Unbelievable – who would have thought it? Last week, silver reached the USD 64 per ounce level for the first time, reflecting a pronounced imbalance between supply and demand. In contrast to the bubble surrounding the Hunt brothers, who effectively bought up the silver market to nearly USD 50, today’s rally is based on a global structural deficit driven not only by industrial demand but also by geopolitical tensions, rising government debt, and a weak US dollar. Physical silver availability is declining worldwide due to low production levels. At the London Metals Exchange (LME) in particular, inventories have fallen by roughly one third since 2021, while ETFs have reduced the freely available supply by more than 75%. The situation is coming to a head! Where should investors start paying closer attention?

This article is disseminated in partnership with Apaton Finance GmbH. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Silver North – A promising newcomer in the silver universe

Silver is increasingly becoming the focus of industrial attention. This is because the classic precious metal has long since become a strategic metal of the future, gaining considerable importance both technologically and macroeconomically. With the rapid digitalization of vehicles, for example through driver assistance systems, autonomous driving functions, and extensive infotainment architectures, the use of silver-containing circuit boards, sensors, and connecting elements continues to increase. In addition, silver plays a key role in future energy systems: in photovoltaics, solar cells currently account for around 10% of global silver demand. In electrical engineering, the precious metal is found in contacts, switches, relays, and connectors, as well as in inverter modules and battery management systems that optimize efficiency, control, and heat management.

Silver North Resources’ (TSXV:SNAG) silver is still in the ground. The Company is currently positioning itself as a promising explorer in the Yukon, one of North America’s most silver-rich regions. The focus is on the Haldane and Tim projects, which are strategically located in established mining districts and benefit from good infrastructure and the active presence of large producers in the vicinity. The 100% owned Haldane project is immediately adjacent to Hecla Mining’s producing Keno Hill mine and has been considered significantly underexplored to date. The ongoing 2025 drill program is now impressively confirming the project’s potential, particularly at the Main Fault target. Recent investigations have yielded thick sections with high silver, gold, lead, and zinc grades, including intervals with over 2,000 g/t silver. The mineralization has now been traced over a strike length of 100 meters to a depth of approximately 150 meters, significantly improving the size perspective of the deposit. Particularly positive is the increasing gold content at deeper levels, which could further enhance the economic attractiveness.

Further analysis results from the 2025 drill program are still pending and have the potential to further reinforce this positive trend. The second core asset, the Tim property near Coeur Mining’s Silvertip mine, shows anomalous silver-lead-zinc values. Coeur Mining has already completed an initial drill program there and can secure up to an 80% interest in the project through further exploration steps under an option agreement.

In addition, the GDR project with the Veronica property also shows early but impressive exploration potential. High-grade samples of up to 2,860 g/t silver and an exceptional 76.8% lead underscore the parallels to the Silvertip district. The available results justify further exploration work in 2026. On the financial side, Silver North recently announced flow-through financing of up to CAD 2.1 million, which will be used specifically for exploration. In total, the Company has approximately CAD 2.6 million in equity available for its projects. Given a market capitalization of approximately CAD 29 million, strong partners, a robust shareholder structure, and constructive silver sentiment, Silver North remains an exciting value for risk-tolerant investors. Collect!

Rheinmetall – High expectations for 2026

Rheinmetall also knows a thing or two about high silver consumption. Germany’s leading defense contractor is increasingly integrating the metal into its high-tech products, particularly in the Electronic Solutions division for sensor technology, communication systems, and air defense. The ultra-conductive precious metal serves as an indispensable component for corrosion resistance and heat dissipation in modern tanks, drones, and missile systems. Exact quantities remain proprietary and are not disclosed publicly, as they hold strategic competitive advantages, but industry estimates point to significant volumes. Estimates assume, for example, up to 15 kg per high-precision missile. The ongoing defense boom, driven by large orders such as tank ammunition for the German Armed Forces and NATO, is further driving demand for silver.

But caution is advised: bottlenecks in the raw materials markets could put a stop to the current flood of orders. The increasing electrification of weapon systems is reinforcing this dependency. Investors have already granted a considerable valuation advance with the current valuation of almost 6 times revenue in 2025e and a P/E ratio of 57. Should the peace efforts in Ukraine materialize, Rheinmetall shares are likely to experience a short-term 30 to 50% profit-taking consolidation from EUR 1,650. This would bring the valuation parameters back into line and justify a new entry.

