Canada is entering a pivotal decade for critical‑minerals exploration as global markets accelerate toward electrification, low‑carbon technologies, and supply‑chain security.

Across the country, new exploration corridors are emerging alongside renewed investment in long‑standing mining districts, attracting both private‑sector capital and government support.

From the iron‑rich expanse of the Labrador Trough to the rapidly advancing Ring of Fire in northern Ontario, the nation hosts some of the world’s most important deposits of nickel, copper, iron ore, PGEs, and chromite.

With infrastructure commitments strengthening, major operators consolidating key projects, and a growing emphasis on domestic battery‑materials production, early‑stage explorers positioned in these districts are gaining increased attention from investors seeking the next wave of discovery‑driven growth.

MetalQuest Mining Inc. (TSXV:MQM) is an exploration‑stage company focused on the acquisition, exploration, and development of mineral properties across Canada. Its commodity exposure spans iron, zinc, lead, copper, silver, and gold—an increasingly important mix as global markets tighten around critical‑mineral supply chains.

This article is disseminated in partnership with MetalQuest Mining Inc. It is intended to inform investors and should not be taken as a recommendation or financial advice.

While MetalQuest has long been associated with its significant position in Québec’s Labrador Trough, including its 100 per cent-owned Lac Otelnuk Iron Project, the company is now accelerating its footprint into one of Canada’s most promising future mining hubs: Ontario’s Ring of Fire.

This emerging district, rich in nickel, copper, PGEs, and chromite, has become a focal point of provincial economic strategy and private‑sector investment. MetalQuest’s recent acquisition of the ROF‑1 Project places the company directly within this rich landscape, making a strong case for investor due diligence at this early stage of development.

The Ring of Fire: Canada’s most anticipated critical‑minerals district

The Ring of Fire—located within the James Bay Lowlands of northern Ontario—is one of North America’s most compelling and underdeveloped mineral districts. Spanning more than 5,000 km², it hosts world‑class nickel, copper, PGE, chromite, titanium‑vanadium, and VMS systems within a highly prospective Archean intrusive and volcanic complex. Since its discovery in the mid‑2000s, over $750 million in exploration and development spending has gone into the region from operators such as Noront Resources, Cleveland‑Cliffs, KWG Resources, Bold Ventures, and now Wyloo Metals. Hundreds of drill holes, multiple airborne and ground geophysics campaigns, metallurgical studies, and engineering programs have created one of the most robust technical databases of any greenfield district in Canada.

Government momentum is accelerating

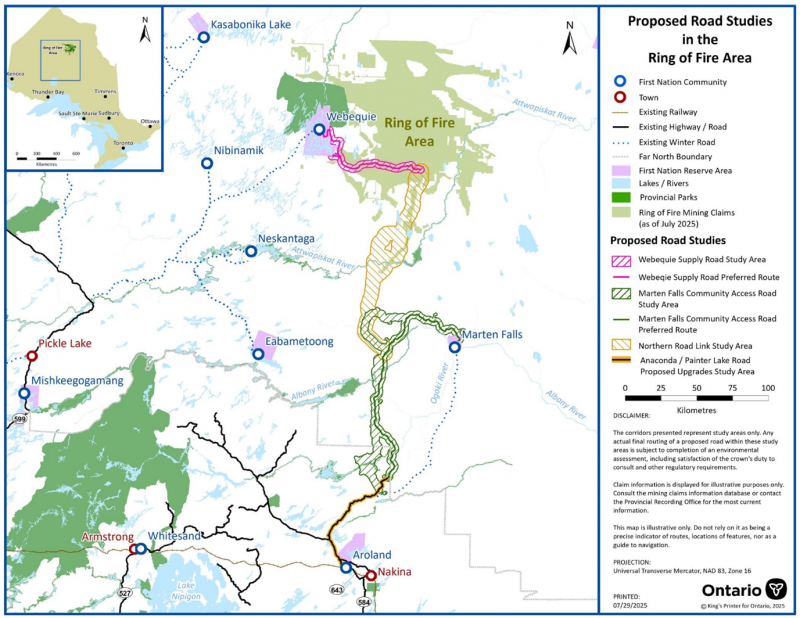

Ontario’s government is now advancing a multi‑road access corridor—including the Northern Road Link, Marten Falls Access Road, and Webequie Supply Road—with agreements recently signed with the Marten Falls and Webequie First Nations. These multi‑use corridors are designed to connect the district to provincial road networks and downstream processing centres.

Ontario’s Premier has publicly stated his intent to begin road construction as early as August 2026, a major signal that the region is entering a development phase rather than remaining a long‑term aspiration.

