- New Found Gold (TSXV:NFG) will undertake a C$49 million bought-deal offering and a C$20 million non-brokered private placement

- Prominent mining investor Eric Sprott will participate in both financings, increasing his investment into a controlling over 20-per-cent stake

- New Found Gold is a top gold explorer and project developer in Newfoundland and Labrador, a tier-one mining jurisdiction

- New Found Gold stock has given back 59.2 per cent year-over-year but remains up by 32.47 per cent since 2020

New Found Gold (TSXV:NFG) will undertake a C$49 million bought-deal offering and a C$20 million non-brokered private placement, including lead orders by prominent mining investor Eric Sprott.

The bought-deal offering, with BMO Capital Markets, SCP Resource Finance and a syndicate of undewriters, involves 21.4 million charity flow-through shares priced at C$2.29. Closing is expected in tranches on June 3 and June 12, 2025.

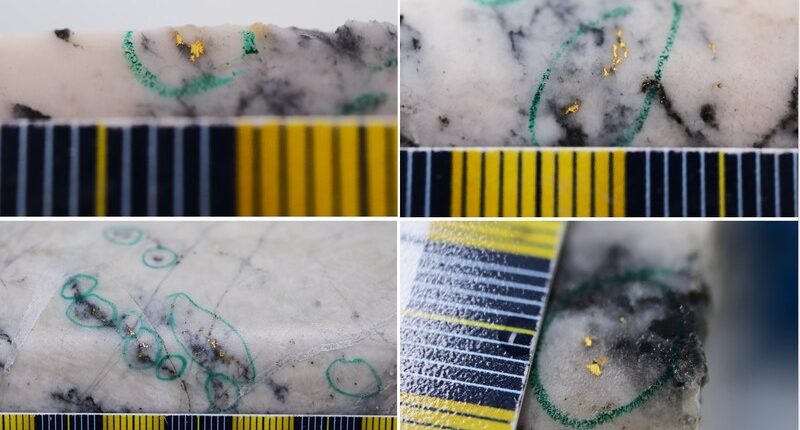

Proceeds will go towards flow-through mining expenditures by December 31, 2026, on the company’s Queensway gold project in Newfoundland and Labrador. Queensway offers exposure to an initial resource estimate of 2 million ounces indicated plus inferred, robust expansion potential across the 1,756-square-kilometre land package and a preliminary economic assessment expected by the end of Q2 2025.

The private placement will see New Found Gold issue 12,269,939 non-flow-through shares priced at C$1.63, with proceeds going towards Queensway, as well as general corporate and working capital purposes, and closing contingent on disinterested shareholder approval.

Sprott will invest in the offering to maintain his approximately 19-per-cent position in New Found, and in the private placement for enough shares to increase his investment beyond the 20-per-cent mark, which would make him a Control Person in the company.

Leadership insights

“With a significant lead order by Eric Sprott on both the offering and the private placement, the proceeds from the financing will allow us to advance the Queensway gold project to the development stage,” Keith Boyle, New Found Gold’s chief executive officer, said in a statement. “Mr. Sprott has been a highly supportive shareholder in the company since its early days and we thank him for his continued support as we embark on this next chapter for the company.”

About New Found Gold

New Found Gold is a top gold explorer and project developer in Newfoundland and Labrador, a tier-one mining jurisdiction.

New Found Gold stock (TSXV:NFG) is up by 13.97 per cent on the news trading at C$2.04 per share as of 9:57 am ET. The stock has given back 59.2 per cent year-over-year but remains up by 32.47 per cent since 2020.

Join the discussion: Find out what everybody’s saying about this Canadian gold stock on the New Found Gold Corp. Bullboard and check out the rest of Stockhouse’s stock forums and message boards.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.