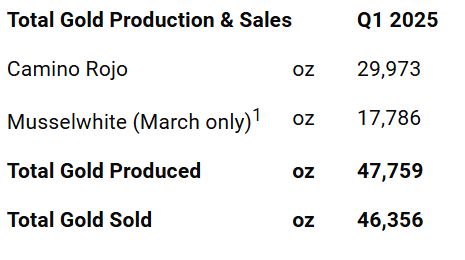

- Orla Mining (TSX:OLA) archived record quarterly gold production of 47,759 ounces in Q1 2025 ended March 31

- The results put the company on a path to meeting annual guidance of 110,000 to 120,000 ounces

- Orla Mining acquires, develops and operates mineral properties where management believes it can substantially increase stakeholder value

- Orla Mining stock has added 172.88 per cent year-over-year and 508.64 per cent since 2020

Orla Mining (TSX:OLA) archived record quarterly gold production of 47,759 ounces in Q1 2025 ended March 31, putting the company on a path to meeting annual guidance of 110,000 to 120,000 ounces.

The company ended the quarter with US$184.2 million in cash and US$450 million in debt and expects to release Q1 financial results on May 9, 2025.

Management has delivered overall profitability over the past three years combined, despite a net loss in 2023 because of an impairment charge related to its Cerro Quema project in Panama. Law 407, passed in November 2023, effectively put a halt on the country’s mining industry. The company filed a request for arbitration against the Government of Panama in July 2024.

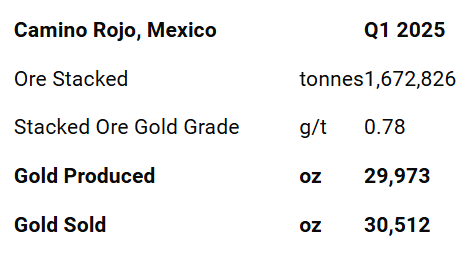

Camino Rojo

Orla’s Camino Rojo operation in Mexico mined just under 1.9 million tons of ore and 2.8 million tons of waste, implying a strip ratio of 1.48. The asset’s daily stacking rate reached 18,400 tons per day at an average grade of 0.78 grams per ton (g/t) of gold in line with expectations.

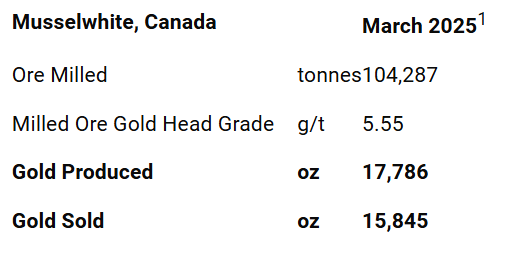

Musselwhite

Orla’s Musselwhite operation in Ontario mined 108,000 tons of ore and milled 104,000 tons at a mill head grade of 5.55 g/t gold, yielding recovery rates of 95.7 per cent and production of nearly 18,000 ounces.

1 Orla acquired Musselwhite on February 28, 2025. Operational figures are provided from March 1 onward.

Consolidated production

About Orla Mining

Orla Mining acquires, develops and operates mineral properties where management believes it can substantially increase stakeholder value. Besides its two operating mines in Mexico and Canada, the company’s portfolio includes the South Railroad gold project in Nevada, a feasibility-stage, open-pit asset located on the state’s Carlin trend.

Orla Mining stock (TSX:OLA) last traded at C$14.79 per share. The stock has added 172.88 per cent year-over-year and 508.64 per cent since 2020.

Join the discussion: Find out what everybody’s saying about this gold producer on the Orla Mining Ltd. Bullboard and check out Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top image, generated by AI: Adobe Stock)