- Tantalex (TTX) has averaged 0.946 per cent Li2O from the Manono Tailings K Dump in the Congo

- The figure stems from the final 115 drill assays from the K Dump’s 2022 infill drilling program

- A Mineral Resource Estimate for Manono is slated for early next month

- President and CEO Eric Allard spoke with Sabrina Cuthbert about the results

- Tantalex Lithium Resources is a mineral exploration, and development company focused on lithium, tin, tantalum and other high-tech minerals in Africa

- Tantalex (TTX) is down by 5.88 per cent, trading at $0.08 per share

Tantalex (TTX) has averaged 0.946 per cent Li2O from the Manono Tailings K Dump in the Congo.

The figure, measured from surface, stems from the final 115 drill assays from the K Dump’s 2022 infill drilling program.

The company has completed 2,117 m across 156 aircore drill holes at the K Dump to define a measured category for Manono’s Mineral Resource Estimate, which is expected for early October. Once it receives assay results from the G Dump, Tantalex intends to proceed to a Preliminary Economic Assessment.

President and CEO Eric Allard spoke with Sabrina Cuthbert about the results.

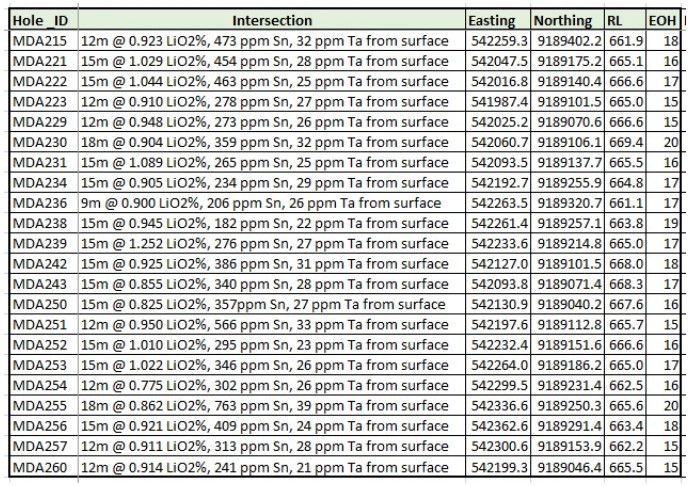

Assay intersections from MDA211 to MDA325 greater than 15 m depth

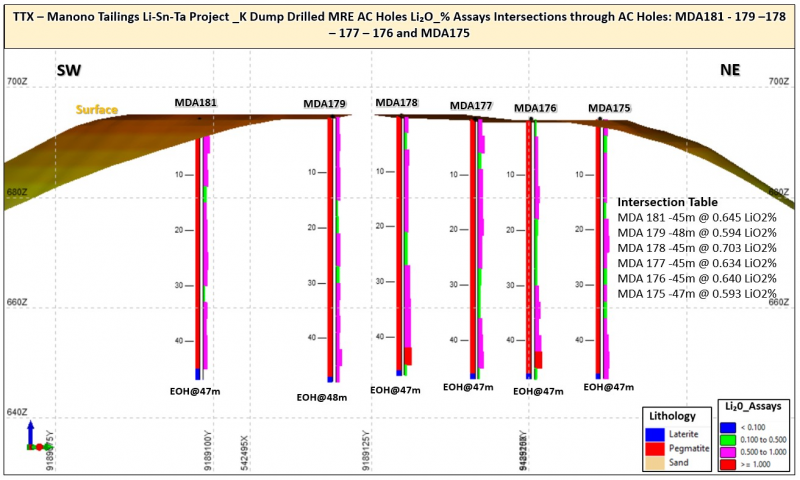

A typical section through K Dump’s course stacked dumps showing vertical and lateral lithium grade continuity

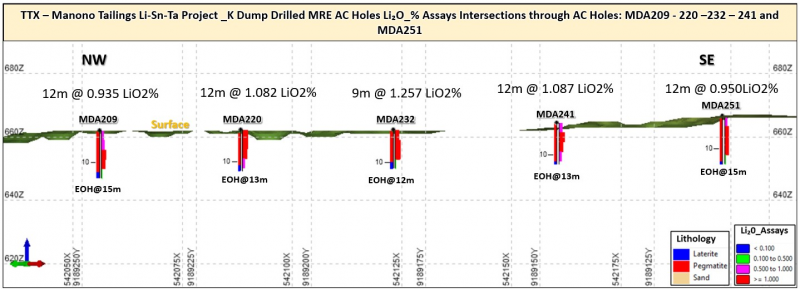

A typical 200 m section across K Dump’s domed terrace showing lateral and vertical lithium grade continuity

OTCQB listing

Tantalex’s application with the Depository Trust & Clearing Corporation has been delayed due to its corporate name change but should be resolved in the next few days.

Tantalex Lithium Resources is a mineral exploration, and development company focused on lithium, tin, tantalum and other high-tech minerals in Africa.

Tantalex (TTX) is down by 5.88 per cent, trading at $0.08 per share as of 12:29 pm EST.