The geopolitical situation brings new uncertainties every day. Most recently, markets reacted strongly to news around the removal of Venezuelan President Maduro, and now massive unrest in Iran has been added to the mix! Commodity prices are galloping against the backdrop of fragile supply chains and the formation of Eastern and Western power blocs with conflicting interests. While the US is formulating its expansionist agenda towards Greenland and Canada, China is responding with further export restrictions. This is exacerbating the situation even further and driving up the prices of silver to USD 85 and gold to over USD 4,600. Both established mines and promising projects are coming into focus, and takeover rumors are circulating once again. How are investors supposed to keep track of all this? We are happy to help.

This article is disseminated in partnership with Apaton Finance GmbH. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Glencore and Rio Tinto – A USD 200 Billion Mining Giant in the Making

The copper deficit is now taking on analytical significance! The renewed talks between Glencore and Rio Tinto mark a potential turning point for the global mining industry. One thing is clear: a merger of this magnitude will permanently change the structural forces in the sector. According to analysts’ calculations, a combined company would have a market capitalization of around USD 200 to 210 billion, clearly surpassing BHP, whose market value was recently around USD 160 billion. Together, Glencore and Rio Tinto would produce well over two million tons of copper annually, making them dominant players in an increasingly tight market. The structural supply deficit is projected to reach several million tons by 2035. Analysts expect copper demand to grow by 3 to 4% annually due to the energy transition, electromobility, and AI data centers, while new large-scale projects are hardly in sight. From a financial perspective, a merger would open up considerable synergy potential, for example, through savings in administration, logistics, and capital expenditure, which are conservatively estimated at USD 2 to 3 billion per year. At the same time, the capital expenditure for new mining projects could be better distributed, as both companies currently have tens of billions tied up in long-term development projects. However, the debt structure remains critical: Glencore traditionally has higher net debt, while Rio Tinto is much more conservative in its balance sheet, which complicates negotiations on valuation and control. Let’s see how industry giant BHP responds to the situation. Perhaps there will be another offer.

Barrick Mining and B2Gold – Africa is back in focus

Investors are now turning their attention back to Africa for gold investments. After a long period of tension, normality is returning to the gold sector in Mali following a comprehensive agreement reached between Barrick Mining and the military government at the end of November 2025. Barrick regains full operational control of the Loulo-Gounkoto complex in exchange for a one-time payment of approximately USD 430 million and the withdrawal of all international lawsuits. The license has been extended for 10 years, allowing production to return to full capacity since October. With approximately 723,000 ounces per year, the mine is one of the largest mining sites in Africa. This significantly reduces the political risk for Barrick, which is already reflected in a strong share price performance and positive analyst upgrades. Investors are now focusing on the spin-off of North American assets to give the group a clearer structure. The share price continues to rise, already up 180% in the past 12 months. Three analysts on the LSEG platform have updated their forecasts, setting price targets between CAD 70 and CAD 78. B2Gold is also benefiting from the easing of tensions, as the Fekola complex was largely spared from intervention. All permits are now valid again. This has prompted B2Gold to maintain its forecast of 515,000 to 550,000 ounces of gold for 2025. Barrick will release its 2025 figures on February 5, with B2Gold following on February 25. Very exciting!

Desert Gold – Exciting times ahead

The situation is quite different in Côte d’Ivoire, which is increasingly establishing itself as a stable growth location for gold. The government is currently issuing new exploration licenses and extending existing mining rights to stimulate investment in the country. Producers such as Perseus Mining with the Yaouré mine and Fortuna Mining with Séguéla are expanding their capacities. At the same time, new discoveries and exploration programs by international companies are fueling additional excitement. Côte d’Ivoire is thus deliberately positioning itself as an investor-friendly alternative to its politically more difficult neighbors.

