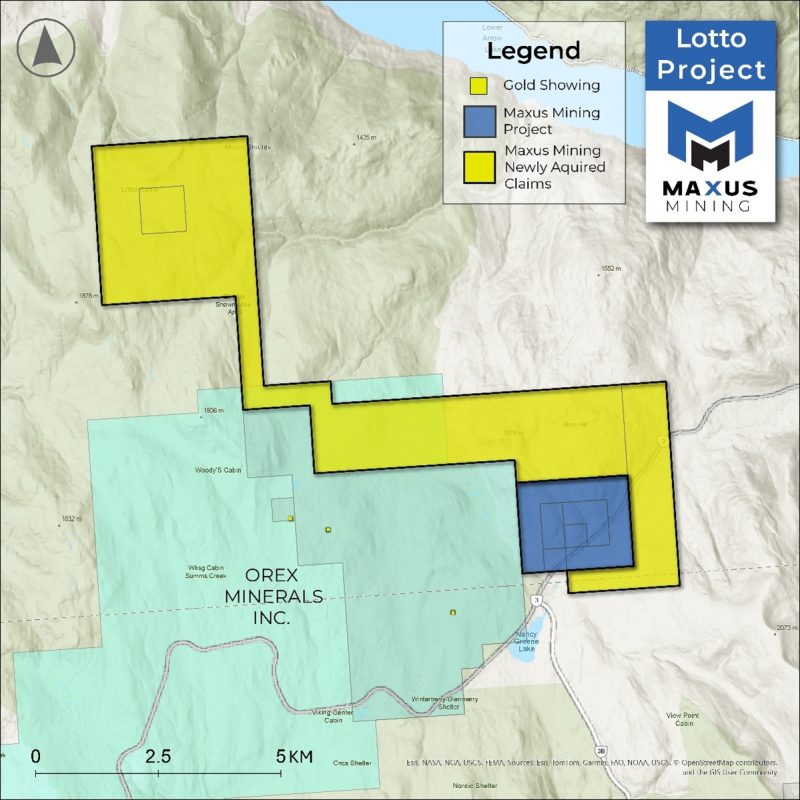

- Maxus Mining (CSE:MAXM) increased the size of its Lotto tungsten project in British Columbia by 600 per cent, reinforcing its conviction in the province’s mineral-rich Kootenay region and Trail Creek mining division

- Maxus Mining is a junior miner focused on acquiring and developing economical properties in established jurisdictions

- The breakout tungsten stock has added 111.36 per cent since listing in May 2025

Maxus Mining (CSE:MAXM) increased the size of its Lotto tungsten project in British Columbia by 600 per cent, reinforcing its conviction in the province’s mineral-rich Kootenay region and Trail Creek mining division.

This content has been prepared as part of a partnership with Maxus Mining Inc., and is intended for informational purposes only.

The 2,633-hectare addition positions the company to add to its more than 110 per cent return since listing in May 2025 through upcoming phase-I exploration, with historical data compilation underway.

Lotto’s historic Lotto 3 showing consists of scheelite (Ca(WO4)) within a 9-metre-wide quartz vein, with numerous others veins to the west and northwest highlighted by a 1980 grab sample of 10.97 per cent tungsten trioxide (WO3).

According to Tuesday’s news release, leadership “believes the stratigraphy and geological setting present on the project provides a prospective environment for potentially economic tungsten mineralization.”

Should phase-I exploration generate positive results, they would coincide with a moment of heightened tungsten demand driven by the metal’s limited supply, critical applications in armor, ammunition, missiles, aircraft, batteries and semiconductors, and China’s restrictions on its more than 80-per-cent control of the global market.

Leadership insights

“We are thrilled to announce the acquisition of additional claims through low-cost staking at the project, effectively increasing the project size by 600 per cent,” Scott Walters, Maxus Mining’s chief executive officer, said in a statement. “The property now spans over 14 kilometres of stratigraphy favorable for tungsten mineralization. Our team is currently compiling all available historical data over the project area and we look forward to kickstarting exploration on this significantly expanded property.”

About Maxus Mining

Maxus Mining is a junior miner focused on acquiring and developing economical properties in established jurisdictions. The company’s portfolio includes:

- The 3,054-hectare Lotto tungsten project.

- 8,178 hectares across three antimony projects, including:

- The Quarry project in British Columbia, yielding a historical sample of 0.89 grams per ton (g/t) gold, 3.8 per cent copper, 0.34 per cent zinc, 42.5 per cent lead and 0.65 g/t silver and 20 per cent antimony.

- The Altura project on strike from Equinox Resources recent antimony discovery assaying up to 69.98 per cent.

- The Hurley project neighboring Endurance Gold’s Reliance project, where 2024 drilling delivered 19.2 per cent antimony and 2.16 g/t gold over 0.5 metres.

- The 3,123-hectare Penny copper project, which boasts a more than 100-year exploration history and resides near the major past-producing Sullivan mine in Kimberley, British Columbia, in an area with increasing junior and major mining activity. Grab samples from 2017 were highlighted by values up to 2,388 parts per million copper.

The breakout tungsten stock (CSE:MAXM) is unchanged trading at C$0.93 as of 11:59 am ET and has added 111.36 per cent since listing in May 2025.

Join the discussion: Find out what investors are saying about this breakout copper, tungsten and antimony stock on the Maxus Mining Inc. Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.