Amid a “perfect storm” of contributing factors, Canada is drawing in substantial multi-billion-dollar electric vehicle (EV) battery plants, with hydrogen playing a key role.

The renewable energy shift

In recent years, the world has seen a move toward sustainable energy sources as the global community recognizes the pressing need to address climate change. Clean energy solutions have become key drivers of economic growth and environmental stewardship.

Among these solutions, hydrogen has emerged as a promising fuel alternative with immense potential.

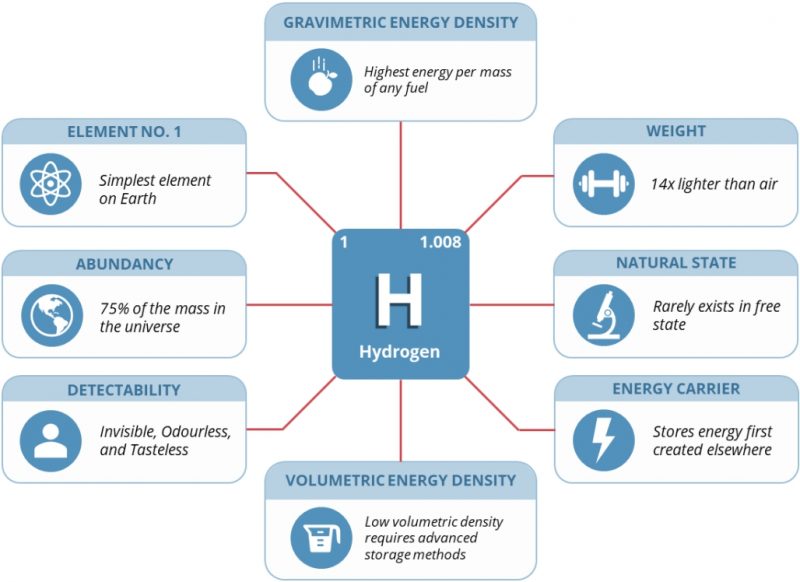

The most abundant element in the universe, hydrogen is a key component of life and matter as we know it. Found in almost all living creatures on Earth, hydrogen is essential to many natural processes. However, as a standalone chemical element, it isn’t found freely in nature because of its highly reactive nature. This reactivity means that hydrogen atoms tend to bond quickly with atoms of other elements, most commonly with oxygen to form water (H₂O). This abundance and reactivity present opportunities and challenges for hydrogen as a future fuel source.

The fuel of the future

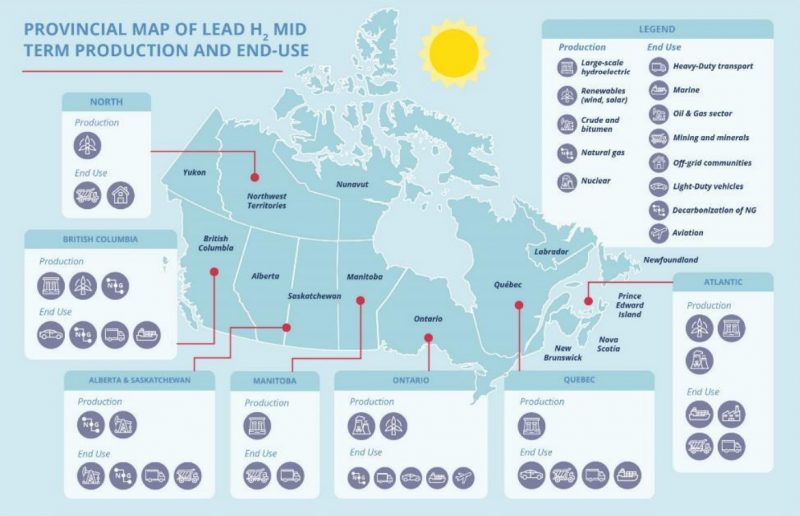

The Canadian hydrogen market is currently valued at approximately C$6 billion per year, making Canada one of the top 10 producers of hydrogen worldwide.

The primary producers of hydrogen are oil companies, capitalizing on their extensive infrastructure and resources. Hydrogen is now seen by many in the industrials and energy sectors as an essential fuel for decarbonizing the global economy, as it does not produce carbon dioxide when used as a fuel or in industrial processes.

The Canadian government has joined this global movement and its hydrogen strategy laid out a framework that focuses on low-carbon hydrogen as a tool to achieve its goal of net-zero emissions by 2050.

Hydrogen can be produced through various methods, with the most common process being “steam-methane reforming.” This method involves combining natural gas, which contains methane (a combination of four hydrogen molecules and one carbon molecule) with steam. The process breaks the hydrogen molecules off methane, resulting in what is known as “grey” hydrogen – the most affordable form of hydrogen to produce.

Hydrogen is now seen by many experts as an essential fuel to help decarbonize the global economy because it does not produce carbon dioxide when used as a fuel or in industrial processes.

Top five hydrogen stocks on the TSX

As the hydrogen industry continues to evolve, several companies listed on the TSX are emerging as key players in this sector. Below are the top five hydrogen stocks currently trading on the TSX, arranged by market capitalization:

Loop Energy

Loop Energy Inc. (market cap: C$1.39 million) is a developer and manufacturer of hydrogen fuel cell solutions designed for commercial vehicles, including transit buses and medium to heavy-duty trucks. It specializes in zero-emission transportation, electric power systems and fuel cells.

