- Deglobalization is reshaping global commerce, driving a shift toward localized production, reshoring, and supply chain resilience due to geopolitical tensions and pandemic-era disruptions

- Investors can benefit from sectors like manufacturing, logistics, and energy, especially those aligned with domestic infrastructure, automation, and regional trade hubs

- Key investment themes include reshoring incentives, industrial real estate growth, and emerging “connector countries” like Mexico and Vietnam that support regional supply chains

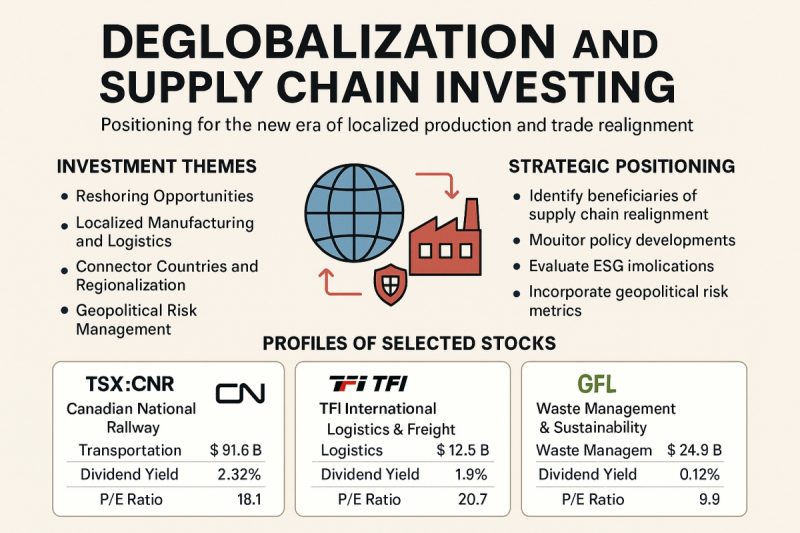

- TSX stocks such as Canadian National Railway (TSX:CNR), TFI International (TSX:TFII), and GFL Environmental (TSX:GFL) are in a position to capitalize on trade realignment and supply chain localization

The global economy is undergoing a serious transformation

The era of seamless globalization is giving way to a more fragmented, localized, and strategically aligned world of commerce. This shift—commonly referred to as deglobalization—is reshaping supply chains, trade relationships, and investment opportunities. For investors, this rewiring of global commerce presents both risks and lucrative openings in sectors like manufacturing, logistics, energy, and industrial real estate.

This article is a journalistic opinion piece which has been written based on independent research. It is intended to inform investors and should not be taken as a recommendation or financial advice.

Why deglobalization matters to investors

Deglobalization is not merely a political or economic buzzword—it’s a structural shift driven by:

- Geopolitical tensions (e.g., U.S.-China trade disputes, Russia-Ukraine war)

- Supply chain vulnerabilities exposed by COVID-19

- National security concerns around critical technologies

- Consumer preferences for locally sourced goods

These forces are prompting companies and governments to prioritize supply chain resilience over cost efficiency, leading to trends like reshoring, nearshoring, and friendshoring.

Investment themes emerging from deglobalization

1. Reshoring opportunities

Reshoring—the return of manufacturing and supply operations to domestic markets—is gaining momentum, especially in the U.S. and Europe. Public policy is a major catalyst:

- The CHIPS Act and Inflation Reduction Act in the U.S. allocate over US$100 billion to domestic semiconductor and clean energy production

- The European Chips Act and Economic Security Strategy aim to reduce EU dependence on foreign suppliers

Investor Takeaway: Look for companies in semiconductors, renewable energy, industrial automation, and transportation infrastructure that are expanding domestic operations.

2. Localized manufacturing and logistics

As companies shift production closer to end markets, demand for industrial real estate, freight services, and automation technologies is surging. This includes:

- REITs focused on logistics hubs and data centres

- Trucking and rail companies benefiting from increased domestic freight volumes

- Automation firms enabling cost-effective reshoring

Investor Takeaway: Consider ETFs or stocks tied to logistics infrastructure and smart manufacturing.

