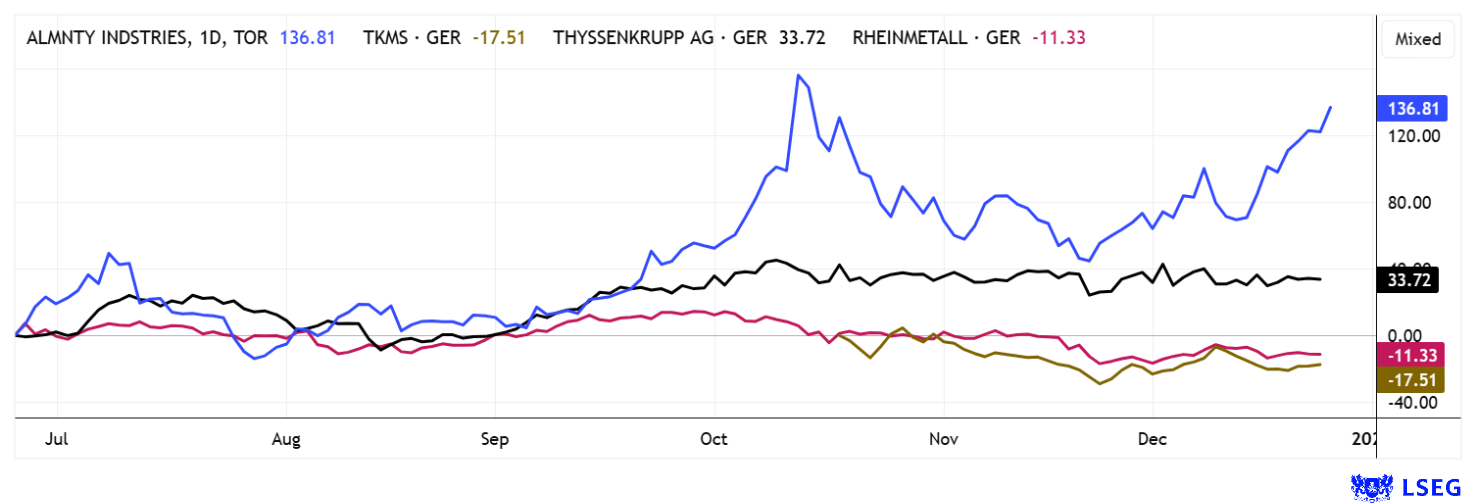

With only two trading days left, one of the most successful investment years of the new millennium is coming to an end. A quarter of the year has already passed, and the major indices have gained around 25% on a currency-adjusted basis, a scenario that is rarely observed. Almonty Industries is among the top-performing stocks of the past 12 months, with investors’ capital increasing by an impressive 730%. The large Sangdong tungsten mine in South Korea has now gone into operation, yet CEO Lewis Black is already working on the next strategic steps. Rheinmetall is in full swing, even if the highest prices could not be maintained here. And for the thyssenkrupp Group, a new era is dawning with the spin-off of its marine subsidiary TKMS. The rally is unlikely to be over yet for this select group. We do the math!

Almonty Industries – Operational start of Sangdong at the end of the year

Almonty Industries’ (TSX:AII) performance over the past 12 months is hard to beat. Patient investors have seen returns of over 700%, and the outlook for the next investment period in 2026 remains positive. Strategically, there is still a lot going on under the energetic and confident CEO Lewis Black. In December, the Company was able to announce the start of operations in Sangdong, the largest tungsten mine outside China, much faster than expected. A few weeks earlier, a significant takeover deal in Montana was announced.

This article is disseminated in partnership with Apaton Finance GmbH. It is intended to inform investors and should not be taken as a recommendation or financial advice.

This has made Almonty not only a world-renowned NASDAQ stock but also a commodity stock that can be mentioned in the same breath as the North American supply chain in the critical metals sector. Driven by geopolitical tensions and growing demand in defense, aerospace, semiconductors, and AI infrastructure, security of supply is becoming a greater focus for politics and industry. Sangdong is considered the cornerstone of an independent supply network for Western countries and could account for the majority of non-Chinese production in the future. At the same time, Almonty is using the Portuguese Panasqueira mine as a stable cash base and expanding it to the next level of production with a large-scale drilling program.

Financially, Almonty raised around USD 129 million in December through an oversubscribed capital increase. It is nice to see how easy this is now. As a result, the balance sheet is very comfortable, and with a capitalization of just under USD 2 billion, the new US investors are catapulting the Company into a completely different league. The price targets on the LSEG platform are a few weeks out of date, as the new strike price poses major challenges for analysts. Only Sphene Capital is still in the race at CAD 13.50. Expect significant upgrades in January!