The Vancouver-based company was selected to supply fuel cell systems for a new fire truck platform by an established specialty vehicle original equipment manufacturer with a significant global presence operating in 14 countries.

Loop Energy Inc. (TSX:LPEN) was last trading at $0.04 per share.

Charbone Hydrogen

Charbone Hydrogen (market cap: C$6.67 million) develops modular and expandable hydrogen facilities. Through the acquisition of hydropower plants in the United States and Canada, Charbone will be able to produce green dihydrogen molecules using reliable and sustainable energy to distinguish itself as a provider of an environmentally friendly solution for industrial and commercial enterprises.

The company has been changing its development and deployment strategy to refocus all of its technical and financing resources from hydropower production to green hydrogen.

Charbone Hydrogen is focused on the production and distribution of green hydrogen, produced using renewable energy sources. The company is committed to developing and acquiring small-scale green hydrogen production facilities across North America.

Charbone Hydrogen Corp. (TSXV:CH) last traded at $0.06 per share.

First Hydrogen

First Hydrogen (market cap: $28.81 million) is a Vancouver- and London, England-based company focused on zero-emission vehicles, green hydrogen production and distribution and supercritical carbon dioxide extractor systems.

The hydrogen EV stock has received Rivus’ vote of approval from fleet manager Rivus for its hydrogen-fuel-cell-powered vehicle.

First Hydrogen is an energy company that focuses on zero-emission vehicles and green hydrogen production. The company is developing light commercial vehicles powered by hydrogen fuel cells and is exploring opportunities to produce and distribute green hydrogen in North America.

First Hydrogen Corp. (TSXV:FHYD) last traded at $0.41 per share.

DynaCERT

DynaCERT (market cap: C$85.36 million) manufactures and distributes carbon emission reduction technology along with its proprietary HydraLytica Telematics, a means of monitoring fuel consumption and calculating GHG emissions savings designed for the tracking of carbon credits for internal combustion engines.

DynaCERT’s HydraGEN technology uses hydrogen gas to improve fuel efficiency and reduce greenhouse gas emissions from diesel engines. The company is also exploring further applications of its technology in the broader hydrogen economy.

The company has formed a specialized team, the “DynaCERT Green Freight Program Task Force,” to assist all of its Canadian dealers and their clients that seek to realize the financial advantages of the recently launched Stream 2 of the Green Freight Program of Natural Resources Canada. The Green Freight Program provides funding assistance to qualified purchasers.

DynaCERT Inc. (TSX:DYA) last traded at $0.18 per share.

Ballard Power Systems

Ballard Power Systems (TSX:BLDP) (market cap: C$751.52 million) produces fuel cells that enable the adoption of electric vehicles. Ballard Power Systems’ zero-emission fuel cells enable the electrification of mobility, including buses, commercial trucks, trains, marine vessels and stationary power.

Ballard and Ford Trucks are developing a hydrogen-fuel-cell-powered vehicle prototype.

Ballard will supply a fuel cell system as part of the partnership, which includes its high-performance fuel cell engine, the FCmove-XD.

At the 2024 Advanced Clean Transportation Expo, Ballard unveiled the latest iteration of the FCmove-XD, now in its ninth generation.

Ballard Power is one of the most established companies in the hydrogen space, with more than four decades of experience in developing hydrogen fuel cell technology. The company’s fuel cells are used in a wide range of applications, including buses, trucks, trains and marine vessels. Ballard’s technology is a cornerstone of the growing global hydrogen economy.

Ballard Power Systems Inc. last traded at C$2.67 per share.

Invest in hydrogen stocks

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risks of investing in hydrogen stocks

While hydrogen represents a significant opportunity, investing in hydrogen stocks carries certain risks. The industry is still in its early stages, and many hydrogen companies, especially smaller ones, are not yet profitable.

Market volatility, technological advancements, and changes in government policies can significantly impact the value of hydrogen stocks. The cost of producing hydrogen, particularly green hydrogen, still remains high, which could affect the sector’s growth trajectory.

Investment corner

Hydrogen’s potential to revolutionize the energy sector and contribute to a decarbonized global economy makes it an attractive area for investment. However, as with any emerging industry, it is crucial for investors to conduct thorough due diligence.

Understanding the risks and potential rewards associated with hydrogen stocks can help investors make informed decisions and potentially capitalize on the growth of this promising sector.

Canada boasts a significant advantage in hydrogen production because of its abundance of natural gas and renewable energy resources.

Canadian hydrogen stocks in turn are well-positioned to play a pivotal role in the transition towards sustainable energy solutions.

With government support, collaborative efforts and plenty of natural resources, the country is primed to become a global leader in hydrogen production.

As the world intensifies efforts to combat climate change, investing in Canadian hydrogen stocks might prove to be a smart choice, enabling environmental stewardship and financial growth.

Join the discussion: Find out what everybody’s saying about these renewable energy stocks on energy-related Bullboards, and check out other hot topics about stocks at Stockhouse’s stock forums and message boards.

This content contains affiliate links for Interactive Brokers Group Inc., and Stockhouse receives payment for qualified leads. The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

(Top photo Ontario’s Low-Carbon Hydrogen Strategy)