CEO Jared Scharf has reached an important strategic milestone with the recently revised preliminary economic assessment (PEA) for the Barani and Gourbassi gold deposits of the SMSZ project, which is wholly owned by Desert Gold (TSXV:DAU). The analysis shows a net present value (NPV) of USD 61 million and an internal rate of return (IRR) of 57% at a gold price of USD 2,850 per ounce. The plan is to increase monthly mining capacity to 36,000 tons, with a modular and cost-effective processing concept envisaging a start in Barani and, in a second phase, in Gourbassi. A total of 113,100 ounces of gold are to be mined over the planned 10-year period. Under current market conditions, this even results in an NPV of around USD 124 million with an IRR of 101%. It should be noted that the valuation is based on less than one-tenth of the total concession area, indicating considerable growth and exploration potential for the future. With initial investment costs of approximately USD 20 million and a clearly structured production strategy, the project offers an attractive return on investment.

At the same time, Desert Gold Ventures is strengthening its presence in West Africa through the Tiegba Gold project in Côte d’Ivoire, which, despite its early stage of development, is already attracting attention with large-scale geochemical anomalies. The politically stable situation and investor-friendly conditions create additional planning security and allow for the complementary development of both projects. According to a recent valuation by GBC AG, Desert Gold continues to trade well below its fundamental value on the stock market. Assuming a spot NPV of USD 124 million, the estimated total project value, including the Tiegba area, amounts to approximately USD 133.5 million. GBC reaffirms its “Buy” rating with a price target of CAD 0.81 by the end of 2026. Yesterday, DAU shares got off to a strong start with solid trading volume, reaching a 12-month high of CAD 0.09. By simple arithmetic, that implies a ninefold upside to GBC’s price target.**

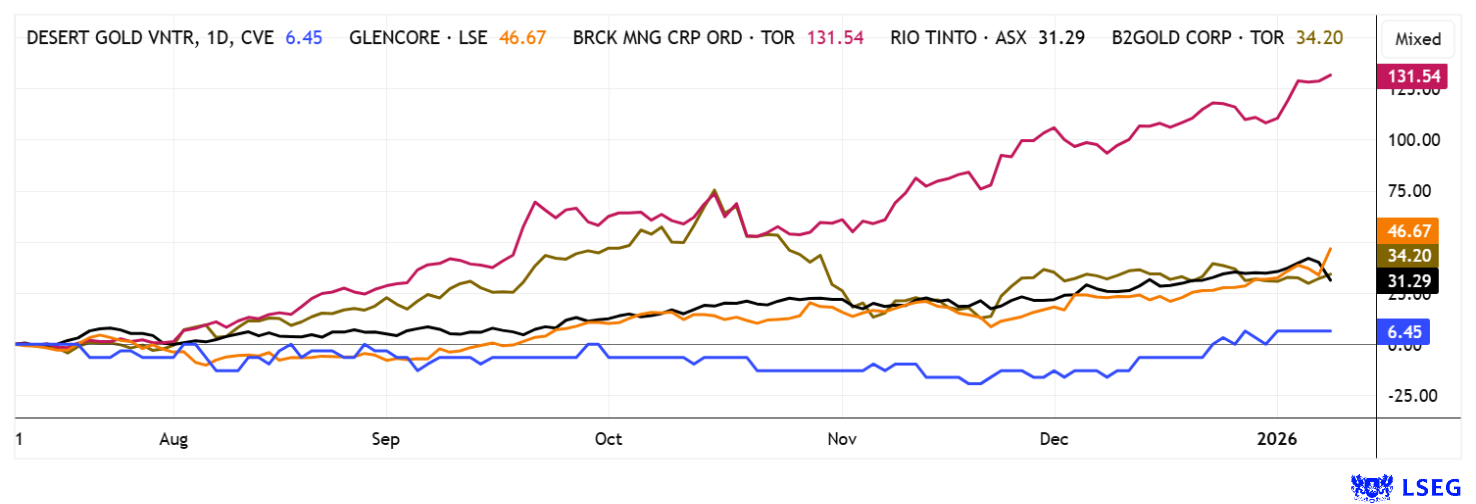

Stock markets are starting 2026 much as 2025 ended: with panic buying of commodities and mounting takeover rumors. Gold and silver stocks remain in the spotlight, having realized their potential since mid-2025. With operating profits tripling in some cases, the rally is likely far from over. Barrick, Rio Tinto, and Glencore have already made considerable gains, and B2Gold and Desert Gold could prove to be followers, with both already ringing the bell yesterday.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a “Transaction”). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.