As global demand for critical minerals intensifies and tungsten prices hit record highs, a Canadian exploration company in Europe is making waves with one of the most significant tungsten discoveries in recent memory.

With a fully funded drill program uncovering high-grade intercepts and expanding the footprint of a historically productive deposit, this emerging player is positioning itself as a cornerstone supplier in the West’s push for resource independence. The timing couldn’t be better — tungsten has surged and the market is hungry for secure, scalable sources. What’s unfolding in northern Portugal could reshape the tungsten supply landscape.

This article is disseminated in partnership with Allied Critical Metals Inc. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Unlocking a signifcant tungsten supply in Europe

Allied Critical Metals Inc. (CSE:ACM), a Canadian-listed exploration and development company, is rapidly emerging as a key player in the global tungsten market. With 100 per cent ownership of the past-producing Borralha and Vila Verde tungsten projects in northern Portugal, Allied is well positioned to deliver secure, high-grade tungsten supply to Western markets amid tightening global supply chains.

Borralha Tungsten Project: A significant asset in the EU

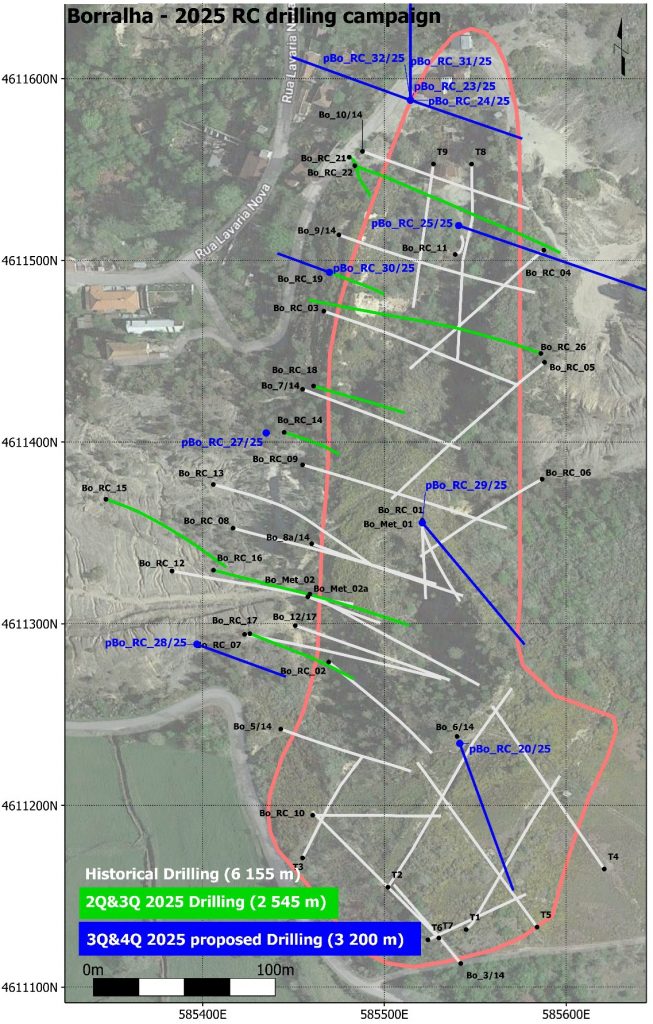

The Company recently announced that it has tacked another 1,528 metres of drilling on its original 4,200-metre Reverse Circulation (RC) drilling campaign, which launched in June 2025 on its flagship Borralha Project. As of late July, over 2,500 metres across nine drill holes had been completed, with operations resuming in September following seasonal fire safety restrictions. The campaign is designed to support:

- An updated Mineral Resource Estimate (MRE) in Q4 2025

- Advanced metallurgical testing to validate concentrate grades at 65 per cent WO₃

- A Preliminary Economic Assessment (PEA) for a large-scale processing facility

Breakthrough drill results: Scale and grade combine

The standout result from drill hole Bo_RC_14/25—12.0 metres at 4.27 per cent WO₃, including 6.0 metres at 8.39 per cent WO₃—marks one of the highest-grade tungsten intercepts ever reported in Western exploration. This breakthrough has catalyzed further drilling and technical assessments.