Wyloo Metals: The anchor setting the pace

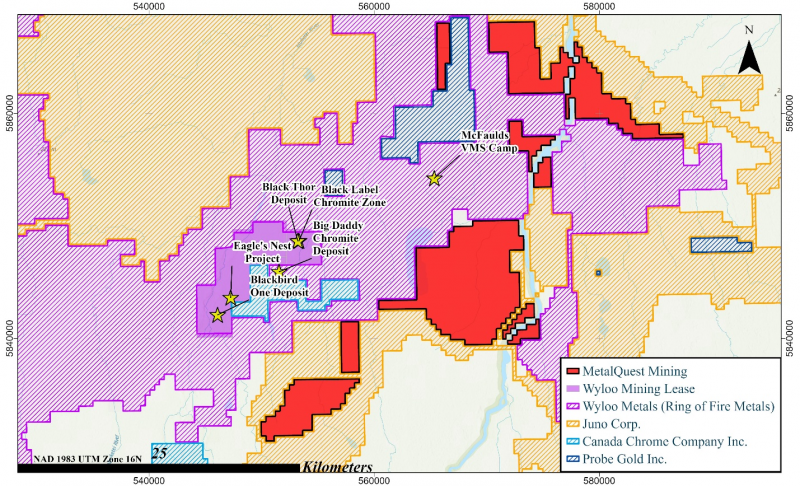

Wyloo Metals—an Australian critical‑minerals producer—is now widely viewed as the district’s anchor operator. Its portfolio includes:

- Eagle’s Nest, one of Canada’s highest‑grade undeveloped nickel–copper–PGE deposits

- The Black Thor–Black Label–Big Daddy chromite belt, home to some of North America’s largest chromite resources

- A planned battery materials processing facility in Sudbury

Wyloo’s consolidation and significant capital commitment have re‑energized interest in the district, helping define a clear development trajectory.

The ROF‑1 Project: An entrance into a high‑grade district

In December 2025, MetalQuest announced the acquisition of the ROF‑1 Project, a district‑scale land package totalling 1,034 claim cells (208 km²) in the Ring of Fire. This move represents the first step in MetalQuest’s broader Ring of Fire strategy.

Proximity to major deposits

ROF‑1 is located approximately:

- 10 km from Wyloo’s Eagle’s Nest nickel‑copper‑PGE deposit

- Near the Black Thor chromite deposit

- Adjacent to the McFaulds VMS trend

This proximity places MetalQuest directly within the most prospective corridor in the Ring of Fire—an area where multiple advanced deposits are clustered and where infrastructure plans provide future access.

While the presence of mineralization on nearby properties does not guarantee mineralization on MetalQuest’s claims, the geological trends—structural corridors, EM/IP conductors, intrusive contacts, and magnetic highs—align with known systems hosting nickel‑copper‑PGEs, chromite, VMS, and gold mineralization.

A strong technical foundation

MetalQuest’s geological team is integrating extensive historical exploration data from prior operators, including geophysics, drill logs, engineering studies, and metallurgical reports. This provides a validated technical starting point for renewed exploration once field programs commence.

