- Orvana (ORV) has achieved standout intercepts and a 49-per-cent Q3 production increase from its OroValle operations in Spain

- A highlight intercept from Ortosa West graded 22.16 g/t gold over 6.05 m

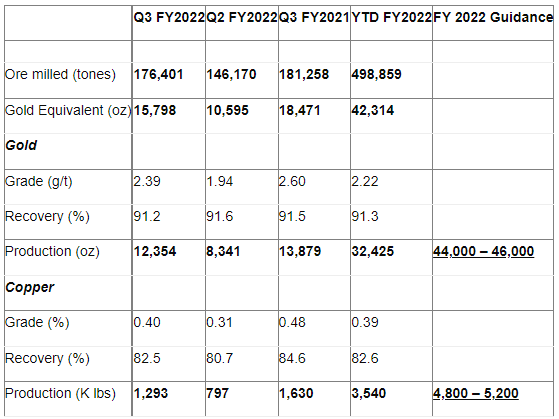

- Q3 FY2022 production was 15,798 gold equivalent ounces

- CEO Juan Gavidia sat down with Sabrina Cuthbert to discuss the news

- Orvana is a multi-mine gold-copper-silver producer active in Spain, Bolivia and Argentina

- Orvana Minerals (ORV) is up by 1.79 per cent trading at $0.285 per share

Orvana (ORV) has achieved standout intercepts from its OroValle operations in Spain.

It is also announcing a 49-per-cent Q3 production increase from the property.

Production results

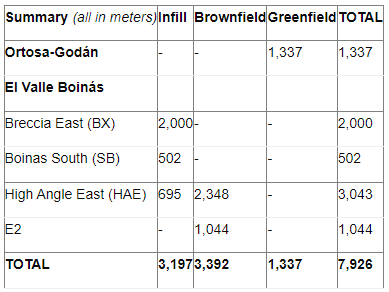

Q3 exploration drilling

Ortosa-Godán

The Ortosa-Godán Project is located three km northwest of the Carles Mine.

Ongoing drilling at Ortosa West is focused on defining mineralization to the northeast and the structure at depth.

Results confirm mineral continuity along 250 m of northeast-southwest trend. The company also intersected calcic skarn with sulfides (arsenopyrite mainly) and mineralized silicified breccias.

Intercepts from Ortosa West

El Valle Boinás

Exploration continued with 3,197 m of infill drilling to upgrade inferred resources at Breccia East, Boinas South and High Angle East, as well as 3,392 m of brownfield drilling executed at High Angle East and E2 to extend mineralized areas and add inferred resources.

CEO Juan Gavidia sat down with Sabrina Cuthbert to discuss the news.

Orvana is a multi-mine gold-copper-silver producer active in Spain, Bolivia and Argentina.

Orvana Minerals (ORV) is up by 1.79 per cent trading at $0.285 per share as of 10:42 am EST.