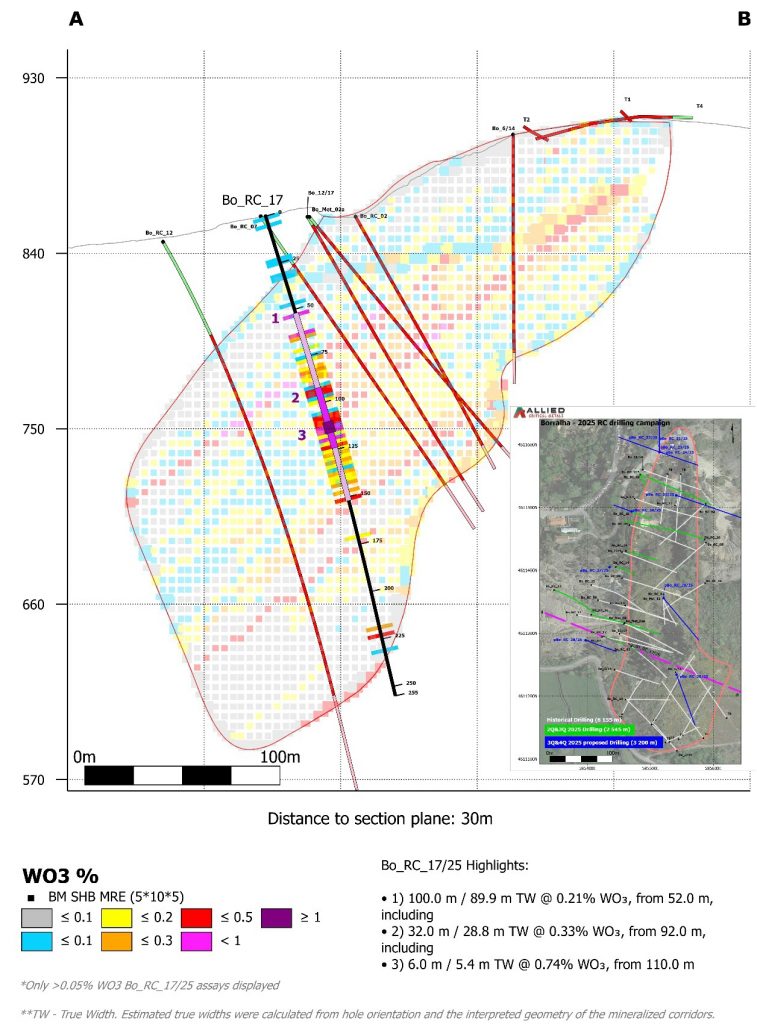

Subsequent holes have reinforced the scale and continuity of the mineralized system:

- Bo_RC_17/25: 100.0 metres at 0.21 per cent WO₃, including 32.0 metres at 0.33 per cent WO₃, and 6.0 metres at 0.74 per cent WO₃

- Bo_RC_15/25: 2.0 metres at 0.97 per cent WO₃

- Bo_RC_22/25: 64.0 metres at 0.12 per cent WO₃, including 16.0 metres at 0.21 per cent WO₃

These results confirm the Santa Helena Breccia as a larger and higher-grade orebody than previously modeled, with mineralization expanding both west and north.

Leadership insights

“Tungsten is recognized by the European Union as both a critical and strategic raw material under the CRMA. With Europe producing less than 3 per cent of its annual needs and facing increasing Chinese export restrictions, the Borralha Project represents a vital opportunity to strengthen secure, Western-aligned supply chains,” Allied’s president and COO, João Barros explained in a media statement. “Our work directly supports the EU target of sourcing at least 10 per cent of its critical raw materials domestically by 2030, while reinforcing Portugal’s role as a key contributor to Europe’s strategic independence.”

“Expanding the mineral resource at the Borralha Project is an essential next step in path to fulfilling the immense need in Portugal, the EU, NATO and the United States for tungsten powders, concentrates and other byproducts,” General (Ret.) James A. “Spider” Marks, one of the directors of the company’s U.S. subsidiary, added. “The U.S. and NATO defense military complexes are dependent on tungsten. Without domestic supply of tungsten, the Borralha Project becomes a very important piece to the critical mineral supply chains for the United States and NATO.”

Strategic timing: Tungsten prices surge

The timing of Allied’s technical success aligns with a sharp rise in tungsten prices, now at $645 USD/MTU, up approximately 45 per cent over the past four months. This surge is driven by increasing demand and export restrictions from China, which currently dominates global tungsten supply.

Geopolitical relevance and supply chain security

Tungsten is classified as a critical and strategic raw material by the European Union and the U.S. Department of Defense. Its irreplaceable properties—extreme hardness and the highest melting point of any metal—make it essential for defense, aerospace, and electronics.

With Europe producing less than 3 per cent of its annual tungsten needs, Allied’s Borralha Project is poised to play a pivotal role in Western-aligned supply chains. The company’s alignment with NATO and EU specific goals is reinforced by its membership in the Critical Minerals Forum, and its support of the EU’s Critical Raw Materials Act (CRMA), which targets 10 per cent domestic sourcing by 2030.

Next steps and investor outlook

Allied will commence an additional 1,528 metres of fully funded drilling in Q4 2025 to build on recent successes. The updated MRE is expected in Q4 2025 and the PEA is anticipated to be released shortly thereafter, providing a clearer picture of the project’s economic potential.

With a strong technical team, favorable jurisdiction, and growing geopolitical importance, Allied Critical Metals is well-positioned to become a cornerstone supplier of tungsten to Western markets.

“As we advance toward the Mineral Resource update and Preliminary Economic Assessment, these results strengthen our confidence in Borralha’s potential to become a cornerstone of Western countries’ strategic raw material supply,” Allied’s CEO Roy Bonnell said in a news release on the results.

Conclusion: A solid opportunity for investors

Allied Critical Metals Inc. offers investors a compelling opportunity to participate in the development of one of Europe’s most promising critical mineral assets. The combination of high-grade results, expanding resource footprint, and rising tungsten prices creates a powerful investment thesis.

Investors are encouraged to conduct further due diligence into Allied’s technical reports, smart partnerships, and upcoming milestones. As the global race for secure critical minerals intensifies, Allied stands out as a company with both vision and execution.

Join the discussion: Find out what the Bullboards are saying about Allied Critical Metals and check out Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.