DroneShield – Will this revival succeed?

The example of DroneShield is a perfect illustration of what happens when hype turns to disillusionment. The Australian defense technology company announced ambitious growth plans, including capacity expansion at its main facility, which management believes could support order volumes of up to AUD 500 million over the medium term. The crux of the matter: speculative investors had backed the AUD 500 million revenue target for 2026 with a tenfold increase in the share price, which rose from EUR 0.38 to EUR 3.80 since January. What was not known was the fact that senior executives and management held extensive options to purchase shares in the portfolio. When revenues approached AUD 200 million, additional shares entered the market and were largely sold immediately, increasing free float and triggering a sharp reassessment by investors. The result was a correction of approximately 75% from the peak. One man’s loss is another man’s gain! A recent price revival from around EUR 0.80 to EUR 1.35 was immediately sold off again to EUR 1.17. Casino Royale for investors with quick reactions!

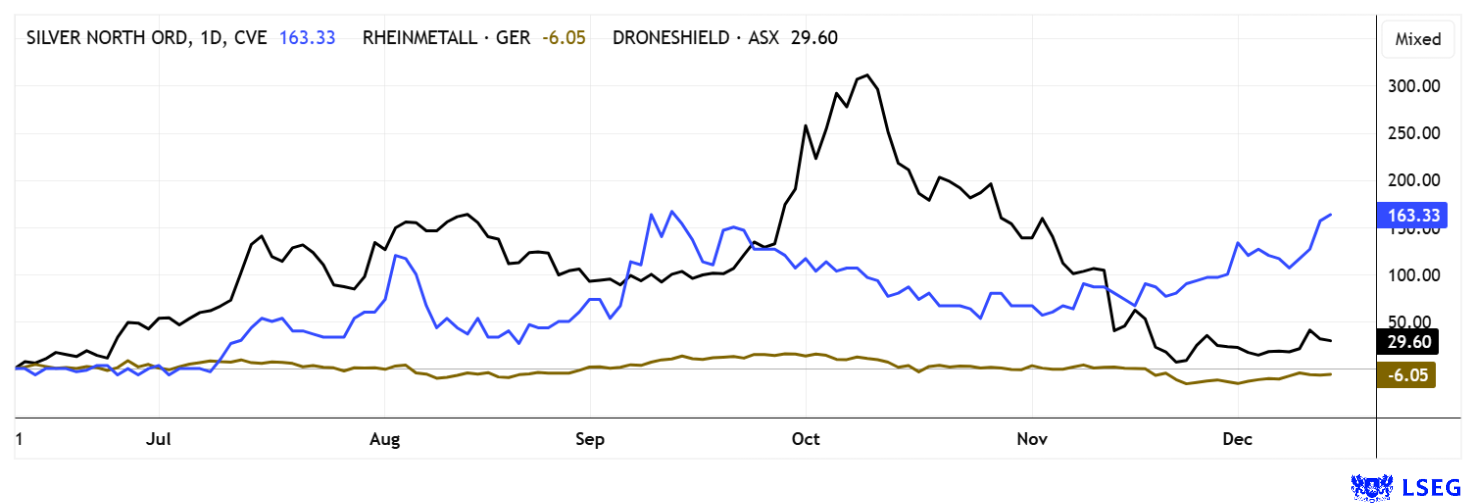

Silver is one of the top commodity stocks of 2025. With a performance of over 100%, the precious metal outperformed virtually every other asset class. While the hyped defense stocks shifted into sideways-downward mode, speculative investors were able to strike gold with the right explorer stocks. With a current market capitalization of CAD 29 million, the explorer Silver North still offers outstanding potential for risk-conscious investors.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as shareholders, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price development. In this context, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a “Transaction”). The Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

Apaton Finance GmbH reserves the right to enter into paid contractual relationships with the company or with third parties in the future with regard to reports about the company that are reported on the Apaton Finance GmbH website as well as in social media, on partner sites or in e-mail messages.

The above information on conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications about companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.