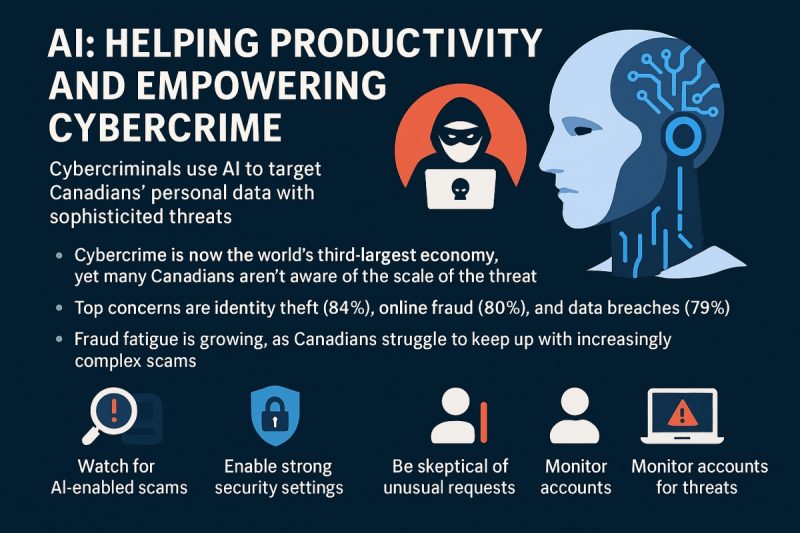

- AI boosts productivity but also empowers cybercriminals, who use it to launch more sophisticated and personalized attacks on Canadians’ personal data

- Cybercrime is now the world’s third-largest economy, yet many Canadians remain unaware of the scale of the threat, with rising concerns about identity theft, online fraud, and data breaches

- Fraud fatigue is growing according to Royal Bank of Canada (TSX:RY), as Canadians struggle to keep up with increasingly complex scams—highlighting the need for stronger digital habits and vigilance online

- Royal Bank of Canada stock (TSX:RY) last traded at C$205.04

Artificial Intelligence has rapidly become a cornerstone of modern productivity, helping Canadians streamline tasks, automate workflows, and make smarter decisions in both personal and professional settings.

But as AI tools grow more powerful, so too do the threats they pose when weaponized by cybercriminals.

According to the World Economic Forum, cybercrime has ballooned into the third-largest economy globally—surpassing even the illicit drug trade. In Canada, the average citizen may not yet grasp the full scale or sophistication of the risks they face, especially as AI-driven scams become harder to detect and easier to deploy.

Canadians on high alert

Recent polling by Royal Bank of Canada (TSX:RY) reveals a nation deeply concerned about digital safety:

- 84 per cent of Canadians worry about identity theft.

- 80 per cent are concerned about online fraud.

- 79 per cent fear corporate data breaches.

“Generative AI is transforming cybercrime, enabling fraudsters to automate scams, create deepfakes, and exploit the digital footprints Canadians leave behind every day,” Adam Evans, chief information security officer at RBC said in a media release. “Managing your digital persona is now a crucial part of protecting your most valuable asset: your data.”

This content has been prepared as part of a partnership with Royal Bank of Canada and is intended for informational purposes only.

These concerns are not unfounded. A staggering 98 per cent of respondents say they’ve noticed an increase in targeted and sophisticated scams. Nearly 89 per cent report more scam attempts than in previous years, and 86 per cent believe it’s becoming harder to recognize fraudulent activity. This constant vigilance is taking a toll—65 per cent feel fatigued by the need to stay alert, and 33 per cent admit to occasionally letting their guard down.

The rise of “fraud fatigue”

This phenomenon, dubbed fraud fatigue, reflects a growing vulnerability among Canadians. As cybercriminals use generative AI to harvest and enrich data—known as data exhaust—they can launch highly personalized attacks at scale. These attacks often mimic legitimate communications, making it increasingly difficult to distinguish real from fake.

From deepfake video calls to AI-generated phishing emails, the line between reality and deception is blurring.

Are Canadians doing enough?

While many Canadians are taking steps to protect themselves, consistency remains a challenge:

- 92 per cent update software and operating systems at least occasionally, but only 70 per cent do so regularly.

- 88 per cent enable privacy and security settings, yet just 65 per cent report doing this consistently.

This gap in protective behaviours leaves room for exploitation, especially as AI tools become more adept at bypassing traditional security measures.

Staying safe in the age of AI

Experts recommend several practical steps to help Canadians safeguard their digital lives:

- Watch for AI-enabled scams: Be alert to inconsistencies in tone or unusual movements in video calls that may indicate deepfakes.

- Use strong, unique passwords and enable privacy settings across all devices.

- Stay skeptical of unexpected requests for personal information or money.

- Monitor accounts for unusual activity and report suspicious behaviour promptly.

As AI continues to evolve, so too must our awareness and defences. The digital landscape is changing fast—and Canadians must stay informed, vigilant, and proactive to protect what matters most.

Royal Bank of Canada is one of the largest banks in the world, based on market capitalization, and has a diversified business model. Its segments include personal and commercial banking, wealth management, insurance and capital markets.

Royal Bank of Canada stock (TSX:RY) last traded at C$205.04 and has risen 18.30 per cent since the year began.

Join the discussion: Find out what the Bullboards are saying about Royal Bank of Canada and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.