3. Connector countries and regionalization

Emerging markets like Mexico, Vietnam, Poland, and Morocco are becoming key nodes in restructured supply chains. These “connector countries” offer:

- Strategic geographic proximity

- Competitive labour costs

- Trade agreements with major economies

Investor Takeaway: Explore opportunities in regional manufacturing, automotive parts, electronics, and textiles in these countries.

4. Geopolitical risk management

Geopolitical risk is now a central factor in portfolio construction. High-risk periods correlate with:

- Lower equity returns

- Higher volatility

- Sectoral divergence (e.g., energy and defense outperform, consumer services underperform)

Investor Takeaway: Diversify across sectors with varying exposure to geopolitical risk. Consider defensive sectors like healthcare and utilities, and hedging strategies using commodities like gold.

Smart positioning for investors

To capitalize on the deglobalization trend, investors can:

- Identify beneficiaries of supply chain realignment using tools like MSCI’s Economic Exposure data

- Monitor policy developments that incentivize domestic production

- Evaluate ESG implications, as localized supply chains often reduce carbon footprints

- Incorporate geopolitical risk metrics into asset allocation models

Stocks to watch

Canadian National Railway (TSX:CNR)

Sector: Transportation

Market cap: C$79.5billion

Dividend yield: 2.32 per cent

P/E ratio: 18.1

Why it stands out: Canadian National Railway (CN Rail) operates the largest rail network in Canada, connecting key industrial hubs across North America. As supply chains localize and cross-border trade intensifies under agreements like USMCA, CN Rail is a backbone of freight movement—from grain and oil to consumer goods.

Investment highlights:

- Near-monopoly in Canadian rail transport

- Strong pricing power and operational efficiency

- ESG initiatives including fuel efficiency and emissions reduction

- Consistent dividend growth (9.5% CAGR over 5 years)

Risks:

- Sensitive to economic cycles and fuel costs

- Regulatory and labour challenges

Sector: Logistics and freight

Market cap: C$9.5 billion

Dividend yield: 1.9 per cent

P/E ratio: 20.7

Why it stands out: TFI International is one of North America’s largest trucking and logistics firms, with operations spanning Canada, the U.S., and Mexico. It’s a direct beneficiary of reshoring and e-commerce growth, offering diversified services from parcel delivery to warehouse logistics.

Investment highlights:

- Strong acquisition strategy and U.S. market expansion

- High dividend growth (17.3 per cent CAGR over 5 years)

- Positioned for last-mile delivery and supply chain optimization

- Benefiting from automation and smart logistics investments

Risks:

- Regulatory changes in emissions and trucking laws

- Economic downturns affecting freight volumes

Sector: Waste management and sustainability

Market cap: C$18.4 billion

Dividend yield: 0.12 per cent

P/E ratio: 9.9

Why it stands out: GFL Environmental is a fast-growing waste management company with a strong presence in Canada and the U.S. Its focus on sustainability, including waste-to-energy and organic processing, aligns with ESG investing and government regulations favoring green infrastructure.

Investment highlights:

- High recurring revenue from municipal contracts

- Aggressive expansion via acquisitions

- ESG-aligned business model with regulatory tailwinds

- Long-term visibility in revenue and cash flow

Risks:

- High debt from acquisition-driven growth

- Rising operational costs (fuel, disposal)

- Competitive industry landscape

We got the whole word in our hands

Deglobalization is not a retreat from international trade but a recalibration toward resilience, security, and strategic alignment. For investors, this shift unlocks new avenues in supply chain investing, reshoring opportunities, and geopolitical risk management. By understanding the sectors and regions poised to benefit, investors can position themselves at the forefront of this global transformation.

Join the discussion: Find out what the Bullboards are saying about these stocks on Stockhouse’s stock forums and message boards.

Stockhouse does not provide investment advice or recommendations. All investment decisions should be made based on your own research and consultation with a registered investment professional. The issuer is solely responsible for the accuracy of the information contained herein. For full disclaimer information, please click here.