What if a company could sidestep many of the hurdles to building a mine, and do so with a 2-million-ounce, high-grade gold resource?

That’s the possibility that Grande Portage Resources (TSXV:GPG; OTCQB:GPTRF) offers investors.

And yet, the market has yet to take sufficient notice of this company.

But with gold trading near $2,700/oz., this oversight won’t last long, making this the time to take a closer look at Grande Portage.

Every potential mine faces obstacles – you need sufficient grade, you need size.

But beyond that, you have permitting costs and risks … and the costs to construct and operate a mine. All these cost and risk hurdles have to be overcome.

So what if a mine could bypass many of these cost and operational hurdles by simply scooping out the ore, doing minimal handling and processing and shipping it off to a mill that was already constructed at someone else’s expense?

And what if this mythical mine also had millions of ounces of gold in a mine-friendly jurisdiction … and at absolute eye-popping grades?

The good news for investors is that this project exists … although it’s been almost completely overlooked by the market.

It’s called New Amalga, and it’s 100%-owned by Grande Portage Resources (TSXV:GPG; OTCQB:GPTRF).

As you’re about to see, Grande Portage has a plan for New Amalga that will allow this potential mine to skip past many of the roadblocks that typically face a mine on its path to profitable production.

In doing so, it is offering the market a high-grade mine in a great jurisdiction (southeast Alaska) and, at current trading levels, it’s doing so at a bargain price.

Two Million Ounces Of High-Grade Gold

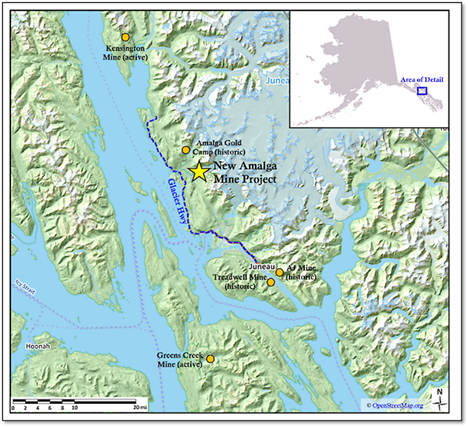

Formerly known as Herbert, Grande Portage’s New Amalga project lies just north of Juneau, Alaska.

It’s in a district that is one of the state’s most promising for gold, yet it’s been almost completely underexplored until recently.

Grande Portage has put out four resource estimates on New Amalga over the years it has operated it, and its high-grade, vein-hosted resources have grown with each new report.

The most recent estimate came out earlier this year, and it showed the project to host nearly two million ounces of gold and remarkably high grades (1.44 million ounces of indicated gold at 9.47 g/t and 515,700 ounces of inferred gold at 8.85 g/t).

Those are grades any gold explorer would love to have, and they’ve allowed Grande Portage to look at taking a direct shipping ore approach to the mine.

Skipping Some Of The Hard Stuff

The company is serious about the “direct shipping ore option” – something that only the highest-grade projects can even consider.

To explore that potential for New Amalga, Grande Portage has just produced a conceptual mining plan that takes that approach. It envisions selective underground mining at New Amalga that would selectively extract high-grade material with minimal dilution.

High gold grades aren’t the only reason this option is being considered – the project also sits near tidewater and less than four miles from a paved highway.

The New Amalga Mine Project lies just north of Juneau, Alaska, near tidewater and a paved highway.

The ore grades are high enough that the company is assessing strategic partnerships to process the material from New Amalga off-site, with the potential use of third-party facilities around the Pacific Rim or direct shipment to smelters in East Asia.

Taking this approach would eliminate the need to build a tailings facility on site and for permanent waste-rock storage facilities. It would also dramatically reduce land usage and would bypass the need for gold processing reagents on site.

Not only would it simplify post-mining closure and reclamation, but it would minimize project capex and de-risk the environmental review and permitting process.

Plus: Even More High-Grade Gold At Depth?

Adding to the good news of Grande Portage’s plan for New Amalga is the likelihood that underground development for the mine will allow the company to explore for even more high-grade gold at depth.

The veins that host the mineralization on the project are mesothermal veins, and these systems have a reputation for pinching and swelling … and going deep.

A good example is the Red Lake Mine in Ontario, which yielded some of its highest-grade ore at depth and has returned high-grade gold down to 2,100 metres.

Drilling for gold at New Amalga has reached a point where it is too expensive to test for its steep-dipping mineralization from surface.

But once the underground infrastructure has been built on the project, Grande Portage will be able to more efficiently and inexpensively probe for much more high-grade gold at depth.

Time To Act

This fast-track to production, with a minimal environmental footprint, is very much in front of Grande Portage Resources.

As the company moves the vetting process for its plans forward with strategic investors, the possibility of a company takeout, at significantly higher prices, is a distinct possibility.

To beat the market to the punch on this prospect, the time to thoroughly investigate Grande Portage is now.

This is third-party content provided by Grande Portage Resources Ltd. Please see full disclaimer here.

Join the discussion: Find out what everybody’s saying about this company on the Grande Portage Resources Ltd. Bullboard investor discussion forum, and check out the rest of Stockhouse’s stock forums and message boards.

(Top photo: Grande Portage Resources)