- Patriot Battery Metals (PMET) has announced an $11M flow-through financing

- It will issue 17,973,856 units priced at $0.612 per unit

- It will use the proceeds for exploration work on its Corvette-FCI Project in James Bay, Quebec, by December 31, 2022

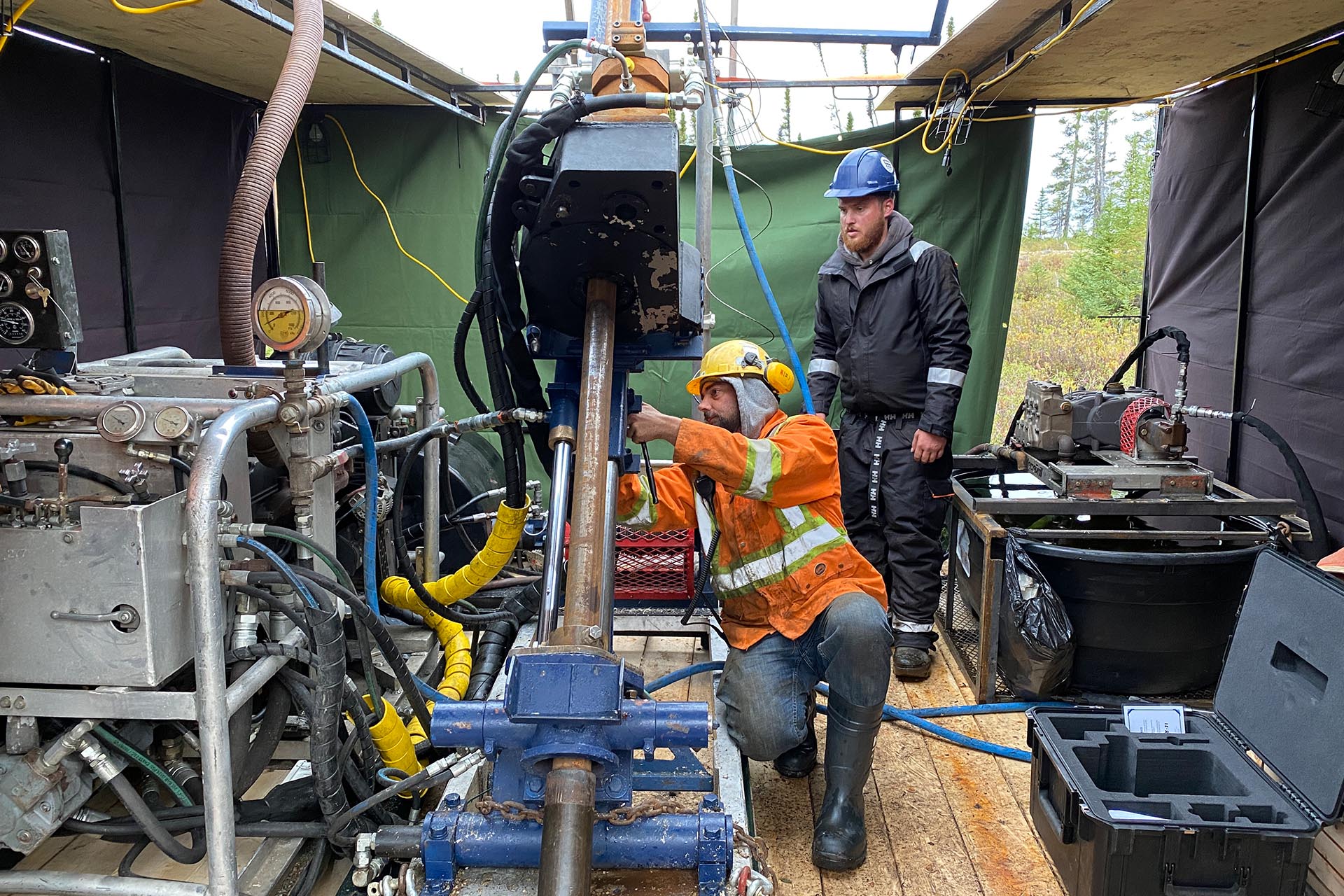

- Patriot Battery Metals is focused on the acquisition and development of mineral projects containing battery, base and precious metals

- Patriot Battery Metals (PMET) is unchanged trading at $0.40 per share

Patriot Battery Metals (PMET) has announced an $11M flow-through financing.

It will issue 17,973,856 units priced at $0.612 per unit.

Each unit is comprised of one common flow-through share and one common share purchase warrant exercisable for two years at a price of $0.75.

The company will use the proceeds from flow-through units to incur Canadian exploration expenses that qualify as flow-through mining expenditures as defined in the Income Tax Act (Canada).

It will conduct the exploration work on its Corvette-FCI Project in James Bay, Quebec, by December 31, 2022. It will renounce its expenditures to subscribers effective December 31, 2021.

PearTree Securities is overseeing the unit sale.

Patriot Battery Metals is focused on the acquisition and development of mineral projects containing battery, base and precious metals. Its flagship assets are located in Canada and the U.S.

Patriot Battery Metals (PMET) is unchanged trading at $0.40 per share as of 9:36 am EST.