- Starcore International Mines (SAM) released its updated NI 43-101 reserve and resource estimates to April 30, 2022, for its San Martin mine

- San Martin proven mineral reserves decreased 24 per cent to 82,559 ounces (oz.) of contained equivalent gold, exclusive of mineral reserves

- The decrease is attributable to mining depletion of 52,467 oz. of gold equivalent from April 30, 2019, to April 30, 2022

- Starcore International Mines Ltd. (SAM) is trading steady at $0.24 per share as of 10:00 a.m. ET

Starcore International Mines (SAM) released its updated NI 43-101 reserve and resource estimates to April 30, 2022, for its San Martin mine.

San Martin proven mineral reserves decreased 24 per cent to 82,559 ounces (oz.) of contained equivalent gold, exclusive of mineral reserves.

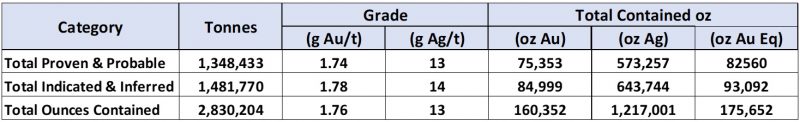

San Martin proven and probable mineral reserves as of April 30, 2022, are estimated at 1,348,433 tonnes grading 1.74 grams per tonne (g/t) gold and 13 grams per tonne silver, for 82,559 oz of contained equivalent gold. The decrease from the previous estimate is attributable almost entirely to mining depletion of 52,467 oz. of gold equivalent from April 30, 2019, to April 30, 2022.

San Martin’s indicated and inferred mineral resources decreased 21 per cent to 93,092 oz. of contained equivalent gold.

San Martin exploration success offset 36 months of mining depletion, with mineral reserves essentially maintained at 175,652 oz. of contained equivalent gold representing five-plus years of mine life.

Starcore’s updated mineral reserve and resource estimate for San Martin contains 13 per cent lower tonnes with 4 per cent lower grades compared to the previous reserve/resource estimate of 2019. The company pointed to using more conservative estimation parameters consistent with the reserve / resource estimates for the San Martin mine as the reason.

The company’s Chief Operating Officer, Salvador Garcia stated that the result of this updated 43-101 report is that exploration efforts are continuing to assure the mine life growth at San Martin.

“The additional investment this year of $1 million dollars that was approved by the Board of Directors will see 10,000 diamond drill meters in the targets defined and near the current operations of the areas 28 and 33.”

Ongoing efforts at San Martin are focused on resource growth at the Area 28 and Area 33 ore bodies, as well as the conversion of mineral resources to mineral reserves with underground mine workings and via metallurgical test work studies.

Starcore is engaged in precious metals production, focusing on Mexico. Some of its projects include San Martin, El Creston, and Toiyabe.

Starcore International Mines Ltd. (SAM) is trading steady at $0.24 per share as of 10:00 a.m. ET.