- Lion One Metals (TSXV:LIO) achieved record quarterly gold sales and production in Q4 from its Tuvatu mine in Fiji

- Sales reached 4,741 ounces supported by production of 4,300 ounces for the quarter

- Lion One Metals is a Canadian gold producer operating its Tuvatu mine in Fiji

- Lion One Metals stock has given back 63.41 per cent year-over-year and 82.14 per cent since 2020

Lion One Metals (TSXV:LIO) achieved record quarterly gold sales and production in Q4 from its Tuvatu mine in Fiji.

The company recovered 4,300 ounces of gold from 29,525 tons milled during the quarter, managing to sell 4,741 ounces (as well as 841 ounces of silver) for total revenue of C$17,993,020, which is up by 72 per cent quarter-over-quarter.

Management attributes the increased revenue to higher gold prices, better gold grades and recoveries, and the addition of unsold gold from the previous quarter. The average sale price in Q4 was C$3,787 per ounce of gold.

Q4 production and operations at the Tuvatu gold mine

| Q4 CY2024 | Q3 CY2024 | ||

| Gold sold | oz | 4,741 | 3,129 |

| Silver sold | oz | 841 | 1,093 |

| Total revenue | C$ | 17,993,020 | 10,470,518 |

| Plant throughput | tpd | 321 | 341 |

| Gold grade | g/t | 5.49 | 4.59 |

| Gold recovery | % | 82.50 | 78.20 |

| Gold produced | oz | 4,300 | 3,638 |

Management has delivered quarter-over-quarter increases in gold production, recoveries and grades since plant commissioning in Q1 2024. The ongoing 300 tons-per-day (tpd) pilot plant phase will expand to 600 tpd in 2026, supported by the company’s prospective exploration license in the surrounding and richly mineralized Navilawa Caldera.

Leadership insights

“2024 was a pivotal year for Lion One Metals as we brought the Tuvatu mine in Fiji into production at the pilot-plant level,” Walter Berukoff, Lion One Metals’ chairman and chief executive officer, said in a statement. “We are delighted to have achieved consecutive increases in production every quarter throughout 2024, culminating in a record C$18 million of quarterly revenue at the end of the year. As we continue to develop the mine and unlock the higher-grade portions of the deposit, we look forward to continuing this trend of increased production at Tuvatu, and ultimately doubling our plant capacity from 300 tpd to 600 tpd in 2026.”

About Lion One Metals

Lion One Metals is a Canadian gold producer operating its Tuvatu mine in Fiji.

Lion One Metals stock (TSXV:LIO) is up by 5.26 per cent trading at C$0.30 per share as of 10:19 am ET. The stock has given back 63.41 per cent year-over-year and 82.14 per cent since 2020.

Join the discussion: Find out what everybody’s saying about this gold mining stock on the Lion One Metals Ltd. Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.

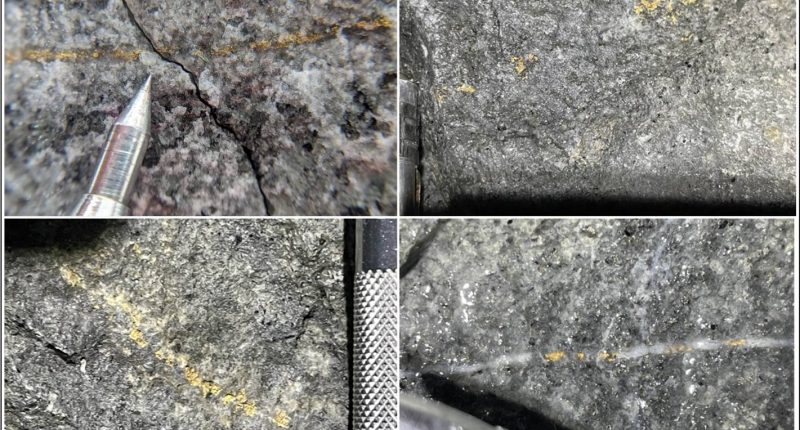

(Top photo of gold mineralization at the Tuvatu mine in Fiji: Lion One Metals)