investor relations and junior mining advisory services. Prior to RFC Ambrian, Eckhof was an Associate on the Equity Capital Markets team at Azure Capital in Perth, Australia, where she also helped to set up and manage the A$25 million Azure Resources Fund.

Guided by market-tested mining professionals with directly applicable experience, NSJ Gold benefits from a deep familiarity with capital markets and how to best navigate them on the long journey from exploration to production, rounding off its already outsized value proposition as a potential pillar in an independent North American antimony supply chain.

High-quality leverage to a booming commodity

The best-case scenario for a junior mining investor looking to fill an empty spot in their portfolio is to find companies that minimize the sector’s main risks – namely, financing and dependence on target commodities – by pairing seasoned capital allocators with data-rich assets in markets propelled by long-term tailwinds, and NSJ Gold passes the test on all counts.

From the technologies that keep our military members safe, to leading-edge energy storage solutions that ensure grid stability while lowering emissions, antimony earns its status as a mineral critical to national security in no uncertain terms. Its availability among conflict-free nations, constricted by Chinese export restrictions, makes this status all the more apparent.

The Antimony 2.0 project, rich in exploration potential validated through extensive prospecting, represents a clear lever to tip the scales and begin a generational shift for antimony towards a market immune to authoritarian whims.

This thesis, in the hands of a highly-specialized leadership team that knows how to raise capital, make discoveries and generate operational growth, suggests an abundance of economical mineralization is in NSJ Gold’s future.

Look for news about planned geophysical testing, prioritization of drill targets and eventual intercepts to drive further shareholder value, leveraged by the flexibility of only 23.76 million shares outstanding.

Join the discussion: Find out what investors are saying about this antimony stock on the NSJ Gold Corp. Bullboard and make sure to explore the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.