Lac Otelnuk: One of North America’s largest untapped iron assets

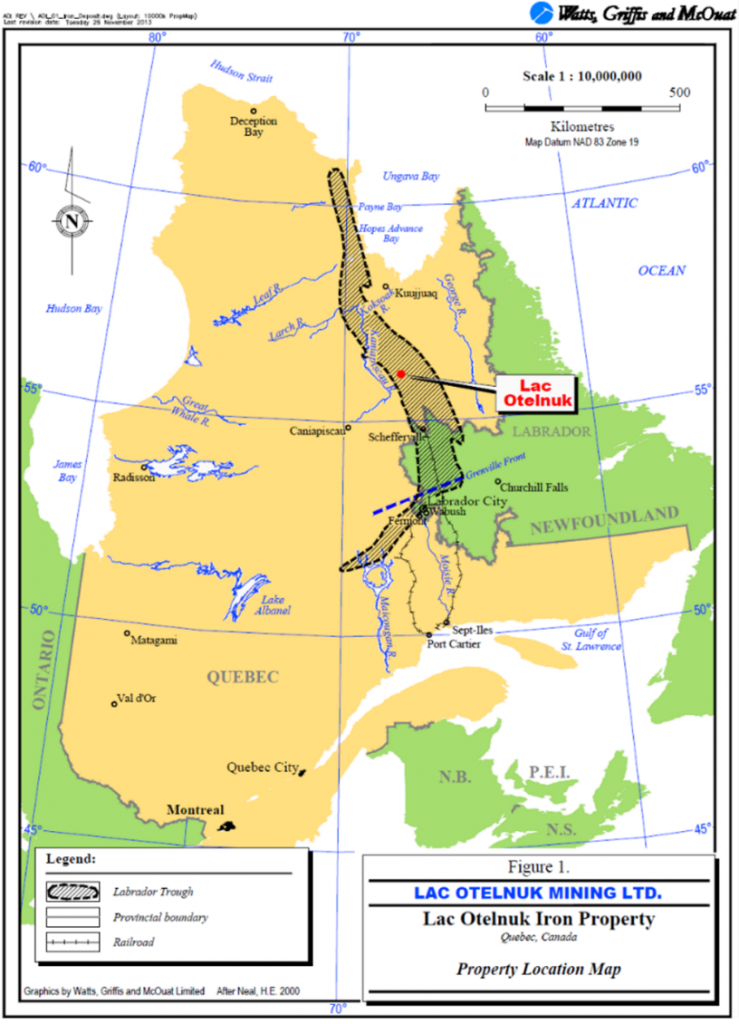

While the Ring of Fire is the company’s most recent catalyst, the Lac Otelnuk Iron Project remains one of MetalQuest’s most significant assets. Located in the Labrador Trough—a globally recognized iron ore district—Lac Otelnuk is surrounded by major operators including Rio Tinto, Champion Iron, Tata Steel, Arcelor Mittal, and Oceanic Iron Ore.

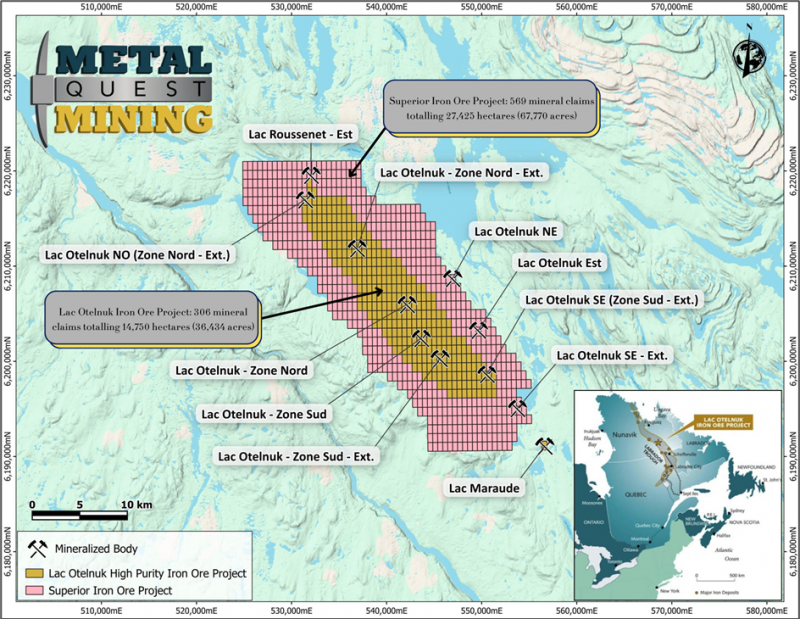

MetalQuest Mining holds:

- 100 per cent interest

- 306 mineral claims

- Coverage of the historic resource area, including 75 core claims at its centre

The Labrador Trough has long been Canada’s premier iron ore district, benefiting from large‑scale infrastructure, deepwater shipping access, and a history of production by global majors. Iron ore remains a critical component of steelmaking, and high-purity resources like those in the Trough continue to command attention.

Expansion continues: The Superior Iron Project

In November, MetalQuest further expanded its Labrador Trough footprint by staking a 100 per cent interest in the Superior Iron Project, comprising:

- 569 additional mineral claims

- 274.25 km² of land

- Located 165 km northwest of Schefferville, Québec

This acquisition brings MetalQuest’s total land position to:

- 875 claims

- 421 km²

This makes MetalQuest Mining one of the largest landholders in this region of the Northern Québec Labrador Trough, and the Superior Iron Project runs parallel to the company’s flagship Lac Otelnuk asset.

The scale of this consolidated land package—rare for a junior company—gives MetalQuest a significant position among both mid-tier operators and major global iron producers.

A company positioned for growth

MetalQuest Mining is transitioning into a multi‑asset, district‑scale explorer with exposure to two of Canada’s most important mining jurisdictions:

1. The Ring of Fire

A rapidly advancing critical‑minerals district aligned with EV, battery, and stainless‑steel supply chains.

2. The Labrador Trough

One of the world’s most established iron ore belts, anchored by major global producers.

The company’s timing appears well‑aligned with:

- Significant government infrastructure momentum

- Increased investment from private‑sector operators

- Growing global demand for both high‑purity iron ore and critical minerals

And the market has noticed.

A final note for investors: The stock is surging

MetalQuest Mining’s share price has risen more than 500 per cent since January 2025, reflecting rising investor interest as the company executes its extensive expansion.

However, despite the recent performance, the company’s entry into the Ring of Fire, combined with its dominant land position in the Labrador Trough, suggests that MetalQuest’s growth story may still be in its early chapters.

Conclusion: A strong case for deeper due diligence

With a rapidly expanding land position, proximity to world‑class deposits, and entry into Canada’s most important critical‑minerals corridor, MetalQuest Mining has emerged as a junior explorer worth watching closely.

For investors seeking early exposure to district‑scale exploration, structural catalysts, and assets positioned for future infrastructure build‑out, MetalQuest Mining offers a compelling case for deeper due diligence in 2026.

Join the discussion: Find out what the Bullboards are saying about MetalQuest Mining and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.