CEO Lewis Black talks to IIF host Lindsay Malchuk and provides deep insight into the new US tungsten deal in Montana.

Rheinmetall – Valuation questions may be asked

Although the shares of defense specialist Rheinmetall have already gained 147% over the year, they have fallen by a good 11% in the last six months. Are these the first signs that the party is over? It is clear that expectations for the future growth of the Düsseldorf-based defense stock remain high, and minor disappointments or delays are already having an impact on the share price. Analysts expect revenue of around EUR 12.4 billion for the current fiscal year, which is expected to rise to around EUR 28 billion by 2028. Using all strategic levers, the management under CEP Papperger is even talking about EUR 50 billion by 2030. This contrasts with a current market capitalization of around EUR 70 billion, which is a solid five times the revenue for 2025.

The Company’s momentum is primarily driven by ongoing high geopolitical tensions and defense budgets, which are reaching historic highs in many countries and securing the order situation for years to come. A recent large order placed by the German government for armored personnel carriers and wheeled howitzers with a total volume of EUR 4.2 billion is a prime example of this, as the German Armed Forces also want to implement their “refurbish” objectives as quickly as possible. In addition, the German Armed Forces Procurement Office has awarded a further contract worth around EUR 1.7 billion in the new business field of space-based systems. In addition to the traditional systems and platform business, high-margin service and maintenance services are increasingly coming to the fore, such as long-term maintenance and availability contracts for vehicles, artillery systems, and naval units, which generate stable recurring revenues and increase cash flow visibility.

The civilian divisions are a hindrance to the Group’s structure and are to be sold off entirely in 2026. The Düsseldorf-based company naturally has its eye on the more lucrative margins offered by public-sector clients, who in the current environment are hardly in a position to resist a well-defined pricing policy. After all, only those who pay what is asked will receive the coveted goods. The defense market is thus developing into a supply market. Acquisitions in the military sector are therefore likely to increase next year, but the sellers of these units also know their price. All in all, caution is advised with regard to Rheinmetall shares in many respects. The big jump in valuation is over, especially if the first ceasefire is declared in Ukraine. In our opinion, dynamic investors will then see entry levels drop by up to 25% within minutes. Wait and see!

thyssenkrupp in transition – How the spin-off of TKMS is unlocking new value

The Duisburg-based steel group thyssenkrupp is in the midst of a strategic realignment that is increasingly taking shape but will continue to require a lot of time and capital. The latest fiscal year figures showed solid operating results, while the outlook was somewhat more conservative. With the share price falling to around EUR 9, the difficult situation facing the new management remains unchanged. Analysts also emphasize that the measures introduced should be implemented consistently in order to convince the markets of greater capital discipline. The group is receiving a clear tailwind from the spin-off of its marine subsidiary, thyssenkrupp Marine Systems (TKMS), which now operates completely independently. The spin-off reduces the conglomerate discount in the valuation, which is unpopular on the stock market, and ensures greater transparency for both business models. At the same time, sentiment for the parent company is also improving, with 12-month price targets of around EUR 10.90 now being quoted on the LSEG platform. From the current level, that represents a potential gain of more than 20%.

TKMS itself is developing into a clearly positioned European heavyweight in the naval sector. Recently, a significant framework agreement was signed with the German Armed Forces Procurement Office for the delivery of modern DM2A5 heavyweight torpedoes. These systems are based on a flexible software architecture, have quiet electric drives, and are designed for complex deployment scenarios. For TKMS, this is already the largest torpedo order in the Company’s history, while the highly acclaimed German-Norwegian 212 CD submarine program is also progressing. Up to 12 units are planned here in the future. In addition, TKMS is bidding with international partners for an extensive submarine program for Canada. A strategic cooperation with manufacturing specialist Marmen is intended to shift industrial value creation to North America and create local jobs.

After a somewhat bumpy start on the stock market with a high initial listing and subsequent sell-off, a sustainable entry point has been reached again at around EUR 66. The majority of experts on the LSEG platform are positive and expect target prices of EUR 82 on average. They highlight the massive pipeline, rising order intake, and strategic options in a European defense alliance. Exciting!

Arms and defense stocks remain on the buy list of international investors. Almonty Industries is going down in history as one of the most dynamic commodity stocks of the still-young century. The rally could continue unabated at the start of 2026. Thyssenkrupp is now also clearly focused following the spin-off of TKMS. However, the road ahead could still be rocky. Rheinmetall is benefiting from rising order intake, but its valuation already reflects the expected growth rates through 2028. There can be no disappointment here!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as “Relevant Persons”) currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a “Transaction”). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies. In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships. For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein.

For full disclaimer information, please click here.